2022 IBM Global Financial Fraud Impact Report Reveals Need for GPUs for Fraud Detection

- IBM's latest move into fraud protection

- AI is the key component

- These tools allow a switch from fraud detection to fraud prevention

IBM and Morning Consult just released a new study: 2022 IBM Global Financial Fraud Impact Report, providing data from six countries on fraud activities being experienced along with identifying the types of payments fraud. The study was conducted online, with a sample of 1000 participants from the United States, China, Singapore, Brazil, Japan, and Germany. The sample groups were also broken down to age groups, consisting of four categories:

- Baby Boomers: 1946-1964

- Gen Xers: 1965-1980

- Millennials: 1981-1996

- Gen Zers: 1997-2012

Highlights from the Study

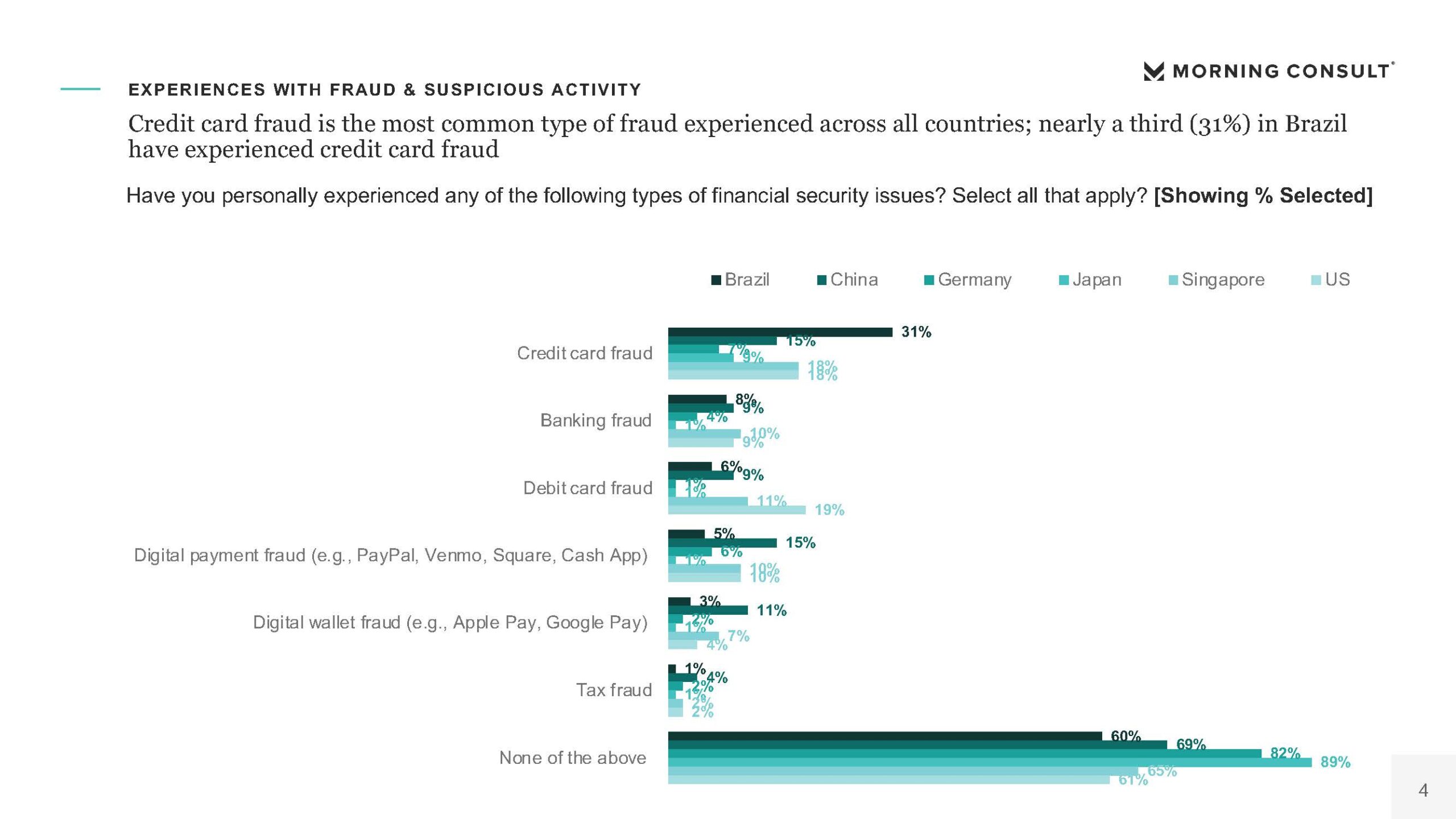

According to the study, credit card fraud is the most common type of fraud experienced across all countries, ranging from as low as 7% in Germany to as high as 31% in Brazil (with the US in the middle at 18%).

Additionally, banking fraud -- which includes checks -- is ranked second with much less variation across the countries as four of the six land between 8% (Brazil) and 10% (Singapore), with the US at 9%.

Click to enlarge the image.

