Avoiding Investment in Fraud Tools — Save Now, Pay Later

- Is your organization lagging behind in fraud detection and prevention tools?

- Waiting for a fraud event can cost more than pre-emptive fraud prevention

- Fraud prevention tech is not a DYI proposition

In his always-entertaining Frank On Fraud blog, Frank McKenna takes a look at businesses that are struggling to get the fraud tools and technology they know they need in the current business environment. Unfortunately, many are getting hung up on immediate return on investment rather than proactive, preventive steps.

Building an ROI (Return on Investment) is a prerequisite these days with most banks. To get the funding to purchase any fraud tool these days fraud managers not only have to show the lift but have to show how much money they will return to the organization by purchasing the tool.

That is far easier said than done in most cases. Why is that you ask? Because from my experience, good fraud managers spend most of their time putting in technologies and practices that will stop future fraud. That makes building an ROI for a progressive tool a daunting task. How do you return money to a bank that has not been lost yet? That is the dilemma.

No executive in his right mind would buy off on a business case for a fraud tool based on fraud that they haven’t even experienced right? Right! Wrong.

Frank goes on to list the following four examples of how building ROI on past fraud alone has gone "spectacularly wrong."

#1 – CHIP Card in US Showed Us That There is Always an ROI for Fraud If You Wait Long Enough.

In summary: The US could not build the business case to spend the money to make the transition from magnetic stripe to Chip Card. That is, until...

Target was breached and lost 33% of their stock value in a month resulting in billions lost to stockholders – it became worth it. When Home Depot had the largest breach recorded and lost hundreds of millions of plastics, it became worth it. When the US became the defacto #1 targets of global fraud, the ROI suddenly worked.

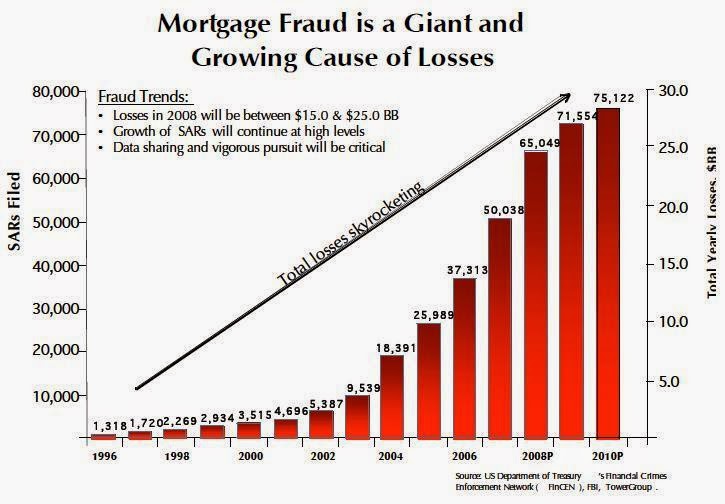

#2 – Because There Was Never a Business Case for Mortgage Fraud Tools Until it Was Too Late

In 2004, I started an analytics company focused on Mortgage Fraud. When we started speaking with Mortgage Lenders at that time everyone was living the high life. Mortgage was booming, things were great and surprisingly there was almost zero reported fraud.

Mortgage lenders informed us that there was less than 1 basis point of fraud loss! With reported fraud so low, they could not justify spending any money on fraud tools. There was simply no ROI.

So many lenders waited, and waited, never investing in any fraud tools. And then I watched many of them go out of business. They went out of business because they got crushed with fraud. Think of that, these lenders were afraid to spend $3 or so per application because it was too much money but that decision ended up bankrupting them. If they could have looked ahead, rather than back, they could have saved billions of dollars.

#3 – We Don’t Need Realtime Scores

Long story short: by integrating scores to real-time, the fraud group knows that they can start to decline high-risk transactions. The IT group, however, realizes it’s a very big project so they quote thousands of hours. Execs see the cost and put it off -- and the result is that the company never moves to real-time.

Then they get hit with fraud. Losses spike sometimes doubling or tripling overnight and the bank finds themselves scrambling for a solution. They cannot stop the fraud from getting through because they cannot decline high risk transactions. The bank starts shutting off accounts to stop the bleeding and then customers start screaming. The bank is in a state of chaos. It is only then that they realize they should have spent the money to implement real time.

As we move towards real time payments here in the US, I think many banks are going to struggle because they will not have spent the money on systems that can stop funds immediately.

Source: Frank on Fraud

#4 We Can Save a Bunch of Money by Doing That Ourselves!.

I think many companies underestimate the level of effort and time required to build and maintain their own fraud tools. While they may have the talent to build the tool themselves they often forget about the hidden cost.

Significantly Longer Time Frames – Building an internally developed tool can take 6-9 months and often the project will be abandoned as higher priorities come about.

Operationalizing a fraud tool is very difficult. Many internally developed analytic tools at banks I work with fail because they never thought about how the fraud analyst would use the scores.

Lost Time is Lost Fraud Dollar Cost – Many companies fail to remember that there is a savings in cost every day sooner they get a fraud solution.

Internal Support, Maintenance and Updates – Fraud vendors often supply regular updates to clients of their solution. Since they have dedicated teams to improve the product, they are constantly evolving the product. Companies fail to account for this in developing their own tools

Another thing to keep in mind. By the time a vendor shows you their fraud tool they have probably invested tens of thousands of hours into that technology and made thousands of mistakes that they have worked through. Do you really want to have to go through that same pain? Take it from me, as a co-founder of a company that builds fraud tools you probably don’t.

This concept is not unlike what we have seen in the banking industry when it comes to check fraud. Check fraud is not a new phenomenon, but similar to the examples above, banks were (and some still are) not properly equipped to detect fraudulent items to protect from losses. The large spikes in check fraud attempts and losses over the last 5-10 years have forced many banks to re-evaluate their current processes and technologies.

This has lead to a huge shift. Banks previously thought that they were able to "do it themselves"; now they realize that partnering with technology vendors with proven expertise in fraud prevention is the wiser move. Banks now understand that deploying dozens, if not hundreds, of fraud analysts to review items for fraud is unsustainable, and many banks lack the internal resources required to develop technologies on their own. Vendors like OrboGraph have developed their fraud solutions -- with the ability to be deployed on-premise or in cloud environments -- to be utilized by any channel, and those banks taking advantage of this partnership are reaping the benefits.