10 Big Ideas for Banking in 2017

American Banker provides their view toward futuristic ideas with 10 Big Ideas for Banking in 2017. It’s a combo of both cool and crazy concepts; each of the 10 predictions/ideas link to a more comprehensive look at the topic in question (also in a fun slideshow format).

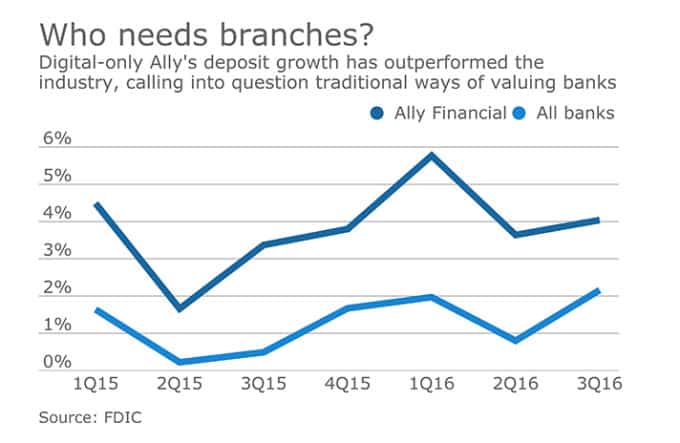

Ally Bank shows that their customers are relying on online and mobile channels to interact – which somewhat contradicts our post from last week. However, I don’t think the Ally Bank customer is the same customer which “likes” to still visit the physical location of a bank. So therein lies the issue of not trying to generalize behaviors of one customer group to all others.

Industry insiders envision a future deal metric that takes into account increasingly precious customer data. Many bankers say that the true value for banks going forward will be in the data. They are building loyalty digitally through additional services, rather than treating mobile banking as just another delivery channel for the same products available at the branch and online. Essentially, they want their customers to love their mobile app, not just see it as a utility.

But, while digital and mobile is the wave of the near-future, we are also cautioned that, because of hacker threats, customer data Is a liability.

Reimagine the Joint Checking Account is interesting as well, addressing how to offer better controls to the account holders. From our standpoint, we are addressing joint account holders with fraud prevention. OrboAnywhere builds profiles and logs activities of check writers based on transaction data and images. Transaction and image analysis then allows for account holder behavior and image profiling, i.e. allowing for multiple signatures and multiple check number ranges from the same account. However, if fraud is attempted outside of these two or three account holders, the system identifies forgeries or counterfeits that hit against the account, thus protecting the account holders!

Opportunity… meet challenge!