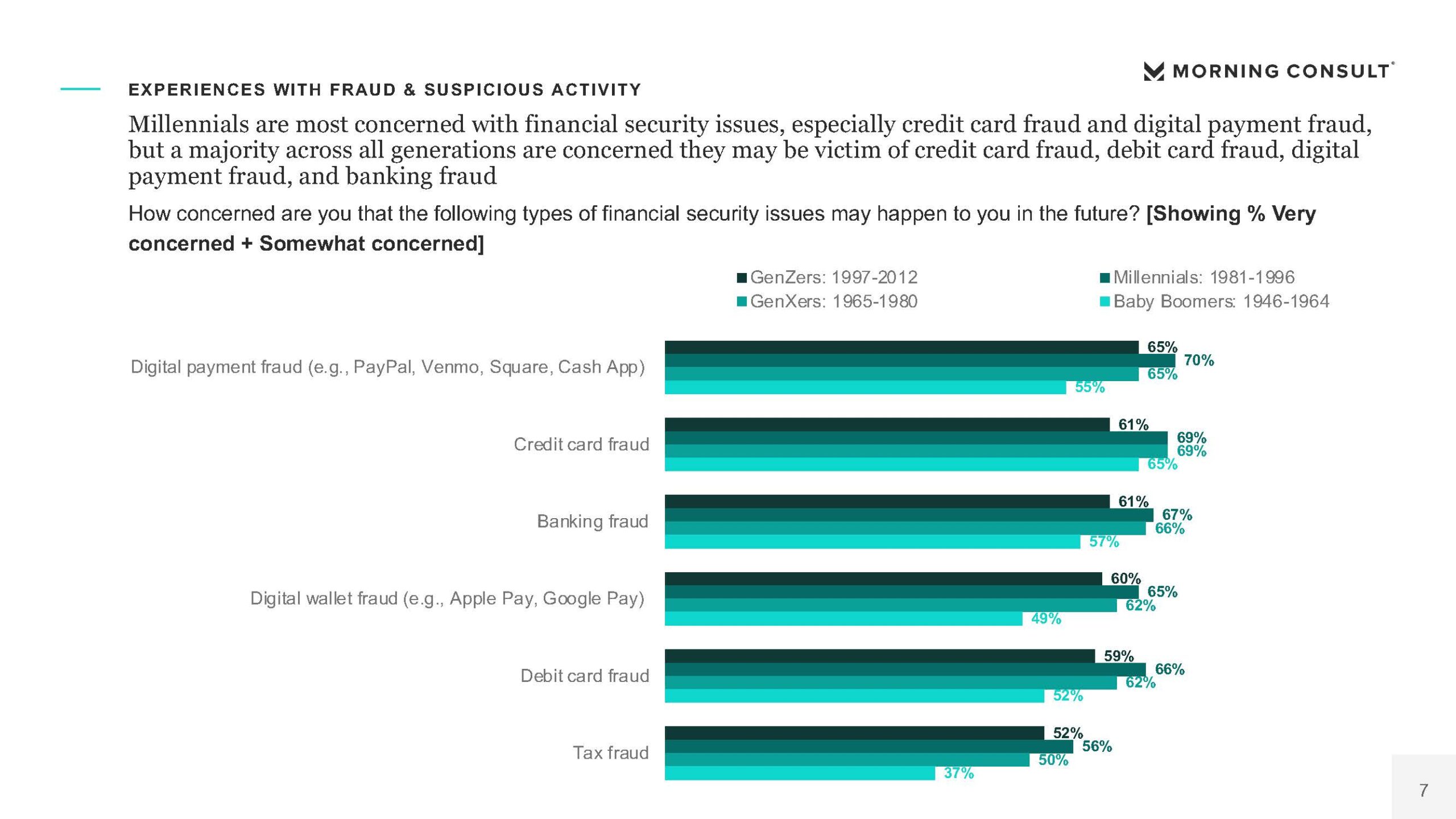

Furthermore, the study looks at what types of fraud most concerns specific groups. It's no surprise that "Millennials are most concerned with financial security issues, especially credit card fraud and digital payment fraud, but a majority across all generations are concerned they may be victim of credit card fraud, debit card fraud, digital payment fraud, and banking fraud."

