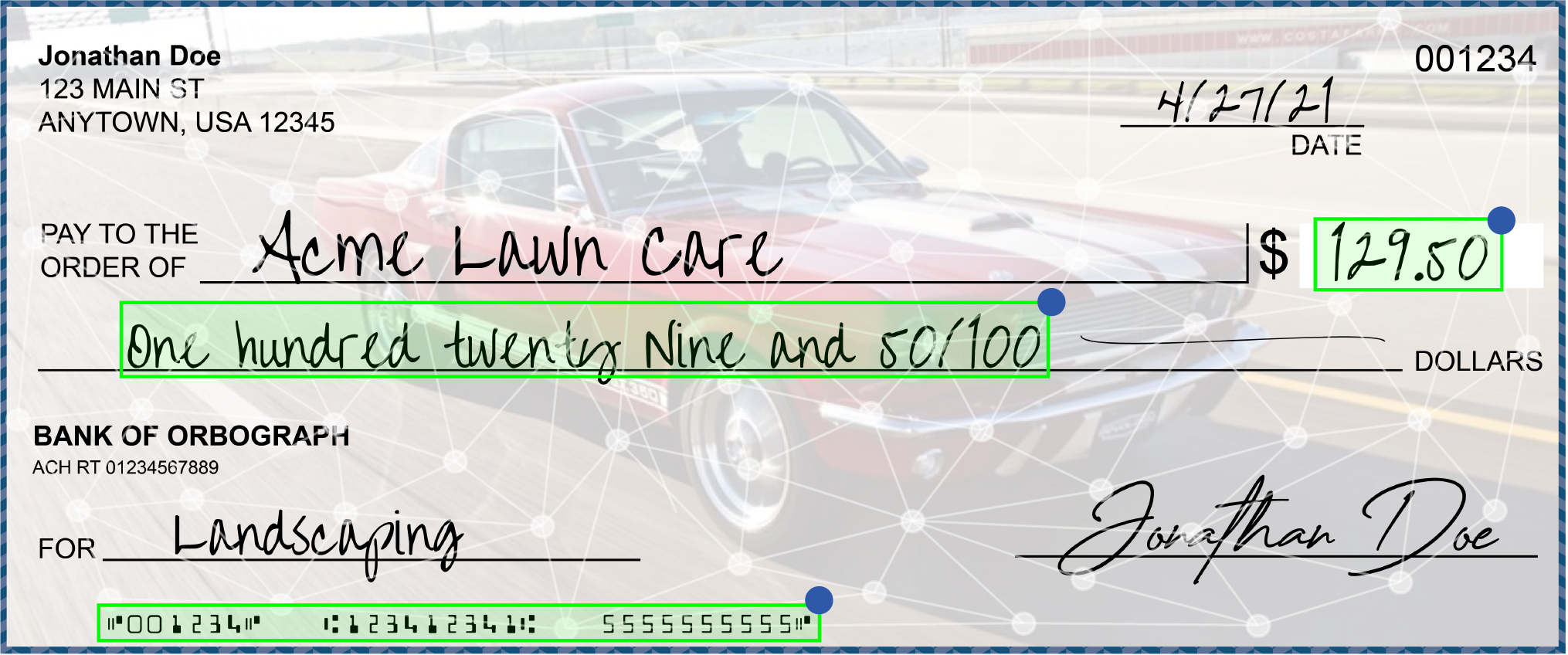

Operationalizing AI in Check

Neural networks (NN), CAR, LAR and ICR have had a significant positive impact in the evolution of check processing into an omnichannel capture environment. If it wasn’t for the efficiencies of check recognition and image analysis, industry-wide adoption of image capture may have never happened because much of the labor savings was driven by amount and field processing automation.

Throughout the years, NNs have illustrated strengths and weaknesses. As an example, OrboGraph operationalized and deployed a 3rd party NN engine in 1999. At the time, our approach to courtesy amount recognition (CAR) handwriting recognition included algorithmic programming coupled with this NN system. For several years, this combination was the best in the market, performing at 60-75% read rate.

However, this NN became outdated as OrboGraph created higher performing solutions which utilized legal amount recognition (LAR). This foundation created a path to virtually 100% recognition.

With the introduction of OrbNet AI technologies with deep learning models, the recognition process has evolved with a path to virtually 100% recognition and fraud prevention rates can now exceed 95% with OrbNet Forensic AI.