Jack Henry’s 2024 Strategy Benchmark Report: 75% of FIs Indicate Check Fraud as a Major Concern

- Jack Henry has released a new report on AI strategy

- The report reveals that a vast majority of financial institutions plan to increase tech budgets

- 75% of banks and credit unions indicate check fraud as a major concern

Our friends at Jack Henry & Associates has recently published the 2024 Strategy Benchmark report. Conducted between January and February of 2024, an online survey was distributed to core clients with responses from 127 bank and credit union CEOs -- representing a diverse sample of Jack Henry clients across the U.S., with assets ranging from under $500 million to more than $10 billion.

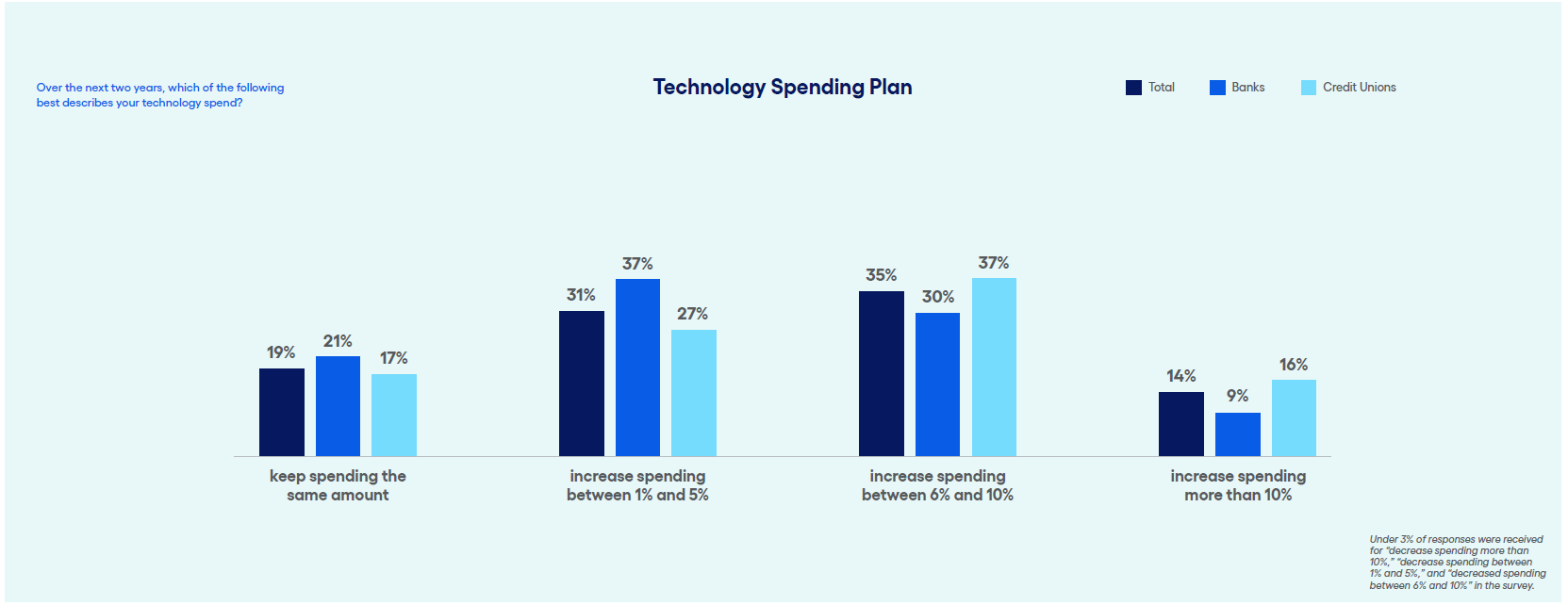

The reports that "80% of all financial institutions plan to increase technology spend over the next two years, but credit unions are more bullish on budgets."

37% of credit unions plan to increase technology investments between 6% and 10%, while only 30% of banks are targeting that investment level. Most banks (37%) plan to increase their investments between 1% and 5%.