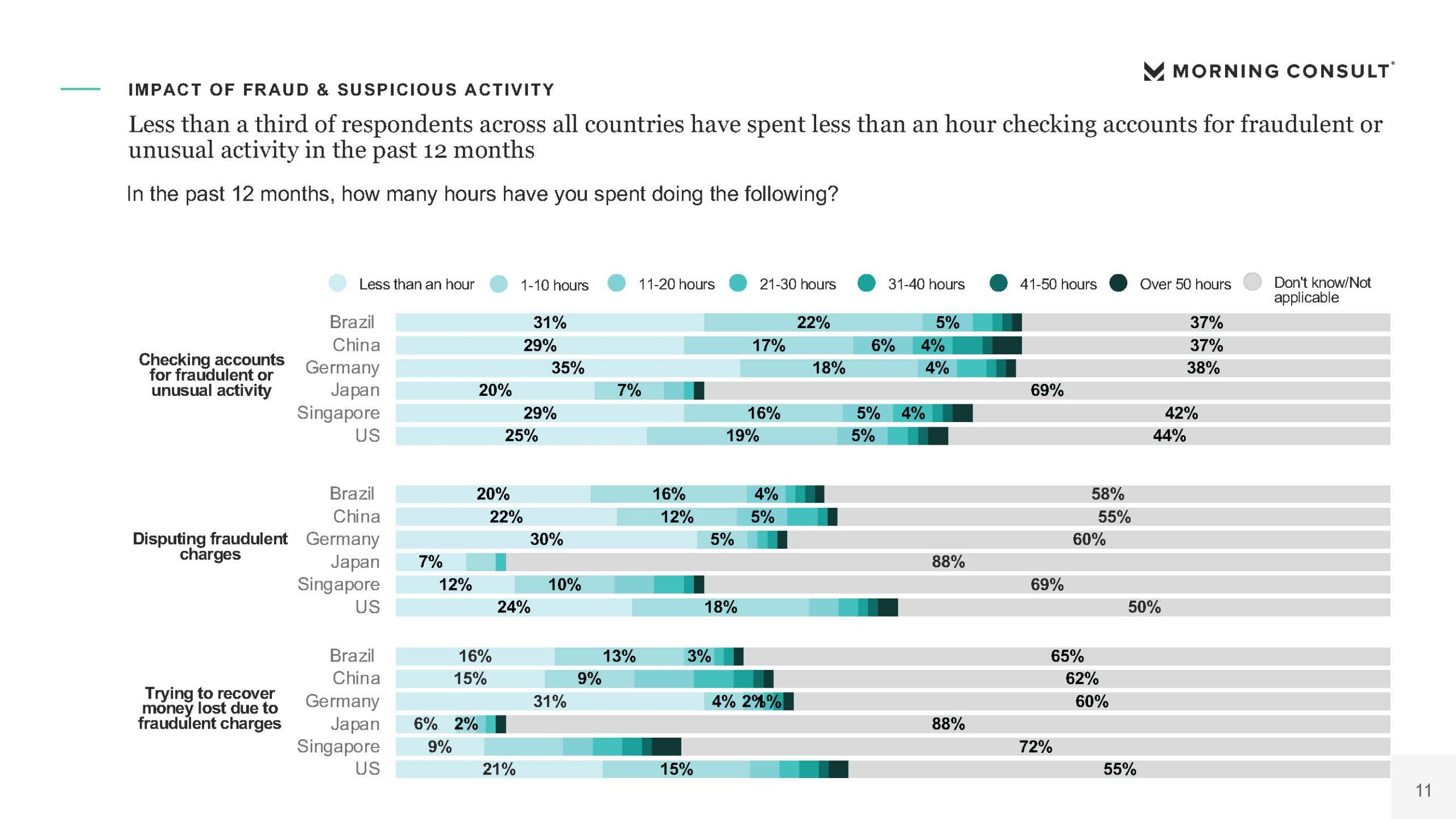

What is surprising however, is that, although concerned, "Less than a third of respondents across all countries have spent less than an hour checking accounts for fraudulent or unusual activity in the past 12 months."

Click to enlarge the image.

Click to enlarge the image.

Focus on AI and Machine Learning Leveraging GPUs for Fraud

The study provides much-needed data to understand the scale of fraud globally. Furthermore, according to the study, "consumers today also expect banks and payment networks to be responsible for preventing fraud."

Financial institutions worldwide struggle with the impacts of fraudulent activities on their revenues and consumer interactions. Today, fraud detection tools are becoming increasingly in demand as financial institutions look to avoid any untoward incidences and protect their customers. Leveraging machine learning and artificial intelligence, the technology continues to evolve with more features being added to improve fraud detection services...

...There is one problem though. Fraud detection can only happen when a fraud is committed. Running deep-learning models at scale in real-time has not been possible due to latency issues, meaning fraud detections models are only run on less than 10% of high-volume transactions – a significant amount of fraud is going undetected.

This is a problem that persists across the fraud detection landscape, particular with check fraud in the US -- both on-us and deposit. Banks are not only tasked with handling hundreds of thousands to millions of daily transactions, but also tasked with analyzing these transactions for fraudulent activity -- whether it's transaction-based for behavioral anomalies or image-based for identification of fraudulent items such as counterfeit, forged, or altered checks.

