76% of Banks Have Implemented New Automation Technologies

- Automation streamlines efficiency and the customer experience

- A whopping 76% of banks have not just invested, but implemented new automation tech

- AI/ML technologies enabled banks to achieve 99% read rates and 99.5%+ accuracy

For financial institutions, automation has been a key goal for decades. Not only does it increase operation efficiency, but it streamlines the customer experience.

In a white paper entitled Banks require intelligent automation processes to compete -- cowritten by UiPath, Arizent, and American Banker -- the research shows that a whopping 76% of banks have not just invested, but implemented new automation technology.

This is a major step for financial institutions, but not all are resulting in success.

Findings from the White Paper

While the implementation is a step forward, the white paper notes that "only half indicate their performance to-date has been good and a third report their performance has only been fair."

The report adds additional context:

A substantial number of banks cite operational concerns about initiating automation initiatives as a hindrance to implementation. In particular, these initiatives require them to reorganize existing business processes and legacy systems. Nearly four in 10 (38%) banking professionals say their companies will need to restructure their processes before they can pursue automation any further. The same percentage say their legacy systems are too cumbersome to enable end-to-end automation.

Other common barriers to implementing new automation initiatives include data security and privacy concerns (45%) and competing IT priorities (31%). If they want to compete successfully with industry leaders, banks must find a way to navigate these hurdles sooner rather than later.

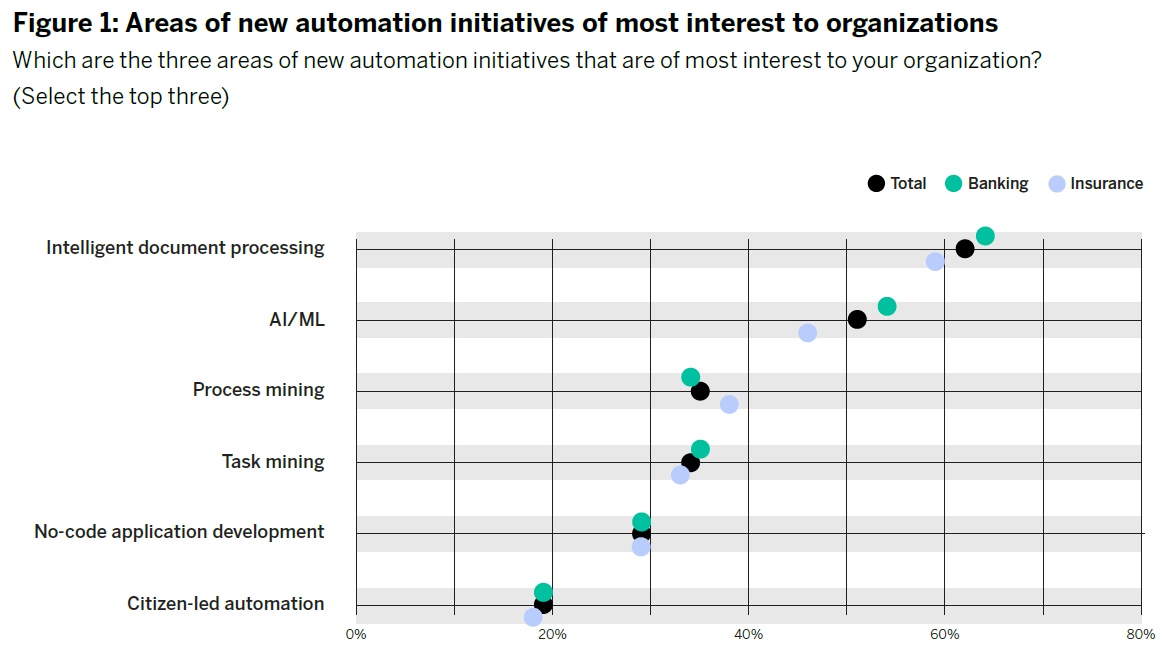

According to the findings, banks major focus was in intelligent document processing and AI/ML:

