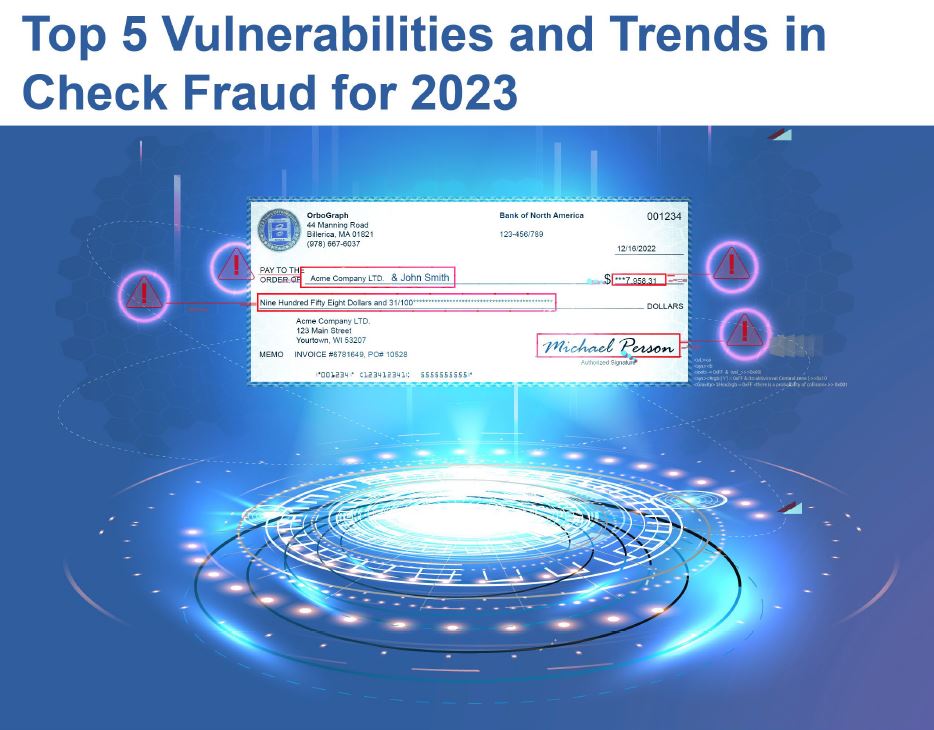

Welcome to the #OrboIntelligence Check Fraud Resource Hub

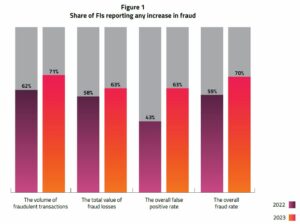

Over the past 3 years, the banking industry has seen a meteoric increase in check fraud -- even with a decrease in check volumes. Traditionally the industry relied on the ABA Deposit Account Fraud Survey as the primary resource for data and trends on check fraud. However, today there are a wider range of resources available with a new report being published virtually every month.

To better serve the industry, OrboGraph not only executes its own research, but is taking a leading role in consolidating these materials into a centralized hub. In the fight against check fraud, the more information that is readily available, the better outcomes we as an industry can achieve.

We hope you find this hub to be beneficial. Please email marketing@orbograph.com if you would like to suggest/add additional resources or reports.