Solution Overview

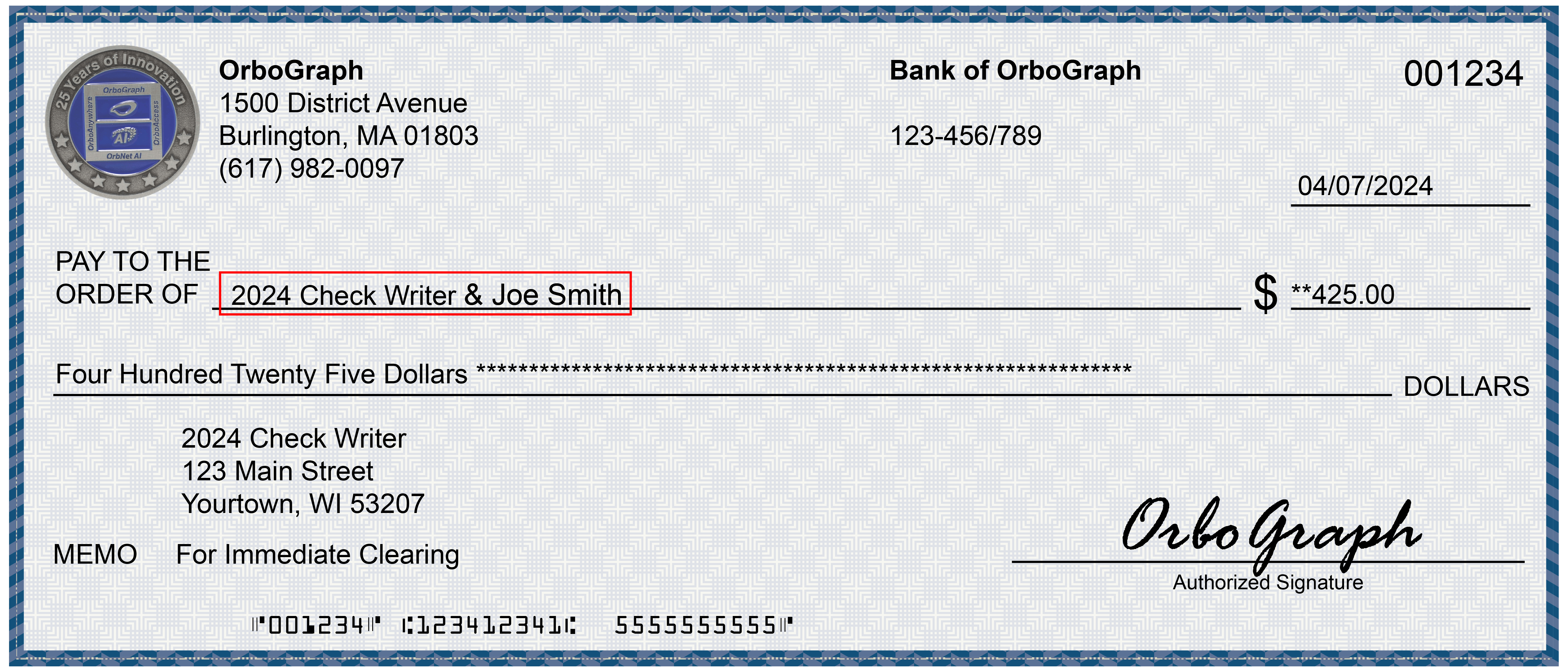

Anywhere Payee applies OrboGraph’s advanced OrbNet AI recognition technology to extract and validate the “Pay to the Order of” name on personal and business checks. This innovation helps financial institutions and remittance processors reduce posting errors, detect fraudulent payee alterations, and protect deposit integrity across all check channels.

Payee recognition and validation have become critical components of modern check fraud prevention. Fraudsters increasingly target the payee field — one of the easiest points of manipulation on a check — to commit altered check and mobile deposit fraud.

Criminals use both physical alteration (e.g., check washing with acetone) and digital editing techniques to replace legitimate payee names. Once altered, these checks are frequently deposited through mobile or ATM channels, bypassing teller review and manual inspection.

Anywhere Payee combats these schemes by automatically reading and matching payee information against authorized account holder names, internal reference lists, and external data sources — delivering a powerful layer of protection for every deposited item.

Integrated Deployment Options

Anywhere Payee is available as a standalone module or as part of Anywhere Fraud, enabling payee results to be leveraged in:

- Positive/Negative list screening

- Fraud pattern analysis and risk scoring

- Data enrichment workflows

Anywhere Payee Highlights

Anywhere Payee incorporates a full suite of capabilities designed to improve accuracy and strengthen fraud defense:

- AI-driven payee recognition for both business and personal checks

- Account name validation with single or multiple account holder matching

- Matching against large-scale data dictionaries

- Free-read data extraction for comprehensive field capture

- Identification of “Cash” payees

- Payee Positive/Negative list management

- Payee vs. Payor comparison for potential kiting or insider fraud scenarios

Key Workflows Impacted

Anywhere Payee delivers measurable value across several critical workflows:

Mobile Remote Deposit Capture (mRDC)

Validate payee names against account holder records to prevent fraudulent mobile deposits and ensure compliance with deposit restrictions.

Wholesale Lockbox

Reduce posting and deposit errors caused by misapplied or incorrectly captured payee names in high-volume lockbox environments.

ATM Deposit Processing

Address one of the most common fraud channels by detecting altered or stolen checks before funds are credited.

Marketing & Data Analytics

Leverage payee data to analyze spending patterns, segment customers, and develop marketing programs that drive electronic payment adoption.

Compliance

Extract payee data for regulatory reporting and verification, often used in conjunction with Anywhere Compliance.

Key Workflows Impacted

Implementing Anywhere Payee delivers measurable operational and fraud prevention gains:

- Reduce posting errors (average cost of $25 per correction)

- Prevent deposit fraud related to payee alterations or mismatches

- Enhance client satisfaction through accurate and secure processing

- Minimize institutional risk and strengthen fraud defenses

- Generate marketing insights based on customer payment activity

- Drive digital payment adoption through data-informed programs

Anywhere Payee — Intelligent Payee Validation for a Safer, Smarter Payments Ecosystem

Join OrboNation

Access to critical updates, new industry insights, & thought leaders.