Anywhere Validate

Anywhere Validate automatically validates the negotiability of paper-originated items for any self-service, centralized or distributed capture channel or image exchange trading partner within the omnichannel of a financial institution. Designed to minimize the risk of checks and cash equivalent images from being non-negotiable, the system is a more comprehensive approach compared to traditional image quality, image usability, and/or manual review processes.

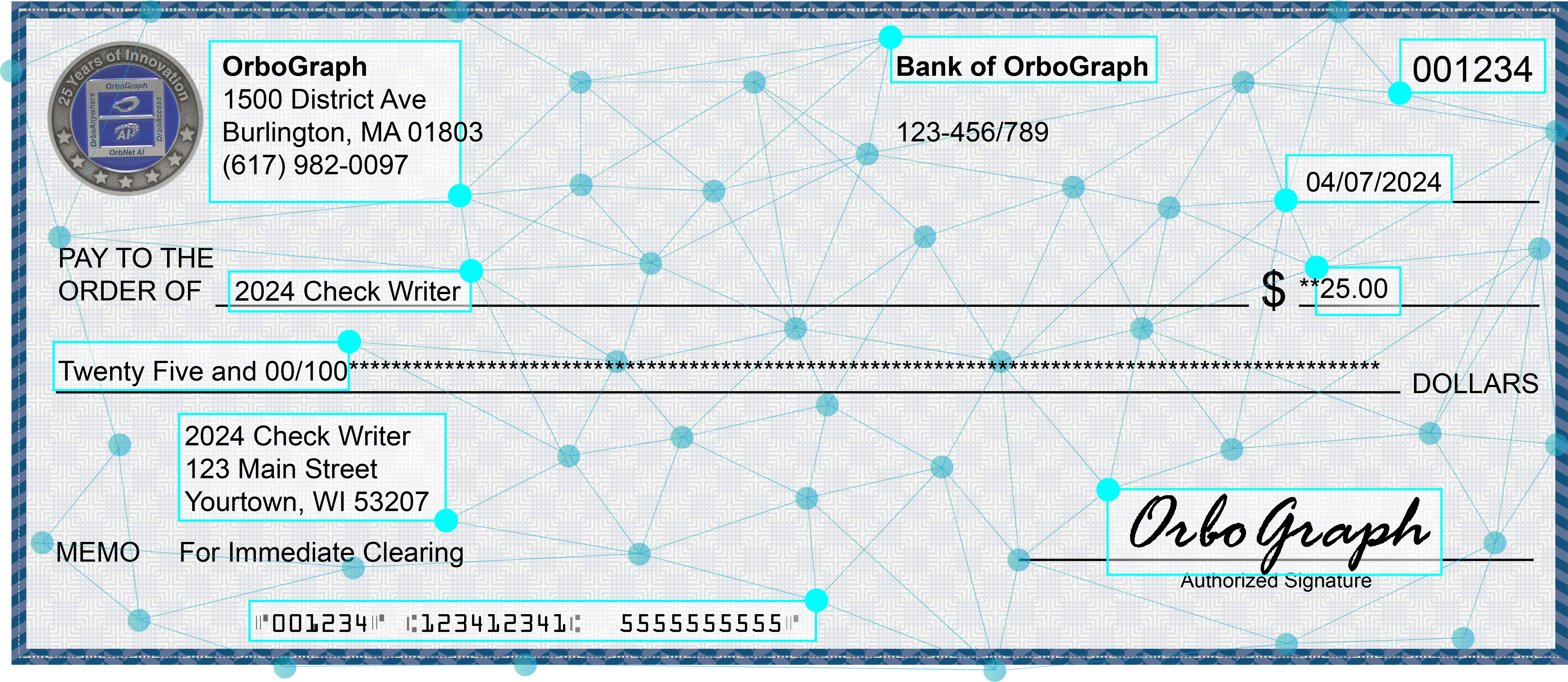

Anywhere Validate applies OrbNet AI recognition to the amount, payer, and date fields. Additional tests include IQA, Amount Verification, signature presence and restrictive endorsement classification.

From these recognition field results, 20+ validation tests are activated to protect all potential parties within the payment stream including: bank of first deposit (BOFD), paying bank, retail customer, corporate client. Note: See how Payor and Payee field validations work under Anywhere Payee.

Each validation test, activated in either real-time or batch, creates a score which complement the overall analysis approach from big data/analytics/capture/fraud systems, streamlining traditional deposit review functions.

Current Tests Performed by Anywhere Validate:

| Field/Type | Name | Use Cases and Tangible Achievements |

| Payor | Account Name Validation | Free read, verify fields, kiting, risk per channel, feed downstream data analysis, marketing campaigns targeting payors from transit banks |

| Payor | Negative List | Identify payors/makers from predetermined lists, i.e. black list, closed accounts, fraud, other |

| Depositor | Check Out of State | Identify payors from outside of state which may pose risk, international items, feed downstream data analysis |

| Payor | Deposit Out of State | Flag if the state of the account holder address is different from the state of the deposit address, risk indicator, risk mitigation of suspect customers, KYC |

| Amount | High Dollar Detection | Risk management for manual review, internal controls, SAR, can use index from balanced file |

| Amount | Verification (CAR, LAR, Index compare) | UDAAP & Reg CC risk mitigation, minimize customer errors, limit cash letter errors, reduce adjustments |

| Amount | Discrepancy (CAR vs. LAR) | Identify customer errors, limit operational errors, ensure LAR precedence |

| Amount | Not to Exceed | Flag if amount exceeds the allowed amount |

| Document | Image Quality Assurance (IQA) | IQA tests minimize non-compliant images (NCI) and identifies quality issues |

| Signature | Presence Detection | Reg CC, UCC and ECCHO rule compliance to confirm signature is on image |

| Endorsement | Presence Detection | Identifies that a signature is present on image |

| MICR | Image Integrity | Compares the MICR line via recognition to the index/metadata values to identify incorrect images associated with MICR |

| Endorsement | Virtual Endorsement Filtering | Selective abilities to filter virtual endorsement out to identify if originating endorsement was present |

| Document | Illegal Document Identification | Identifies RCC/PAD items per ECCHO rules, validates approved document types as defined in bank customer relationships on a workflow level, i.e. RDC, ATM |

| Date | Stale and Post Date | Risk and fraud related topic, UCC related topic, date ranges are flexible per workflow |

| Transaction | Account Negative List | Flag if the payer account (MICR) on the check matches information in a negative account list |

| Transaction | New Account Identification | Identified via application API, fraud and risk control, funds availability considerations, manual review queues |

| Transaction | Short Term Duplicate | Flags immediate duplicates where customer or application submits images more than once | Transaction | Cash Equivalent | Detects items considered same day or day 1 funds availability, See Anywhere Compliance for more details. |

Amount Verification, previously known in the industry as amount encode verification (AEV), and CAR/LAR Discrepancy, now deliver 99%+ coverage of items with the utilization of OrbNet AI. Incorrect amounts can range from 10-50 per 100K items.

Contact OrboGraph for to perform an analysis on the number of incorrect amounts that exist in your inclearing items!