Modernization of Legacy Systems

Financial institutions and their vendors are taking the necessary steps to modernizing legacy systems to meet the needs of their business and their customers. In fact, according to a report, Gartner Inc. predicts that in 2022, banks and financial firms will invest an estimated $623B in technology.

Although fully electronic payments continue to grab the spotlight as the future of payments, there has been significant investment in platform modernization for check payments and fraud prevention. Teller, branch, mobile, RDC, archive, lockbox, and ATM image capture vendors continue to innovate by developing new capabilities.

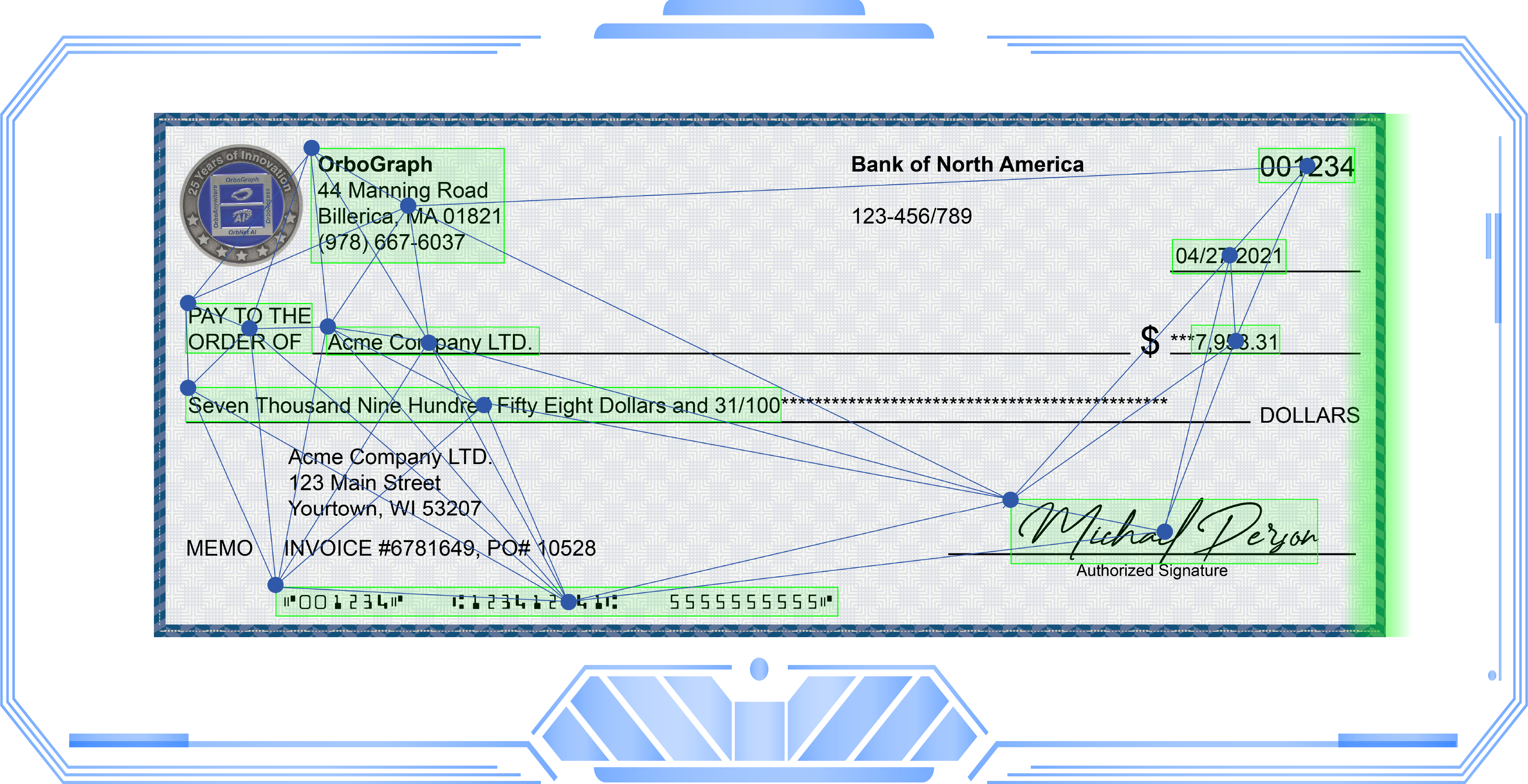

The use of AI and machine learning systems are well-positioned to support these trends by providing check processing automation, payment negotiability testing, fraud detection, compliance, and analysis of consumer and corporate behavior. OrboGraph provides AI-based solutions as part of the OrboAnywhere Platform.

