Industry Experts: Healthcare RCM M&A Trend Will Stretch Into 2022-2023

Over the past five years, mergers and acquisitions (M&A) within healthcare RCM have made headlines across news outlets. In fact, Justin Bentley, Managing Director–M&A and Head of Healthcare Technology at Citizens Bank, describes healthcare RCM M&A as a "white-hot sector" during the recent Healthcare Revenue Cycle Industry Brief & Opportunity Analysis Webinar.

We've covered several recent major M&A's in our blog, including:

- Microsoft acquires Nuance for $19B

- Oracle acquires Cerner for $28.3B

- Optum acquires Change Healthcare for $13B

- Hellman & Friedman and Bain Capital acquires athenahealth for $17B

- R1 RCM acquires Cloudmed for $4.1B early in 2022

With all this in mind, OrboGraph sponsored an informative webinar featuring speakers from Citizens Bank, CAQH, and Linchpin Healthcare to discuss the recent M&A trends, the investor's perspective of these deals, and what the future holds for healthcare RCM M&A. Watch the recording and download the presentation below.

Key Insights from the Webinar

Scale, Revenue Growth, and Gross Margins

Speaker Justin Bentley of Citizens Bank identifies scale, revenue growth, and gross margins as the three key factors/drivers that investors use to evaluate companies in healthcare RCM.

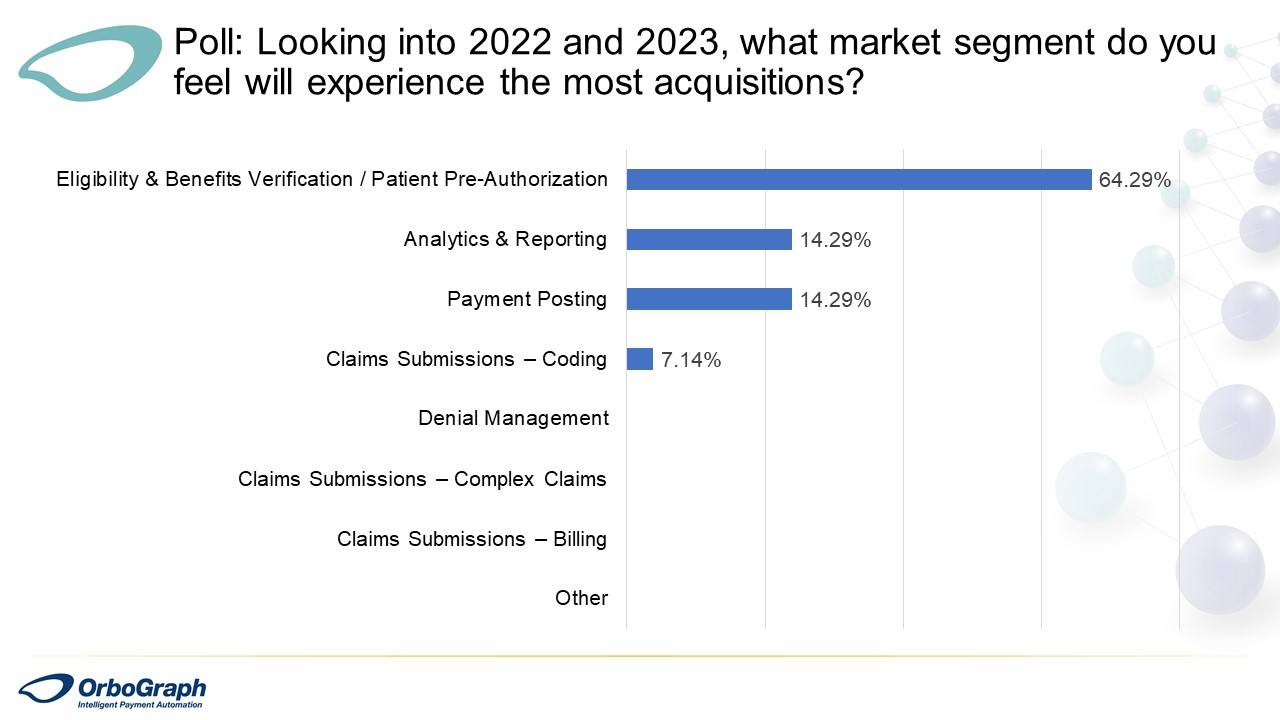

Eligibility & Benefits Verifications/Patient Pre-Authorization will Experience Most M&A

We were able to poll the diverse group of webinar attendees (from providers to investment bankers) to get their perspective on which segment of RCM will experience the most M&A in 2022 and 2023.

