What is Check Fraud?

Due to the limitations of certain check fraud systems in the market, as well as expedited funds availability practices by financial institutions, check fraud perpetrators have refocused into check fraud since 2018. The scope of check fraud has evolved from individual and casual fraudsters to large sophisticated organized crime rings which extract funds by recruiting money mules. In addition to individuals, organized crime even penetrated the United States Postal Service employee base as another way to steal mail. Checks stolen from the mail are often sold via the dark web or social media.

Check Fraud Categories

There are a variety of ways to describe check fraud. Many financial institution's group check fraud into two primary categories; On-Us and Deposit fraud. Why? These categories reflect the distinct ways fraud occurs in the check processing cycle, allowing institutions to better identify, track, and mitigate risks. Another way to classify check fraud by secondary category; first party fraud versus third party fraud. (Described below)

On-Us Check Fraud

Check Deposit Fraud

First Party Fraud

First-party fraud occurs when individuals deliberately exploit their own identity or accounts to engage in fraudulent activities, often driven by a desire for personal gain. first-party fraud is perpetrated by the individual themselves, typically utilizing their legitimate credentials to manipulate systems for illicit advantages.

In the context of check fraud, this involves the account holder deliberately issuing bad checks (e.g., checks with insufficient funds) or manipulating checks to deceive a bank or payee. Examples include: Writing a check knowing there are insufficient funds in the account. Altering a legitimate check (e.g., changing the amount or payee) to benefit the account holder. Opening an account with false information to issue fraudulent checks.

Third Party Fraud

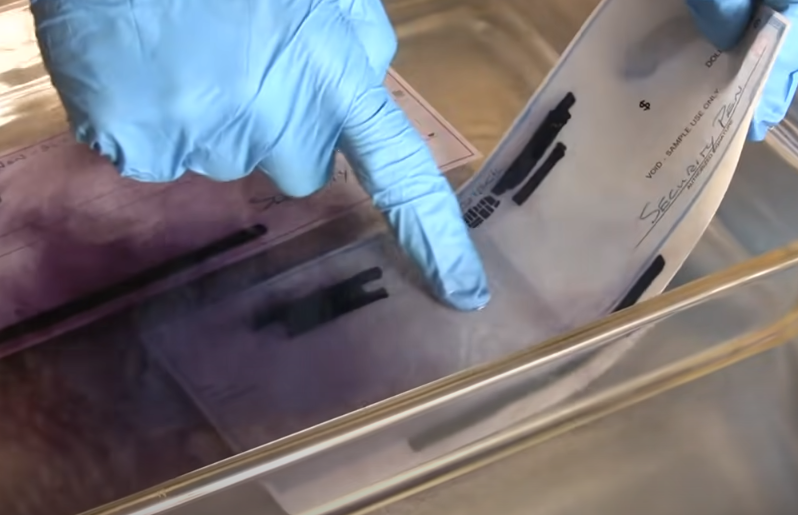

Third-party fraud is a type of financial crime that occurs when an external entity exploits stolen or falsified information to perpetrate fraudulent activities. Typically, the account holder remains unaware that their personal or financial details have been compromised.

In check fraud, this typically involves a fraudster impersonating the account holder or using stolen checks to withdraw money or make unauthorized payments.

Examples include: Stealing checks and forging the account holder’s signature. Creating counterfeit checks using stolen account details. Using stolen identity information to open fraudulent accounts and issue checks.

Check Fraud Market Trends: Yesterday, Today, and Tomorrow

What's next? Based on feedback from industry leaders, banks, credit unions, and service bureaus, we'll continue to see an increase in attempts for the next several years.

Recent Check Fraud Trends

-

75% of banks and credit unions indicated check fraud as a top concern -- Jack Henry & Associates’ 2024 Strategy Benchmark Report

-

90% of community bankers reporting higher levels of fraudulent check-writing -- IntraFi Executive Business Outlook Service Report

-

63% of respondents reporting that their organizations faced check fraud in 2024 -- 2025 AFP® Payments Fraud and Control Survey

-

Check Fraud SARs eclipse 650,000 for the past three years -- The Financial Crimes Enforcement Network reported by Thomas Reuters

Mail Theft and Mail Carrier Robberies

The United State Postal Services (USPS) have struggled to combat the rise in mail theft -- a major source of stolen checks. This includes mail theft/mail carrier robberies and recruiting USPS employees into their organized crime rings. Here are several alarming facts related to statistics involving stolen mail:

- Estimates vary, but according to a 2023 report by Security.org, 1.7 million packages are lost or stolen in the United States every day [1], and over 620 million packages disappear annually.

-

89% of all reported mail thefts happened within these 5 cities (Washington, New York, Los Angeles, Houston & Chicago)

- Robberies of postal carriers climbed 30% in 2023 according to reporting by AP News.

Mitigating Internal Mail Theft Report provides a comprehensive analysis of new activities by the post office.

While the USPS responded with initiatives including Project Safe Delivery, critics says that the USPS and US Government is not doing enough.