AI Innovation for Financial Institutions

Artificial Intelligence has revolutionized banking by driving powerful automation and dramatically improving fraud detection. Routine, time-consuming processes such as transaction processing, compliance checks, reporting, and customer onboarding are now automated, allowing banks to operate faster, reduce costs, and minimize human error. This shift enables financial institutions to scale efficiently while employees focus on higher-value, strategic work.

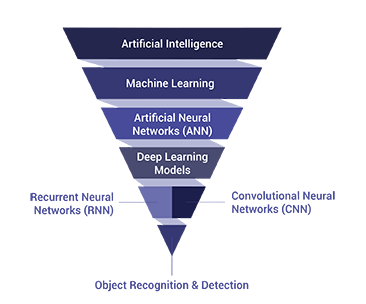

Artificial Intelligence was built to handle processes that were once fully dependent on human intelligence and cognition. But AI is not as simple as this definition may appear. There are many sub-categories and varying levels of AI technologies, involving:

- Machine learning

- Artificial neural networks (ANN)

- Deep learning

- Models

- Convolutional neural networks (CNN)

- Recurrent neural network (RNN)

- Computer vision

Financial institutions across the globe are heavily investing billions of dollars in AI technologies. And, according to Datos insights, financial institutions will spend nearly $1B in check fraud detection and prevention by 2028.

For a brief explanation of each of the above AI technologies, check out our AI, Self-Learning, Deep Learning page.

Organizations processing checks will experience the value of deep learning models within OrbNet AI as Anywhere Recognition delivers over 99% read rates with accuracy levels of 99.5%.

The first deployment of the technology is focused on the amount and MICR fields. Optimized models are created for many fields of interest including: amount fields on checks, numeric fields, MICR, amount fields on internal tickets, date, payee, and payor field.

Through the OrbNet AI Innovation Lab, OrboGraph has release OrboAnywhere Turbo 6.0 -- achieving 2X to 4X overall speed improvement and reduction in recognition latency by up to 70%.

Visit the Product Innovation Briefing for more information.

AI in Banking for Check Fraud Detection

Artificial Intelligence has become a powerful tool in combating check fraud, one of the most persistent challenges in banking. AI-driven systems analyze check images, signatures, handwriting patterns, and transaction data to detect signs of alteration, forgery, or duplication with remarkable accuracy. By leveraging computer vision and machine learning, banks can automatically identify inconsistencies such as mismatched fonts, altered amounts, or suspicious endorsement patterns, enabling real-time decision-making before fraudulent checks are cleared.

Financial institutions of all sizes are leveraging OrbNet Forensic AI technology for On-Us and Deposit fraud detection to detect counterfeit checks, forged signatures, and altered checks. OrboNet Forensic AI is now trained to detect fraudulent checks utilizing security symbol analyzers and analyzes check deposits for transit fraud.

Platform Modernization Movement

A movement has been unfolding in the check processing and fraud detection industries to modernize legacy platforms. OrboGraph is positioned to support market trends with the OrbNet AI technology and OrboAnywhere. Read more about OrboGraph’s company strategy on our About Us page.

Check out artificial intelligence and machine learning in action below.

OrbNet AI Innovation Lab