Solution Overview

Anywhere Validate automatically validates the negotiability of paper-originated items for any self-service, centralized or distributed capture channel or image exchange trading partner within the omnichannel of a financial institution. Designed to minimize the risk of checks and cash equivalent images from being non-negotiable, the system is a more comprehensive approach compared to traditional image quality, image usability, and/or manual review processes. In many cases, Anywhere Validate can eliminate the manual functions of what a teller performs on deposited items.

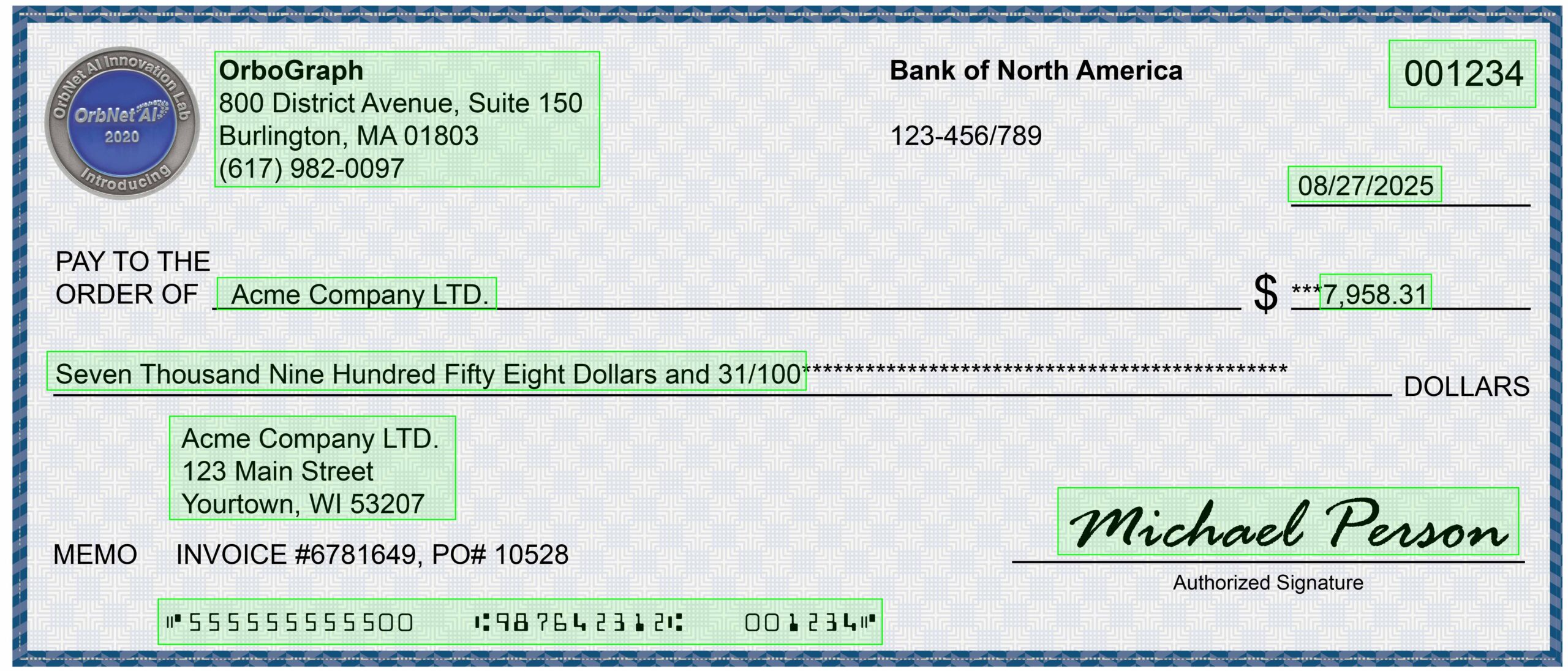

Anywhere Validate applies OrbNet AI recognition to the following fields:

| Field | Description |

| CAR | Courtesy amount used for posting |

| LAR | Legal amount used for posting and comparison to CAR |

| Amount | Net of check used in posting |

| MICR | MICR line used for reject correction, free read of non-MICR items |

| Payee | Matches to payee name data generated from Anywhere Payee |

| Payer | Payer data (Parsed fields) Free read used for kiting analysis, risk per channel, downstream data analysis, and marketing campaigns targeting payors from transit banks |

| Signature | Identify customer errors, limit operational errors, ensure LAR precedence |

| Document | Document IQA: Tests 13 variations of quality analyzers |

| Date | Date used for post/stale date detection and fraud |

| Serial | Check serial number reads supplement MICR correction and fraud |

| Rear Endorsement | Rear endorsement existence confirms endorsement presence |

Click the image above to enlarge.

