Modernizing Omnichannel Check Fraud Detection

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

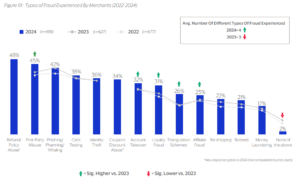

Read MoreFraud attacks of many types are on the rise Merchants are reporting huge fraud impacts A shift from operational costs to improving customer experience and mitigating payment fraud is evident While our blog’s main focus is the checks payment channel, it’s worth taking a look at other payment channels and their fraud trends — particularly…

Read MoreThe internet is buzzing this morning with news that Telegram CEO Pavel Durov was arrested in Paris. According to APNews: Durov was detained in France as part of a judicial inquiry opened last month involving 12 alleged criminal violations, according to the Paris prosecutor’s office. It said the suspected violations include complicity in selling child…

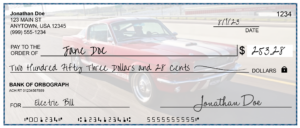

Read MoreCheck writing remains common, with 61% of Americans still using checks. Most persons using checks believe they are deploying all available safeguards In fact, many check-writing habits need to be “upgraded” Recently, Kiplinger Personal Finance Magazine posted a helpful article that explains how to safely write a check in a world where fraud is not…

Read MoreYouTuber Tommy G goes “deep dive” with actual scammers The video discusses the motivations behind scamming, particularly among Gen Z It’s suggested that disillusionment with the financial system, which is see as corrupt and unjust, fuels their involvement in fraud. A recent YouTube video by Tommy G. offers a pretty comprehensive, 30-minute dive into the…

Read MoreCommerce Bank is introducing a new alert via text for potentially suspicious check activity Texting seems to have emerged as best and most efficient method of contact Input from customers will be used to help fortify the system Commerce Bank has developed an innovative Texting for Check Fraud program that alerts customers of potentially suspicious…

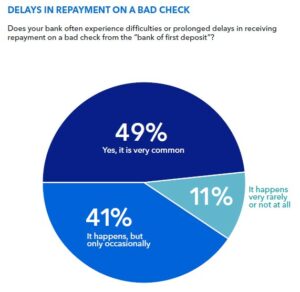

Read MoreCheck fraud rates continue to climb Delays in repayment for bad checks are becoming common A majority of financial institutions want liability shifted to BOFD The recently released IntraFi Executive Business Outlook Service report makes it clear that check fraud has significantly increased, with 90% of community bankers reporting higher levels of fraudulent check-writing. Furthermore,…

Read MoreHELOC records are being used for check fraud The ICBA has been prompted to issue a warning Machine learning and AI detection mechanisms are effective defensive tools Many individuals within the banking sector and home owners are familiar with a “Home Equity Line of Credit” or “HELOC” — a type of second mortgage that allows…

Read MoreCheck fraud is emerging as a huge problem Many vendors are bringing back older technologies to fight fraud “…They’re blowing the dust off their 20- and 30-year old pieces of software and coming back out and saying, ‘I’ve got some check fraud solutions!’” Scott Anchin, VP, operational risk and payments policy at ICBA, and David…

Read MoreWe’ve discussed previously the fact that fraudsters, like most insular groups, have their own lingo. Eric Huber, TD Bank Cybercrime Research & Analysis Leader and curator of Fraudsterglossary.com, discusses the dreaded Stimmy, or Stim — a term used by fraudsters for any sort of check issued by the US Treasury regardless of the program. There…

Read More