Modernizing Omnichannel Check Fraud Detection

SARs accounted for nearly 20% of SARs filings in 2023 There is nothing to indicate they will not continue their increase into 2024 Checks remain fraud targets Thomson Rueters reports that the number of suspicious activity reports (SARs) – the documents that financial institutions must file with the federal government’s Financial Crimes Enforcement Network (FinCEN)…

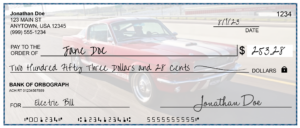

Read MoreWhen examining a check to determine whether it’s real or not, it’s also worth looking for other general irregularities and mistakes. Look for spelling errors or typos in the printed information on the check, such as a misspelled business name or address. You can also check to make sure that the address of the check’s…

Read MoreCheck Fraud is nothing new – it’s been around for decades Methods to ID fraudsters were a bit different as the 80’s began Modern check fraud needs to met with modern tools An interesting artifact from way back in the ’80s depicts a fraudster’s-eye view of the techniques in play a little over 40(!) years…

Read MoreDrop accounts are becoming a fraud “staple tool” These accounts are easy to open Fraudsters are advised to be patient and “age” the account for maximum effectiveness Many in the banking industry as are aware of one tool that is crucial to a fraudster: drop account. For those who are not as familiar, this is…

Read MoreCheck fraud has grown to a major problem Positive pay offers tools to fight fraud However, positive pay adoption is fairly low Less than five years ago, check fraud was a niche topic, with very few outside the banking industry really understanding the in’s and out’s of check fraud. Well, fast-forward to the present and…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read MoreFraud and cybercrime have been increasing Telegram has become a prime platform for threat actors to conduct various scams and distribute malware The fact that it is quick and easy to “set up business” on Telegram is a huge attraction We all seem to know at least one person who has been the victim of…

Read MoreA decrease in check usage has not meant less fraud Nevertheless, checks remain popular in the United States A corresponding jump in fraud — some of it organized — is occurring in the US Jessica Washington, AAP, assistant vice president in the Retail Payments Risk Forum of the Federal Reserve Bank of Atlanta, notes in a post…

Read MoreMail theft is on the rise, and checks are being stolen for fraud The Post Office claims it is doing what it can to combat theft A CBS News investigation seems to show otherwise CBS News reports that while the US Postal Service claims to be applying “rigorous action” to the mounting problem of mail…

Read MoreCheck fraud continues to grow at an alarming rate PYMNTS reports Fed recommendation of electronic payment methods, or “instant disbursement” The data show less than 50% adoption of instant disbursement As we all know, check fraud continued to surge in 2023, and is likely to surge in 2024. A post at PYMTS.com reported estimates by…

Read More