Fraud Expert: Check Fraud Predicted to Hit $24B+ in 2023

- Check fraud is on the rise with no relief in sight

- "I think check fraud is going to hit $24 billion or more this year," says Frank McKenna

- Banks will need to invest in technological "shields" again check fraud

Suparna Goswami of the ISMG Network spoke to Frank McKenna, chief fraud strategist at Point Predictive and creator of the always informative frankonfraud website, about how banks can prep for the onslaught of check fraud, first-party fraud, and AI-related scams foreseen for the immediate future.

McKenna starts by observing that 2022 was "a year like no other," which made it very interesting, he explains, from an observational standpoint.

"We see a thing like check fraud - an "old technology" type of fraud - become the number one type of fraud. Who would have guessed that?"

McKenna also made note of the various digital scams that flourished in the past year, referencing the proliferation of "bots" in the payments environment that make it harder and harder to protect individuals and businesses from becoming victimized.

Check Fraud Remains Top Concern for 2023

Looking ahead, McKenna warns that there is no relief in sight from the fraud threat.

"I think check fraud is going to hit $24 billion or more this year. This will be a 50% increase from the last time it was measured in 2018. You are going to see banks start to implement newer technologies. You are going to see banks start to try to solve the problem of these identity theft and fake accounts that are getting in bank accounts and depositing these fake checks."

McKenna foresees a big enough potential check fraud growth and impact that banks are certain to invest in technological "shields."

I think they're going to do a few things, I think the first thing they're going to do is invest in new technology, I think there's going to be new technology investment in checks, because it's so high.

AI Technology to Fight Fraudsters

When asked which technologies in 2023 will help reduce fraud, McKenna points out the impact AI has had on fraud.

I'm really excited to see what the industry does with AI. Because I think what we've seen over the last year is the absolute explosion of AI and the power that it can represent. I think where we're going to see a lot of advancement is in the use of AI, both in use by fraudsters but anti-fraud as well. I'm really excited to see where that goes.

There have indeed been many fraud-combatting advancements in AI, particularly when it comes to checks. Traditional transactional analytics systems have evolved into behavioral monitoring/predictive systems that can spot anomalous transactions within accounts -- whether they are business or personal checking accounts.

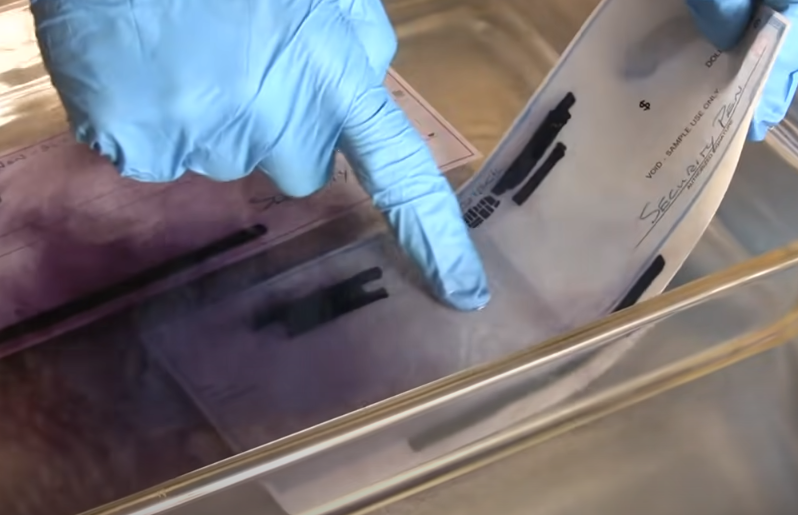

Additionally, image forensic AI -- which interrogates the images of checks for counterfeits, forgeries, and alterations -- has evolved as well. As the system processes more and more checks, the system continues to learn to identify key attributes of the checks -- even the style in which checks are written (aka Writer Verification). By combining these two technologies, banks are able to increase their check fraud capabilities, lower the number of false positives needing to be reviewed, and decrease losses in a time where attempts continue to increase.