A negotiable instrument is a written document that guarantees the payment of a specific amount of money, either on demand or at a set time, and is transferable from one person to another. Common examples include checks, promissory notes, and drafts. The key feature of a negotiable instrument is its ability to be endorsed and transferred, allowing the holder in due course to claim payment in good faith without concern for the original transaction. Governed by the Uniform Commercial Code (UCC) in the United States, negotiable instruments play a vital role in facilitating commerce and credit by providing a secure and efficient means of payment and transfer of funds.

From these recognition field results, 25+ validation tests are activated to protect all potential parties within the payment stream including:

- Bank of first deposit (BOFD)

- Paying bank

- Retail customer

- Corporate client

Each validation test, activated in either real-time or batch, creates a document negotiability score. This output overall analysis approach from big data/analytics/capture/fraud systems, streamlining traditional check deposit review functions.

Current Tests Performed by Anywhere Validate:

| Field/Type | Name | Use Cases and Tangible Achievements |

| Document | Image Quality Assurance (IQA) | 16 IQA tests that minimize non-compliant images (NCI) and identifies quality issues, classifies document type for downstream processing and reporting. |

| Document | Illegal Document Identification | Identifies RCC/PAD items per ECCHO rules, validates approved document types as defined in bank customer relationships on a workflow level, i.e. RDC, ATM. |

| Document | Doc Type ID | Validates Appropriate Document Type. |

| Document | Cash Equivalent | Detects items considered same day or day 1 funds availability, See Anywhere Compliance for more details. |

| Amount | High Dollar Threshold | Risk management for manual review, internal controls, SAR reporting. |

| Amount | Verification (CAR, LAR, Index compare) | UDAAP & Reg CC risk mitigation, minimize customer errors, limit cash letter errors, reduce adjustments. AV previously known in the industry as amount encode verification (AEV), now delivers 99%+ coverage of items.. Incorrect inclearing amounts can range from 10 to as high as 50 per 100K items. |

| Amount | Discrepancy (CAR vs. LAR) | Identify customer errors, limit operational errors, ensure LAR precedence in deposits. |

| Date | Stale and Post Date | Risk and fraud related topic, UCC related topic, date ranges are flexible per workflow. |

| Depositor | Check Out of State | Identify payors from outside of state which may pose risk, international items, feeds downstream data analysis. |

| Endorsement | Presence Detection | Identifies that a signature is present on image. |

| MICR | Image Integrity | Compares the MICR line via recognition to the index/metadata values to identify incorrect images associated with MICR. |

| Payee | Cash Detector | Flag items payable to “CASH”. |

| Payee | Account Name Comparison | Compare payee against account holder name. Flag if they do not match. |

| Payee/Payor | Field Comparison | Flag is the check maker (payor) matches the payee. |

| Payor | Suspicious Payor | Flag if the payor information on the check is suspicious. |

| Payor | Check Out of State | Flag if the state of the payor on the face of the check is different from the state of the deposit address. |

| Payor | Account Name Comparison | Compare payor against account holder name. Flag if they do not match. |

| Payor | Negative List | Identify payors/makers from predetermined lists, i.e. black list, closed accounts, fraud, other. |

| Payor | Deposit Out of State | Flag if the state of the account holder address is different from the state of the deposit address, risk indicator, risk mitigation of suspect customers, KYC. |

| Signature | Presence Detection | Reg CC, UCC and ECCHO rule compliance to confirm signature is on image. |

| Signature | PAD Detection | Flag an item which has been detected as PAD. |

| Transaction | Account Negative List | Flag if the payor account (MICR) on the check matches information in a negative account list. |

| Transaction | New Account Identification | Identified via application API, fraud and risk control, funds availability considerations, manual review queues. |

| Transaction | Short Term Duplicate | Flags immediate duplicates where customer or application submits images more than once. |

Contact OrboGraph to perform an analysis on your images for non-negotiable items or to identify incorrect amounts on your inclearing items.