AI Innovation for Financial Institutions

The technological breakthroughs in Artificial Intelligence (AI) and artificial neural networks (ANN) offer unparalleled benefits for the financial sector.

Servion predicts that by 2025, AI will power 95% of all customer interactions. Accenture projects that AI is set to boost profitability by 38% and generate $14 trillion of additional revenue worldwide by 2035.

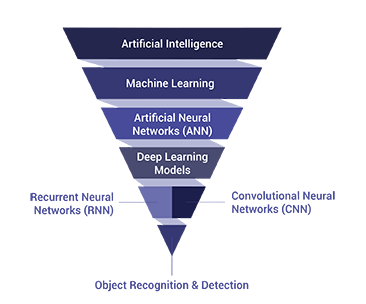

Artificial Intelligence was built to handle processes that were once fully dependent on human intelligence and cognition. But AI is not as simple as this definition may appear. There are many sub-categories and varying levels of AI technologies, involving:

- Machine learning

- Artificial neural networks (ANN)

- Deep learning

- Models

- Convolutional neural networks (CNN)

- Recurrent neural network (RNN)

- Computer vision

For a brief explanation of each of the above AI technologies, check out our AI, Self-Learning, Deep Learning page.

AI in Banking and Financial Check Payments

Organizations processing checks will experience the value of deep learning models within OrbNet AI as Anywhere Recognition delivers over 99% read rates with accuracy levels of 99.5%.

The first deployment of the technology is focused on the amount and MICR fields. Optimized models are created for many fields of interest including: amount fields on checks, numeric fields, MICR, amount fields on internal tickets, date, payee, and payor field.

Check fraud detection also benefits from ANN. OrbNet Forensic AI is now available to dramatically improve the detection of counterfeit checks, forged signatures, and altered checks as a way to improve customer protection and reduce fraud losses as long as fraudsters continue to target financial institutions and their customers.

Platform Modernization Movement

A movement has been unfolding in the check processing and fraud detection industries to modernize legacy platforms. OrboGraph is positioned to support market trends with the OrbNet AI technology and OrboAnywhere. Read more about OrboGraph’s company strategy on our About Us page.

Check out artificial intelligence and machine learning in action below.

OrbNet AI Innovation Lab