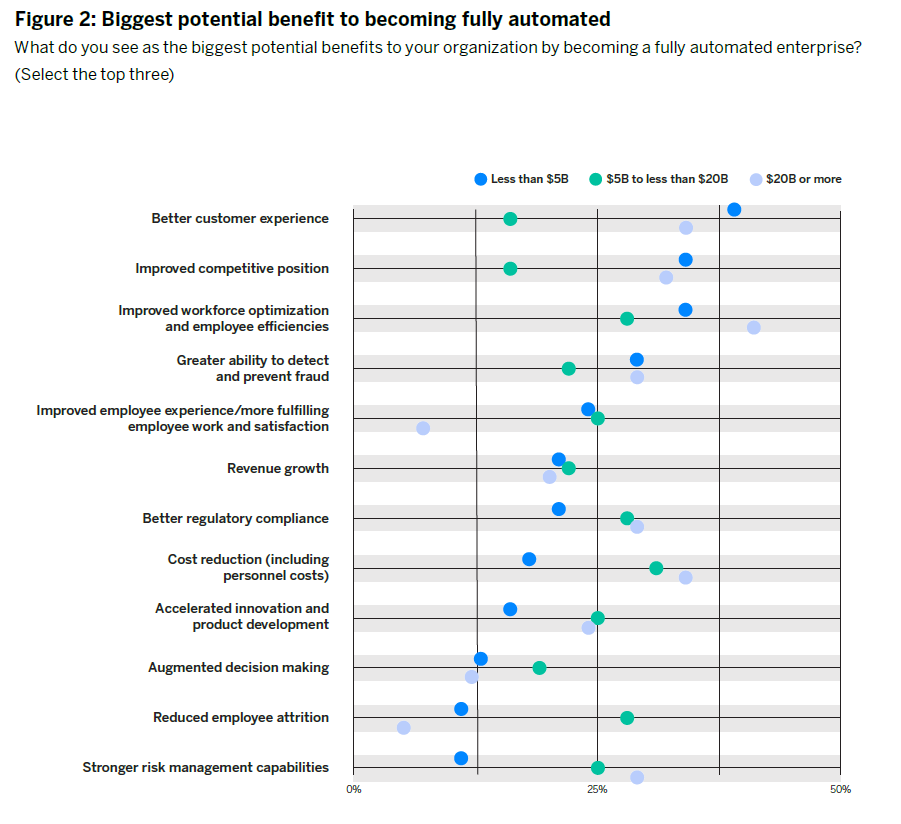

But, what are the potential benefits for FIs becoming fully automated? Well, the opinions are mixed and depending on the size of the FI:

Automation in Check Processing

The research shows that banks were heavily investing in AI/ML and intelligent document processing -- two technologies directly linked to check processing. AI/ML technologies like OrbNet AI enabled banks to achieve 99% read rates and 99.5%+ accuracy -- effectively achieving the elusive straight-through processing.

However, innovation do not stop there. In the recent OrboAnywhere Turbo 6.0 release, our technologies has seen a massive boost in throughput speed and latency. As noted in our Product Innovation Brief:

- Throughput improvements (Speed in DPM - Documents Per Minute): Most OrboAnywhere modules attain 2X to 4X overall speed improvement on the same hardware comparing V6.0 to V5.3. For example, Anywhere Recognition can run nearly 10,000 DPM on a single A100 GPU.

- Faster latency (Response time for real-time API calls): Reduction in recognition latency by up to 70%, with results as fast as 100ms (milliseconds). Real-time check fraud detection can be accomplished with low latency using Anywhere Fraud.

Additionally, we have certified the NVIDIA L-Series GPU as well as optimized the OrboAnywhere Modules for CPU processors only (for low volumes).

To receive a copy of the release notes or the OrboAnywhere Turbo 6.0 Fact Sheet, visit www.orbograph.com/orboanywhere-turbo-6-0 or email marketing@orbograph.com.