Check Recognition Today

Recognition systems deployed in the market today primarily rely on the following technologies:

- Intelligent character recognition (ICR): recognition of handwritten fields

- Optical character recognition (OCR): preprinted fields

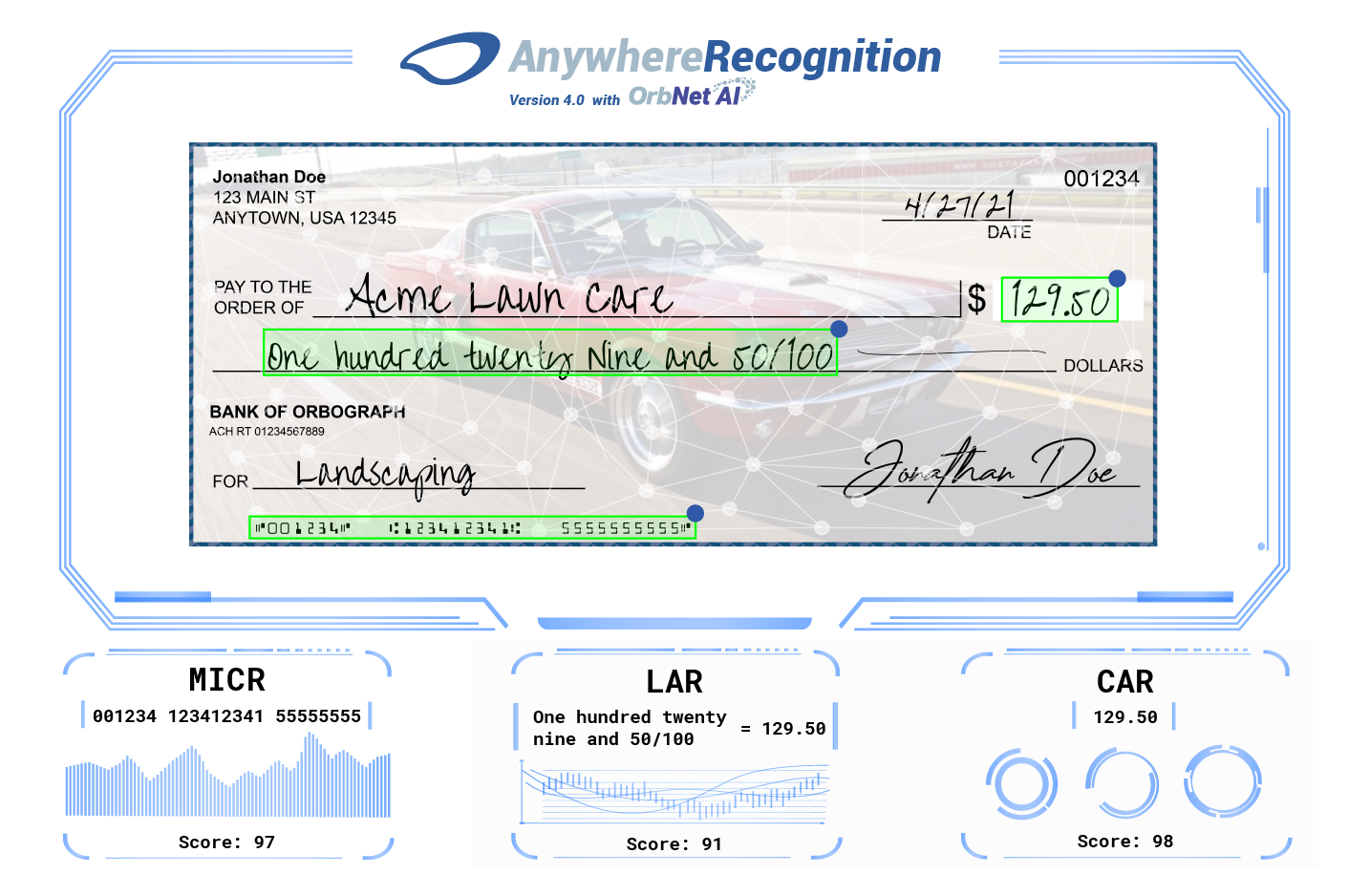

- Courtesy amount recognition (CAR): courtesy field on checks

- Legal amount recognition (LAR): legal field on checks

- Magnetic Ink Character Recognition (MICR): a combination of MICR process with OCR

- Basic neural networks: can apply to any field or document

- Intelligent word recognition (IWR): legal field or payee on checks

Most of these underlying technologies rely on the programming of algorithms, except basic neural networks, which are limited. In many field installations from fintech vendors, CAR/LAR performance levels peaked from 75% to 85%, with error rates approaching 3-4%.

OrboGraph has been at the forefront of performance, utilizing a multi-engine approach, with highly sophisticated voting algorithms. The introduction of neural networks (NN), CAR, LAR and ICR have had a significant positive impact in the evolution of check processing into an omnichannel capture environment.

Today OrboGraph forges ahead with an AI-based approach to check recognition using AI with deep learning models. CAR/LAR, OCR, and ICR are evolving into descriptive terms rather than the technology of deployment.