Solution Overview: Anywhere Fraud

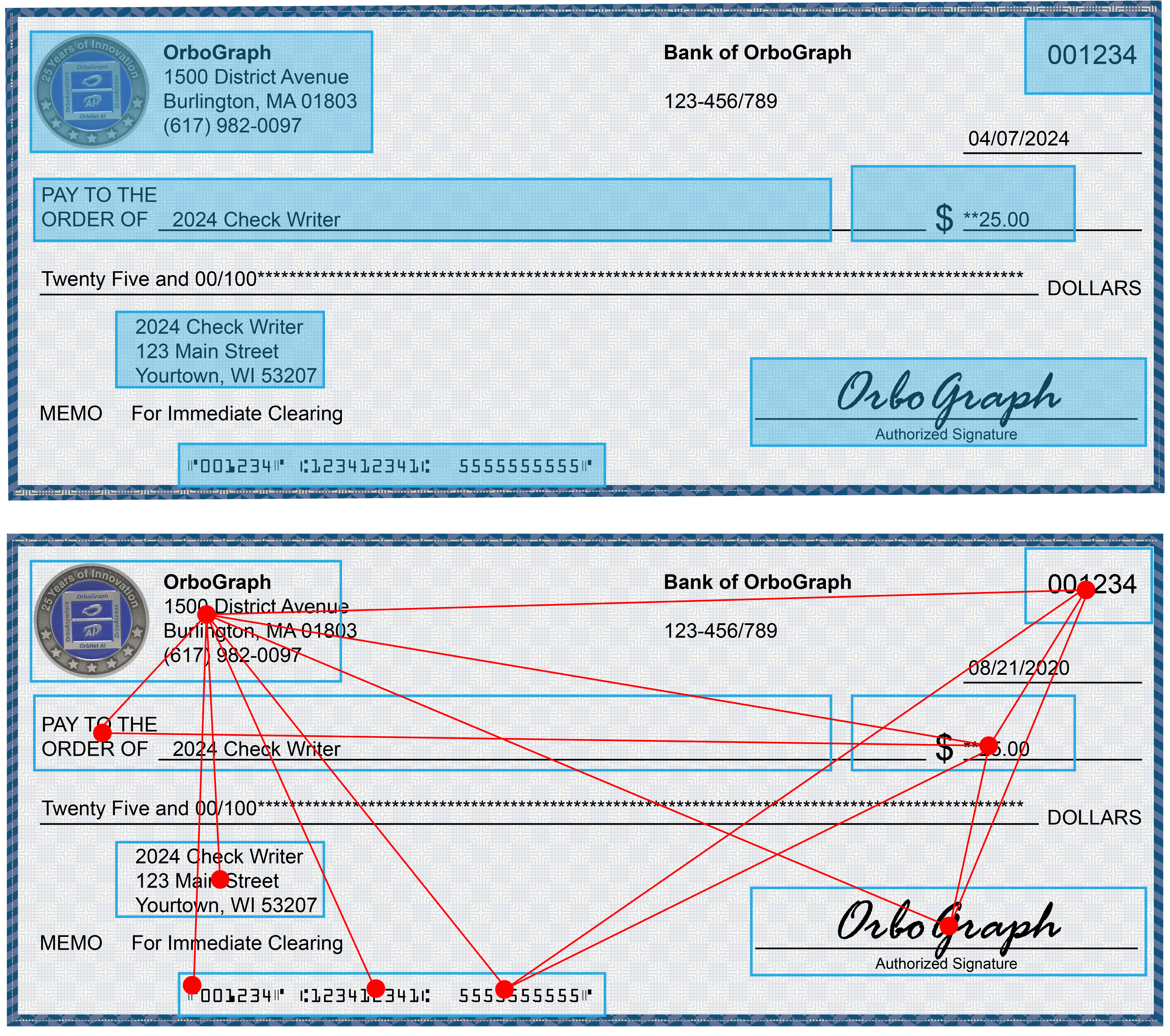

Anywhere Fraud is a specialized module within OrboAnywhere designed to detect check fraud by interrogating the attributes of check images to create a risk score based on the probability of the item being a counterfeit check, forged signature, or altered check. Building upon these scores, the system uses self-learning account profiles to create a statistical representation of the account’s check writing habits and styles. Anywhere Fraud also includes targeted transaction analysis.

Anywhere Fraud with Image Forensics can be utilized directly by banks as part of their fraud detection technology set or integrated within a service bureau/partner/vendor's fraud review platform or solution suite for detection for on-us fraud.