Clearly, this cannot be done by humans, and even CPUs are unable to handle this type of volume. That's why banks are turning to AI and machine learning, leveraging GPUs to process and analyze these large amounts of transactions. We provided in a previous blog an in-depth review of why GPUs are needed for check processing and fraud detection, as it provides provides a higher rate of speed and accuracy than CPU. Consider this excerpt from the post:

So what happens when you have a large amount of items to process against millions of images of check or weights?

"If your neural network has around 10, 100 or even 100,000 parameters. A computer would still be able to handle this in a matter of minutes, or even hours at the most.

But what if your neural network has more than 10 billion parameters? It would take years to train this kind of systems employing the traditional approach. Your computer would probably give up before you’re even one-tenth of the way.

A neural network that takes search input and predicts from 100 million outputs, or products, will typically end up with about 2,000 parameters per product. So you multiply those, and the final layer of the neural network is now 200 billion parameters. And I have not done anything sophisticated. I’m talking about a very, very dead simple neural network model." — a Ph.D. student at Rice University.

As a general rule, GPUs are a safer bet for fast machine learning because, at its heart, data science model training consists of simple matrix math calculations, the speed of which may be greatly enhanced if the computations are carried out in parallel. This is why the banking industry is moving towards AI and machine learning, leveraging GPUs to power their systems.