Winning Strategies for Value Based Reimbursements (VBR)

At the The 2019 OPEN MINDS Management Best Practices conference, Senior Associate Ken Carr provided a deep dive into that subject in his session entitled Are You Ready For Value-Based Reimbursement? An Executive Guide For Assessing Readiness In A Value-Based Market, which is summarized at the Open Minds website.

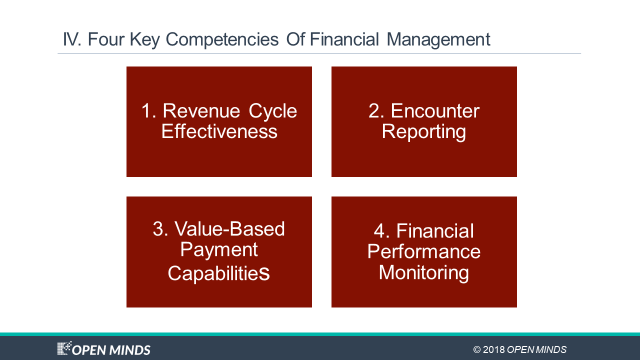

During the session, Mr. Carr zeroed in on one of the key elements to preparing organizations for VBR arrangements: how to build the financial management competencies needed for success. His four essentials include revenue cycle effectiveness, encounter reporting, value-based payment capabilities, and financial performance monitoring.

Mr. Carr went on to note:

Assessing financial readiness for value-based reimbursement is important because moving from the fee-for-service business model to new forms of reimbursement that are tied to outcomes involves taking on new risks. Provider organizations are no longer reimbursed just for providing services. Documenting an encounter and linking it to a CPT payment code is necessary. For instance, in a pay-for-performance agreement, they need to demonstrate that they have achieved agreed upon outcomes in order to receive the maximum payment for their services, and the final payment may be delayed until the outcomes are verified by the payer. This requires the implementation of new skills sets and tools for financial managers: assessing risk, projecting cash based on new payment mechanisms, and working with the organization to support performance management around the contracted outcome goals.

He then listed these four key elements that play a crucial role in supporting the new focus on managing financial risk:

Revenue cycle effectiveness—The ability to align operational and financial processes to assure adequate cash flow. Success relies on practicing effective processes for reconciliation of authorizations and payment verification to credentialed provider organizations. The kicker: it’s often a new and alien process to submit invoices to payers for services delivered under value-based reimbursement agreements (see Adapting Revenue Cycle Management For A VBR-Driven World and Revenue Cycle Management: A New Model For A New Market).

Encounter reporting—The ability to capture, analyze, and report granular utilization data to payers and to internal teams for management. Success relies on electronically capturing and reporting reliable encounter data in the format and time frame required by payers. The kicker: the data needs analyzed to also manage service outcomes and utilization from an in-house performance standpoint.

Value-based payment capabilities—The ability to track and manage contractual outcomes and payments. Success relies on reporting actual performance data (in the form of outcomes and financial performance) against budgets and contractual targets. The kicker: there are many types of value-based reimbursement models and different contracts require different capabilities.

Financial performance monitoring—The ability to monitor actual financial results against contracts, budgets, and forecasts. Success relies on a comprehensive set of key performance indicators and the ability to report incurred but not reported liabilities while monitoring service utilization and costs; with the additional ability to reconcile to service and revenue projections. The kicker: real success takes adopting a system to link population health management and value-based contracting strategies to resources planning and reporting.

A VBR environment requires a variety of new controls and reconciliation points! It is imperative that data silos are eliminated in this new environment so that the reconciliation can take place efficiently without paper and with a complete view of all transactions. This is where 100% remittance and payment electrification is needed. Let us know if you have additional ideas on streamlining a VBR environment at info@orbograph.com.

This blog contains forward-looking statements. For more information, click here.