Large financial institutions have seen a sharp increase in check fraud over the past three years as illustrated in the latest ABA Deposit Fraud Study:

- Attempts increased to $15.1 billion in 2018—up from $8.5 billion in 2016

- Losses increased to $1.3 billion —a rise from $789 million in 2016.

To combat the fraudsters, banks and financial institutions are modernizing their systems to include real-time, image-based capabilities. Image analysis solutions detect the attributes of a check such as check stock, amount, payee, to detect counterfeits, forgeries and alterations. Image analysis, blended with analytics-based solutions, provide a more complete fraud detection and prevention for financial institutions and their customers.

To explore, click the links below:

Watch the video:

Blog Post

OrboNation Newsletter: Check Processing and Fraud – Best of 2025

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Blog Post

Dissecting the Roles Within an Organized Check Fraud Crime Ring

Organized check fraud rings operate like businesses with defined leadership and roles as well as adaptable processes Key roles: orchestrators, source gatherers, production specialists, and money mules/runners, all compartmentalized Rings exploit speed, volume, and trust, using physical and digital methods to steal and alter checks Organized check fraud crime rings are not by any means…

Blog Post

Holiday Season is Scam Season in Canada Too

RBC poll shows 86% of Canadians feel scam-savvy, yet 25% have already fallen victim to fraud Canadians fear AI-powered scams, deepfakes, and holiday fraud, yet many still take significant online shopping risks RBC urges verification, strong security, ongoing education, and advanced fraud technologies to protect Canadian consumers and financial institutions Over the past few years,…

Blog Post

The Account Lifecycle Pattern Behind Today’s Check Fraud

Check fraud now acts as a lifecycle threat, tightly linked to account age Fraud shifts from synthetic-ID abuse on new accounts to sleeper-driven counterfeit checks Tenured accounts face collusion and takeover, demanding adaptive, AI-driven defenses tuned to lifecycle behavior. Check fraud is no longer a simple paper-based crime; it has become a lifecycle threat that…

Blog Post

Video: How Fraudsters Use Gen AI to Alter Checks in Seconds

Gen AI alters check amounts and names in seconds, with minimal prompts Generative tools scale fraud, rapidly creating large volumes of convincing counterfeit checks Multi-layered, AI-powered image and behavioral analysis best detects modern check fraud Way back in 2023, we wrote a post about how generative AI will be a major tool for fraudster to…

Blog Post

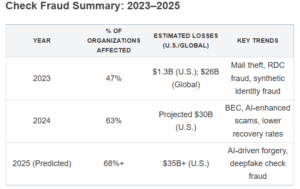

VALID Systems Bold Prediction: Est. $35B Check Fraud Losses in 2025

Check fraud losses continue to accumulate There are solid recommendations available to fight fraud Effective tools can be leveraged for protection As we near the end of 2025, many are wondering what the total losses will be from check fraud. While concrete numbers are not available, our friends at VALID Systems made a shocking prediction:…

Blog Post

OrboNation Newsletter: Check Processing and Fraud – November 2025

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Blog Post

Payee Problems: The Overlooked Weak Point Fraudsters Love to Exploit

Fraudsters exploit the payee field to alter checks and avoid detection Techniques include check washing, digital editing, and adding extra payee names Banks can use AI tools to identify alterations and strengthen payee field security While check fraud tactics have drastically evolved over the past decade, it is easy to overlook that fact that the…

Blog Post

Canada’s New National Anti-Fraud Strategy: Raising the Bar in Fraud Prevention

Fraud losses in Canada reached $643 million in 2024 New laws require banks to improve fraud prevention and consumer protections Financial Crimes Agency planned for 2026 to fight economic abuse and scams While check fraud makes the headlines in the US, we are not the only country that is heavily affected. In a recent announcement,…

Blog Post

2026 Fraud Trends: Addressing Organized Crime Groups with a FRAML Approach

Criminals exploit data silos AI and knowledge graphs are essential for future fraud detection Banks must merge fraud, AML data for true investigative intelligence The landscape of fraud detection in banking is rapidly shifting as financial institutions wrestle with increasingly sophisticated, multi-channel threats. Markus Hartmann, market intelligence expert at DataWalk, provides a forward-looking analysis of the trends…