Large financial institutions have seen a sharp increase in check fraud over the past three years as illustrated in the latest ABA Deposit Fraud Study:

- Attempts increased to $15.1 billion in 2018—up from $8.5 billion in 2016

- Losses increased to $1.3 billion —a rise from $789 million in 2016.

To combat the fraudsters, banks and financial institutions are modernizing their systems to include real-time, image-based capabilities. Image analysis solutions detect the attributes of a check such as check stock, amount, payee, to detect counterfeits, forgeries and alterations. Image analysis, blended with analytics-based solutions, provide a more complete fraud detection and prevention for financial institutions and their customers.

To explore, click the links below:

Watch the video:

Blog Post

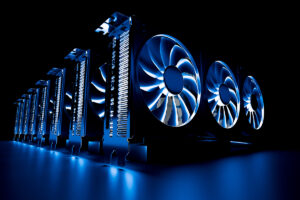

Investment in Hardware/GPU: No Longer a Barrier for AI Check Fraud Detection

AI-powered check fraud detection outperforms manual review and static rules-based systems Mid-range GPUs deliver strong fraud performance without unnecessary hardware expense Optimized AI and GPUs enable real-time, high-volume check fraud decisions With the surge of check fraud over the past decade, we have seen more and more financial institutions transition from traditional rules-based to AI-powered…

Blog Post

SEON Report: The Value of AI in Fraud and AML Increasing

SEON survey shows 98% of organizations already embed AI in fraud, AML workflows Budgets for AI-driven fraud and AML tools are rising, but systems remain fragmented AI augments fraud and AML teams, automating volume while humans handle complex investigations In the recently published report entitled AI Reality Check, 2026 Fraud & AML Leaders Report, SEON…

Blog Post

OrboNation Newsletter: Check Processing and Fraud – February 2026

In case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Blog Post

Are Tougher Prison Sentences the Solution for Check Fraud?

Harsher bank-fraud sentences may deter some offenders, but evidence remains mixed Longer prison terms alone rarely change systemic incentives that make fraud profitable Strong oversight, rapid detection, and credible enforcement often outperform sentence length increases One often ignored factor that help drive the surge in check fraud is the fact that the punishment for committing…

Blog Post

Blank Check Stock: The Quiet Upstream Engine of Modern Check Fraud

Blank check stock is a critical upstream asset for check fraud Fraud rings mass-produce counterfeit checks using blank stock and digital tools Stronger controls around procurement and issuance can disrupt this fraud pipeline Blank check stock has become one of the easiest “upstream” tools for check fraudsters to obtain and weaponize, turning ordinary office supplies…

Blog Post

Should Banks Incentivize Front-Line Staff to Catch Check Fraud?

Performance-based incentives can motivate staff to detect check fraud and protect customers Incentives must be paired with strong training on schemes, red flags, and escalation Overly aggressive vigilance can hurt customer experience if legitimate checks face delays Solving the challenge of check fraud is not just an investment in technologies, it is an investment in…

Blog Post

Scam Detectors Podcast: The History of Check Fraud is as Old as Checks

The episode unpacks modern check fraud, blending old-school scams with advanced AI deception A real-world victim story shows how creative freelancers are targeted through “dream” jobs Overpayment schemes, fake checks, and job scams are explored Did you know the concept of “checks” goes way back thousands of years? According to a blog post from Superior,…

Blog Post

Mastercard: Early Adopters of AI-Driven Fraud Detection See 2X Cost Savings

Generative AI drives a surge in deepfakes and instant-payment fraud Banks deploy AI to monitor transactions and block attacks in real time Behavioral analytics reduce false positives, protect revenue, and strengthen customer trust AI is rapidly reshaping the fraud landscape, and a Mastercard.com post argues that banks can no longer afford to treat it as…

Blog Post

Reliance on Traditional Positive Pay Puts Corporate Clients at Major Risk

Traditional Positive Pay misses altered checks when payee-name verification is absent. Criminals exploit check washing and altered payees to bypass legacy controls Enhanced Positive Pay, field validation, data consortiums, and dark web monitoring strengthen defenses A post by Erin Teta, Director of Cerini & Associates, warns that Traditional Positive Pay is not foolproof: if payee-name…

Blog Post

The Dangers of Social Media: How Scrolling Leads to Check Fraud

Social media oversharing and scam offers give fraudsters personal data to commit sophisticated check fraud Fake contests and money‑glitch trends trick consumers into sending real checks or banking details to criminals Banks must educate consumers and deploy AI‑driven fraud tools to protect customers and maintain trust. Spending a lot of time on social media? Well,…