Update on Unemployment Fraud – Have We Learned Our Lesson?

- Unemployment fraud is not subsiding in sync with lower infection rates

- The fraud loss impact is now national in scope

- Third round of stimulus checks are being distributed -- but what about fraud prevention and detection measures?

Recently, we detailed how millions were finding IRS Form 1099-G in their mailboxes...but they haven't been collecting unemployment! As a result, fraudsters have made away with a conservative estimate of $36B.

With the third round of stimulus checks being distributed at the time of this article, there is a question many are pondering: Have we learned our lesson?

Click the image above to watch the video on NBC News website.

Update on Losses

Here's where the numbers get really frightening: The Labor Department inspector general's office is estimating that more than $63 billion has been paid out improperly through fraud or errors - roughly 10% of the total amount paid under coronavirus pandemic-related unemployment programs since March.

- California has taken the biggest hit: an estimated $11 billion in fraudulent payments and an additional $19 billion in suspect accounts.

- Colorado paid out nearly as much to scammers - an estimated $6.5 billion - as it has to people who filed legitimate unemployment claims.

- Scams have been so widespread that the U.S. Department of Justice is setting aside money to hire more prosecutors.

- In New York alone, the Department of Labor says it has referred "hundreds of thousands of fraud cases" to federal prosecutors.

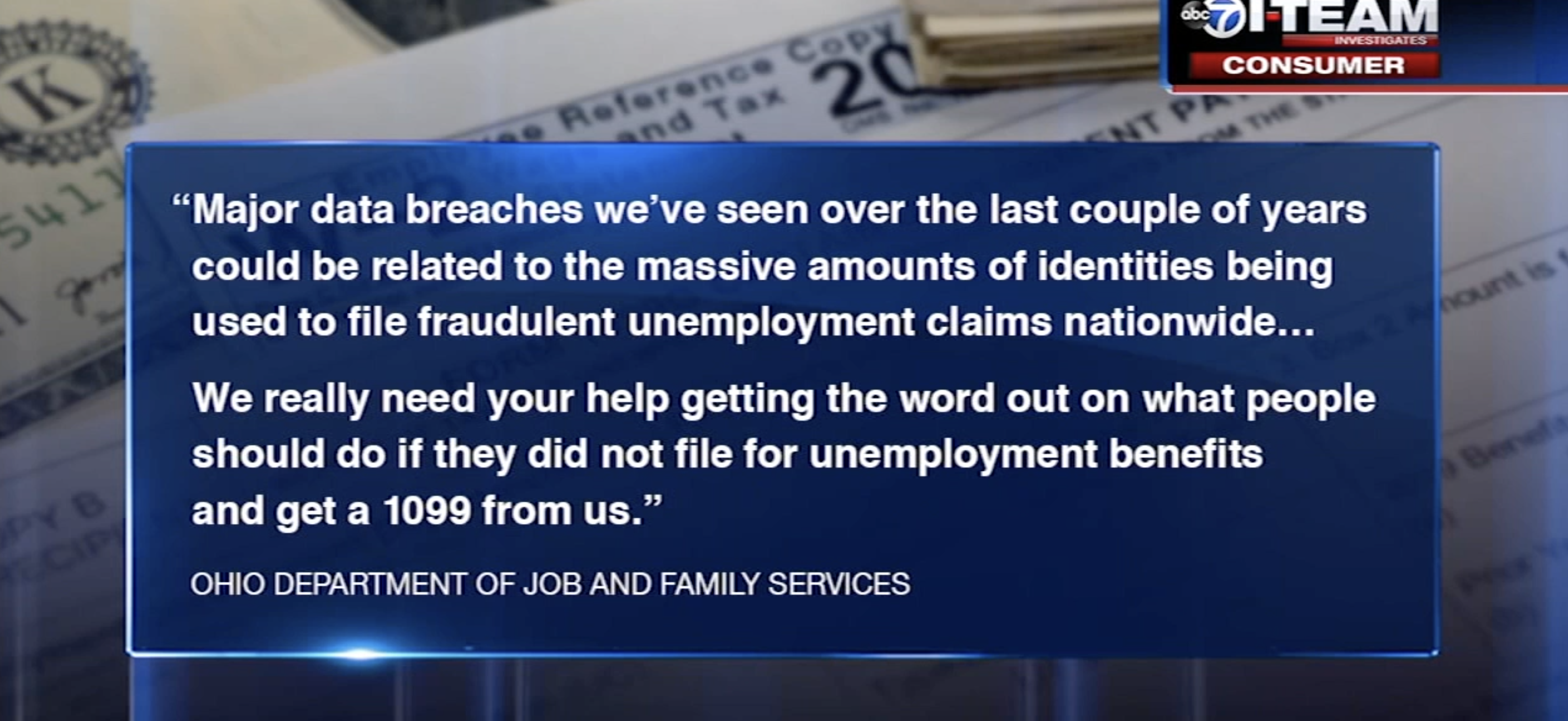

With the wave of fraud picking up steam, the U.S. Justice Department is getting involved. As reported by ABC 7 Eyewitness news in Chicago:

The massive sham springs from prior identity theft from banks, credit rating agencies, health care systems and retailers. Fraud perpetrators, sometimes in China, Nigeria or Russia, buy stolen personal identifying information on the dark web and use it to flood state unemployment systems with bogus claims.

The U.S. Justice Department is investigating unemployment fraud by "transnational criminal organizations, sophisticated domestic actors, and individuals across the United States," said Joshua Stueve, a spokesman for the department's criminal division.

The U.S. Justice Department is investigating unemployment fraud by "transnational criminal organizations, sophisticated domestic actors, and individuals across the United States," said Joshua Stueve, a spokesman for the department's criminal division.

From ABC 7 Eyewitness News Chicago

Have We Learned Our Lesson?

With this extraordinary amount of fraud occurring, experts are concerned that fraud prevention and detection measures are not being prioritized by the US government.

According to the Los Angeles Times:

“It’s like Christmas for the fraudsters,” said Haywood Talcove, chief executive of information firm LexisNexis Risk Solutions, Government Group who says the government should adopt tougher anti-fraud safeguards to verify the identity, work history and location of applicants. “I wouldn’t let another penny go out until the government puts some of these tools in place to prevent it.”

Cybercrime experts, including some who once made their living exploiting weak online systems, warn that as Congress prepares to pass another mass infusion of cash, criminals have gotten smarter, but the federal government hasn’t.

While the House has included $2 billion for improvements to state and federal unemployment systems, the money is not dedicated to prevent fraud alone. And while this is a step in the right direction, more needs to be done -- and from an cybersecurity expert's perspective, the states need only take a few basic steps to implement technologies available to mitigate fraud:

Talcove said even some basic steps would eliminate much of the fraud, such as requiring states to use third-party information companies like his to do the same background identity checks that online retailers and banks do with nearly every transaction online: check if the IP address being used to file the claim is in the same state or country, or if it was used to file multiple claims in a short period of time; use public-record databases to confirm details; and check how long an applicant’s email has existed.

“It’s not hard to fix,” Talcove said. “This is not a complicated fraud.”

While the suggestions seem basic, we all know that identity fraud is a challenging animal requiring more advanced monitoring technologies. For Banks and financial institution to do their part, deploying image-analysis technologies with forensic fraud capabilities along with AI-based field recognition can actually match check data to negative lists, i.e. payee and payor fields. Banks and financial institutions are able to identify counterfeits, forged, and altered checks, and can leverage similar technology for fraud use cases like these.

The technology is readily available for both the U.S. government and banks and financial institutions. With fraud continuing to rise, both must act with urgency to deploy these preventative and detection measures to stop the wave.