The majority (64.29%) selected "Eligibility & Benefits Verifications/Patient Pre-Authorization will Experience Most M&A", agreeing with the sentiment from Justin Bentley.

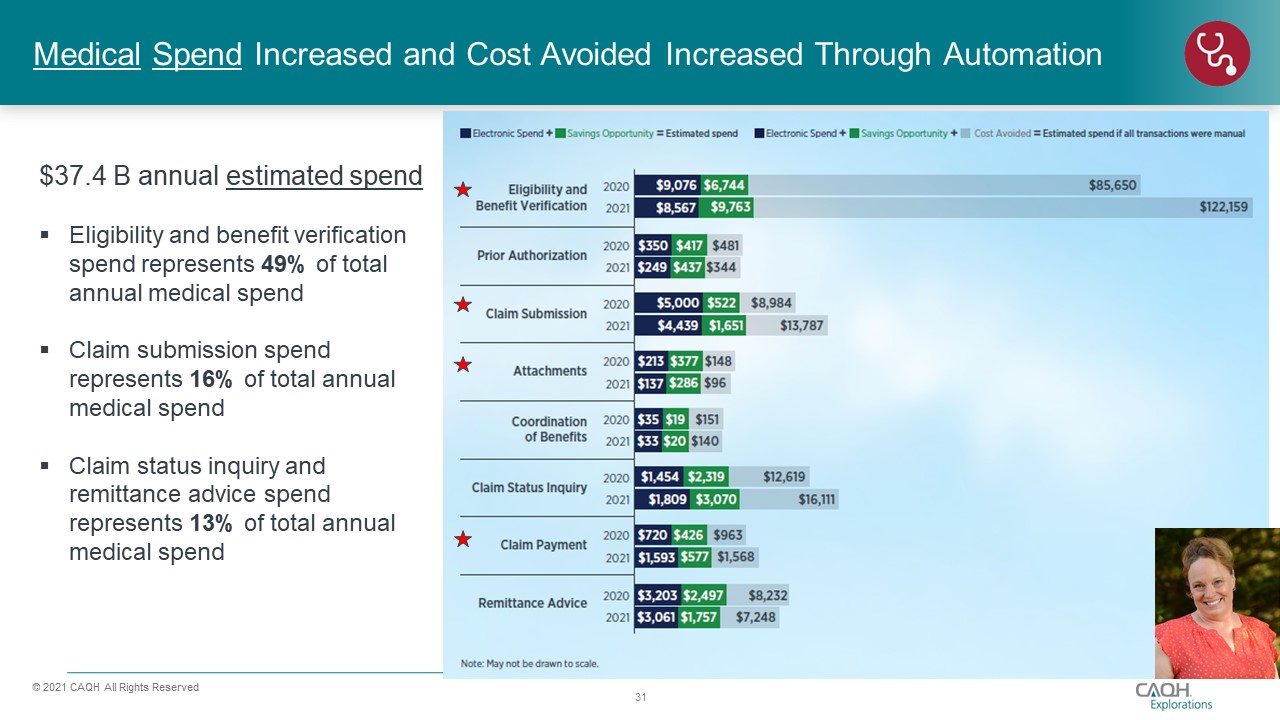

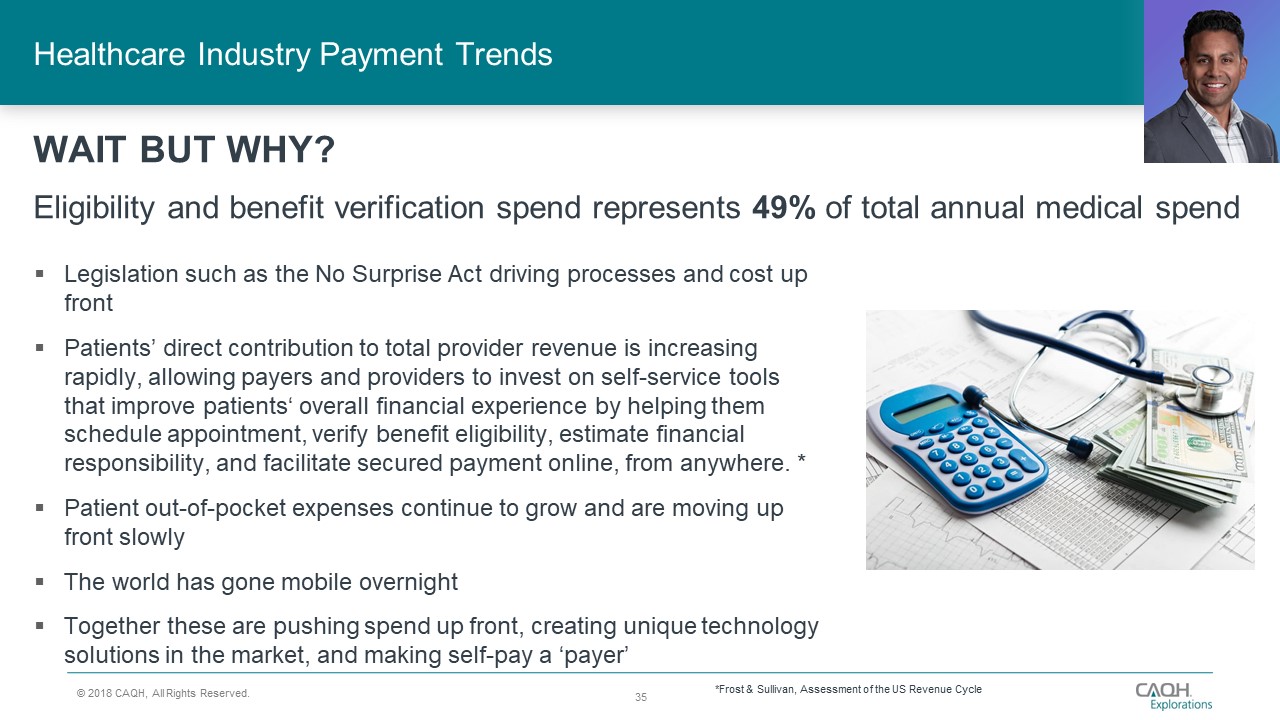

This is further backed by research from CAQH, as "Eligibility & Benefits Verifications represents 49% of total annual medical spend."

Click the images above to enlarge.

Self-Pay IS a "Payer"

Speaker Josh Berman of Linchpin Healthcare notes that large investments into the front-end of RCM result from patients being empowered because of legislation such as the No Surprises Act. This drives up costs, while patients out-of-pocket expenses continue to rise -- effectively making patients a "payer."

Click the images above to enlarge.