Trends in Check Fraud

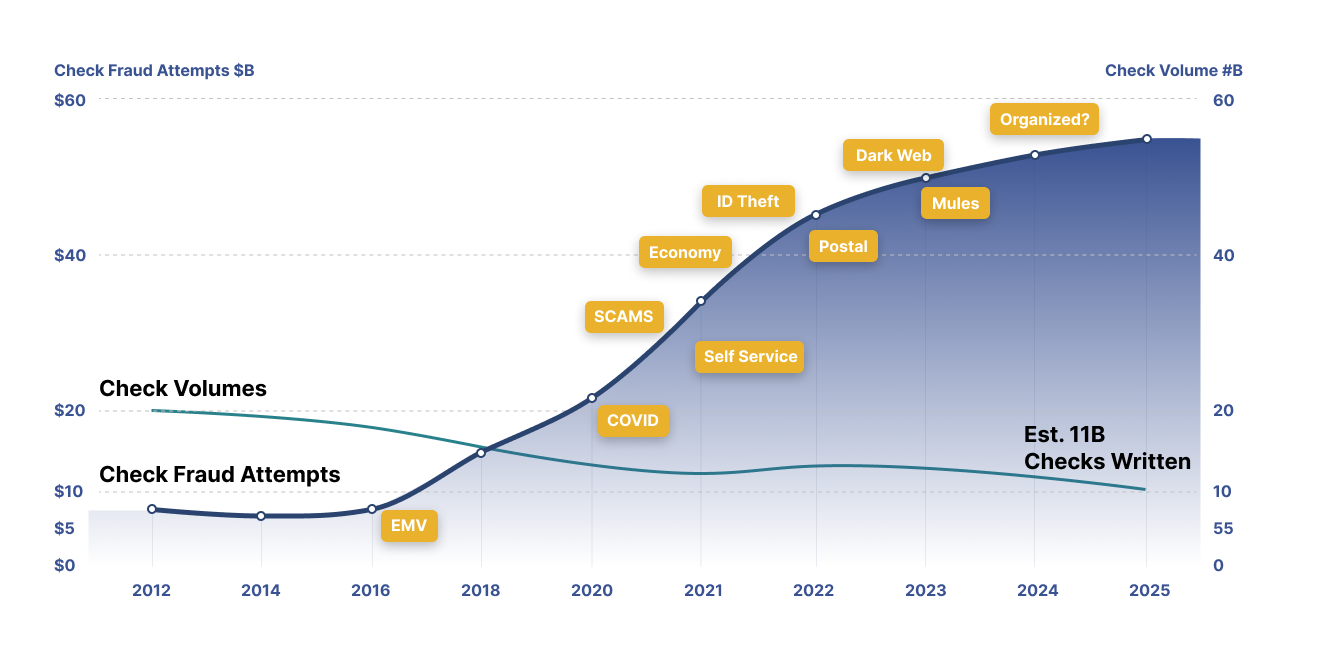

In 2020, OrboGraph’s survey confirmed that the concerns over check fraud continued, as the major of respondents anticipated fraud attempts and losses to increase in 2021 (See Exploration of Check Fraud in 2020).

Check fraud at an industry level has skyrocketed with many experts estimating a 3-4x in fraud attempts from pre-pandemic levels.

As seen in the chart, the upward trend in check fraud began in 2015/2016 with the introduction of EMV chips. With credit and debit cards becoming more secure, fraudsters moved to a less secure payment channel that was easier to exploit: checks.

Since then, the industry has seen a myriad of different factors, from the COVID-19 pandemic increasing the usage of mobile RDC (mRDC) to the rise in postal theft and stolen checks for sale on the dark web. We are now seeing organized crime rings move from other illegal activities and shift to perpetrating check fraud.

To access data and new trends related to check fraud, please visit the OrboIntelligence Check Fraud Resources Hub and subscribe to the Modernizing Check Fraud Detection blog.

Click the graph above to enlarge.

Chart created by OrboGraph based on multiple data sources and news publications

Transaction Analysis (Highly Targeted Data Analytics)

Transactional Analysis detects check fraud by analyzing serial numbers and amounts by applying a set of statistical analyzers to identify anomalies. Examples include velocity analysis, serial out of range (SOOR), and amount out of range (AOOR).

Combined with the power of self-learning at the account-level, targeted image analyzers are blended with transactional characteristics of the account.

Note that image and transaction analysis can be applied to any workflow as a way to detect fraud prior to posting. For example, inclearing items are the focus of on-us fraud detection, while transit checks are a part of a comprehensive deposit fraud approach.

In dealing with fraud detection, low suspect rates (false positives) blended with high detection rates (false negatives) are the most critical objectives for an optimized system. For a full list of image and transaction analyzers, see Anywhere Fraud on-us brochure.

Additional Features

- Individual analyzer scoring is available for optimal tuning and threshold management. Complements existing rule-based systems as well.

- Match to known fraudulent images which were previously confirmed by a fraud analyst.

- Profiling of multiple R&T on-us numbers and transit R&Ts: prevents a wide range of on-us and deposit fraud use cases

- Real-time interface from any deposit/capture channel across the omnichannel: delivers instantaneous fraud detection across traditional and self service workflows

Anywhere Fraud is built on the foundation of targeted analyzers performed on an account level. These account profiles leverage self learning algorithms to adapt to the image and transactional characteristics of each account. The system builds a history of image snippets and transactional data of check writers for batch or real-time fraud detection capabilities.

Targeted Deployment

Existing or new check processing business partners, service bureaus, and financial institutions can implement Anywhere Fraud via a batch or real-time web services interface. Additionally, a file import process with “landing zone” approach can be deployed if programming resources are not available.

This flexibility allows Anywhere Fraud to be deployed into any traditional or self-service check processing workflow including Inclearings, teller image capture, branch image capture, ATM, mobile RDC or RDC. So depending on the fraud use cases, the system is optimized around the requirements of the environment.

Note that either an existing suspect review platform or the check capture system is utilized to review suspected fraud items along with companion images delivered by Anywhere Fraud. This consolidated review workflow is very efficient as it does not create additional overhead or system administration.

Business Case Fraud Detection Benefits

- On-us checks (Inclearings, over-the-counter, and self service channels)

- Counterfeit transit checks

- On-us check cashing

- Transit check cashing

- Protect on-us customers from fraudulent events

- Improved interbank check clearing by replicating loss prevention practices

- Reduction of false positives to streamline suspect review process

- Improve overall check fraud detection