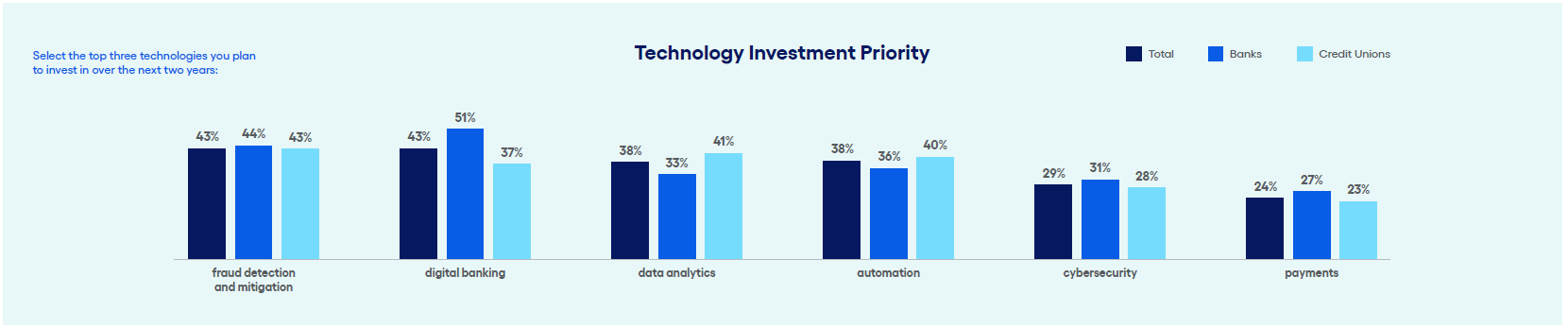

So, what technologies are FIs planning to invest in the next two years? Well, there is no surprise that Fraud detection and mitigation, along with AI are major focuses.

Fraud detection and mitigation, digital banking, and data analytics are the top three technology investments planned over the next two years. Relative to banks, credit unions give outsized priority to investments in artificial intelligence (AI). Consistent with past years, credit unions are also allocating more of their budgets to data analytics and automation relative to banks.

FI's Investing in Fraud Detection and Mitigation

As noted in the report, 43% of respondents selected "fraud detection and mitigation" as one of the top three concerns -- 44% of banks and 43% of credit unions respectively.

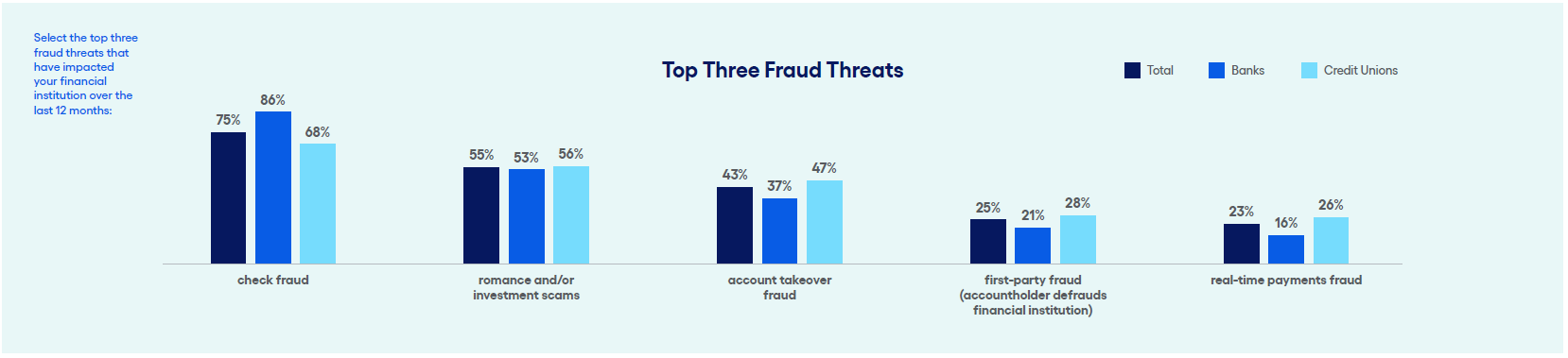

And, it is no surprise that check fraud leads the way as 75% of banks and credit unions indicated check fraud as a top concern:

Addressing Check Fraud Concerns

As fraudsters are adopting new technologies to execute their schemes, banks and credit unions need to continue to invest in fraud technologies:

Strategic investments in advanced technology geared toward identity will become imperative for banks and credit unions looking to protect themselves and their accountholders.

Jack Henry notes that addressing fraud "begins (and ends) with data." Data offers crucial insights into behaviors of account holders and allows for anomalies to be identified. This is particularly for both on-us and deposit fraud, where multi-layered strategies should be deployed.

For on-us fraud detection, data plays a major role. Image forensic AI technologies leverage previous cleared checks and fraudulent checks as training data to identify counterfeits, forgeries, and alterations. As checks are cleared or rejected by fraud analysts, this new data is incorporated and the AI models receive new images as part of their profile.

For deposit fraud, check items being deposited leverage a combination of transactional data, image forensic AI, and consortium data to identify suspicious activity in the depositing account at the bank of first deposit (BoFD), the image of the new deposited item, AND data from the consortium on the drawing account. This data enables the BoFD to leverage all the data available to determine if the deposited check is fraudulent.

Adopting a multi-layered approach to check fraud is crucial to protect not only your accountholders but also for safeguarding your financial institution.