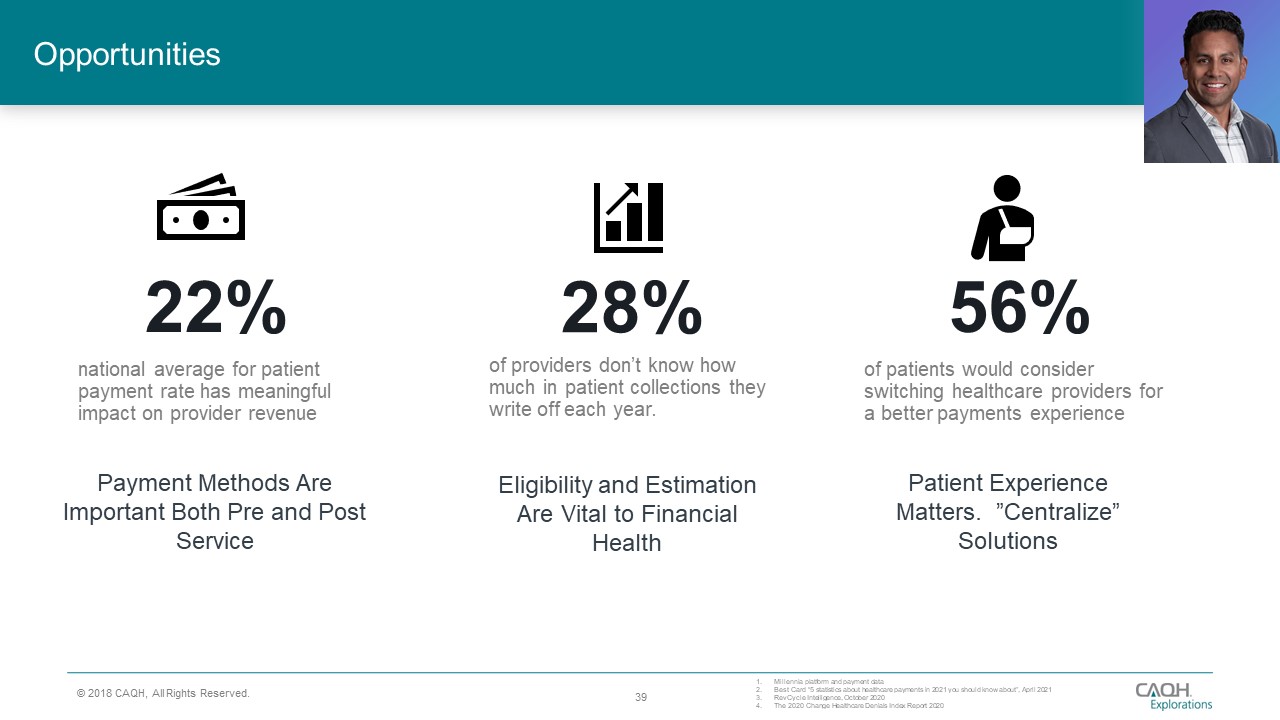

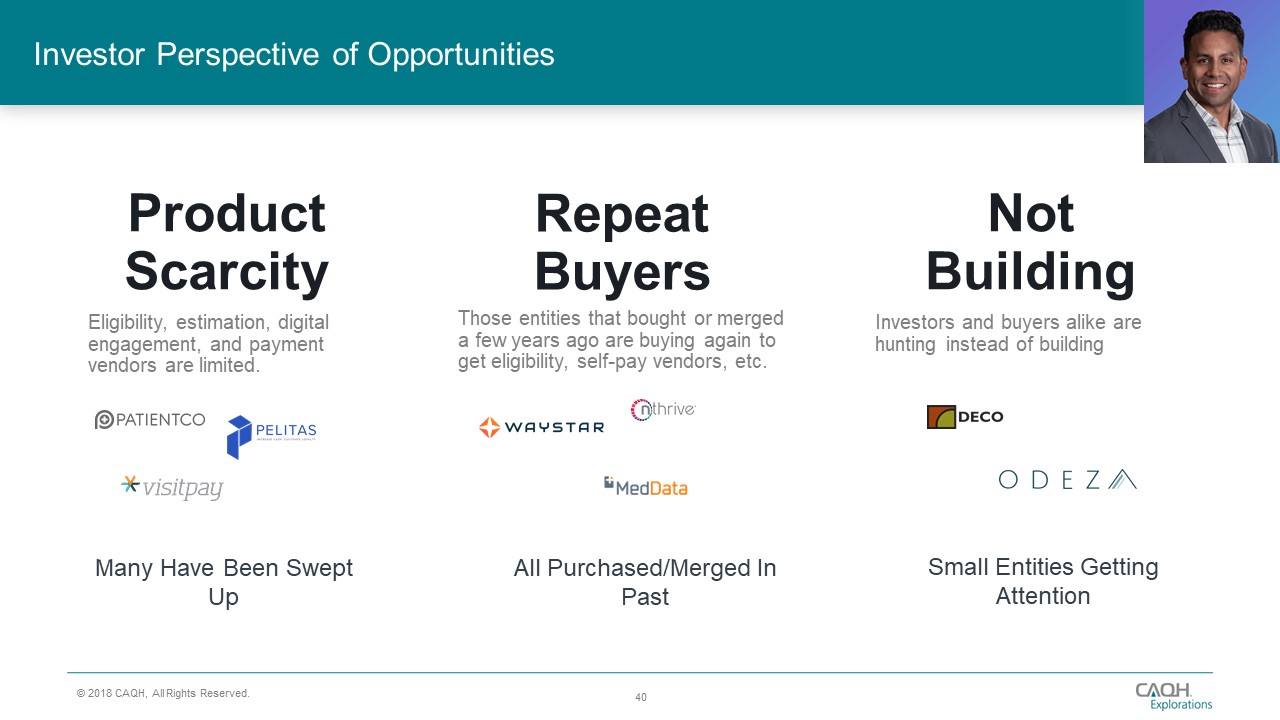

Mr. Berman goes on to point out that there are major investment opportunities for RCM, particularly as providers are struggling to manage payments. He also notes things investors can look for when weighing opportunities:

Click the images above to enlarge.

The next few years are shaping up to be an exciting time in the healthcare RCM M&A space -- particularly technology companies that are are solving an issue or filling a need. If you have any questions for the speakers, please reach out to marketing@orbograph.com.