Writing Fraud-Proof Checks? Think Again…

- Check writing remains common, with 61% of Americans still using checks.

- Most persons using checks believe they are deploying all available safeguards

- In fact, many check-writing habits need to be "upgraded"

Recently, Kiplinger Personal Finance Magazine posted a helpful article that explains how to safely write a check in a world where fraud is not only prevalent, but fairly easy to execute.

It may seem as though check-writing is becoming a lost art, but it remains a popular way to send money. A recent study from Abrigo, which makes fraud-prevention software, found that 61% of Americans still write checks.

While many people believe they are already doing all they can to remain safe from fraud, they may well be overlooking one or more of the top "check security" tips to keep in mind when writing a check:

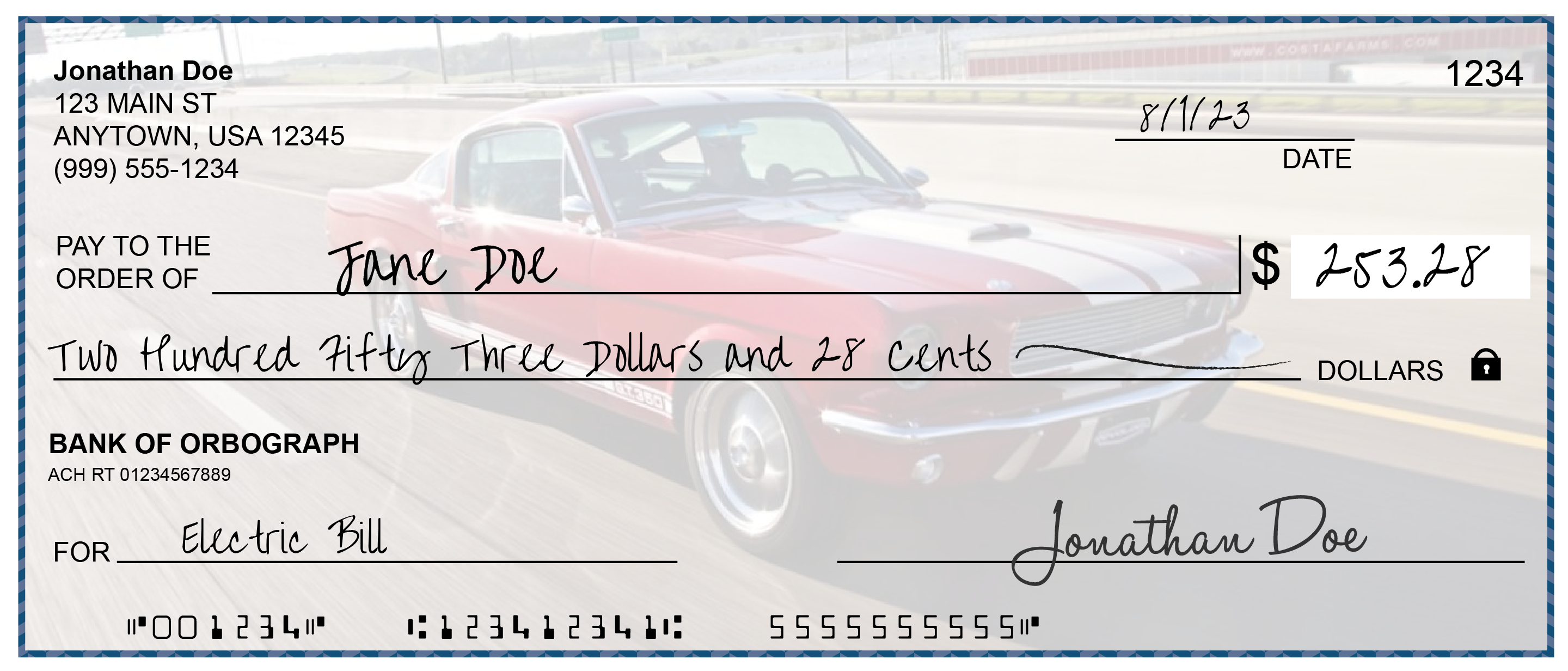

- Use indelible ink or gel pens and fill out all check fields

- Draw a line through blank spaces on checks and avoid making them payable to "cash"

- Use security envelopes or wrap checks in paper when mailing the check

The article also notes that if you are mailing a check, it's recommended that you take it directly to the post office, rather than using the convenient blue mailboxes nearby. This can lower the chances of your envelope and check being stolen by criminals who have been targeting mailboxes and carriers.

Is There Truly a Method for Writing a "Fraud-Proof" Check?

While we commend Kiplinger for providing this invaluable information, the title of the article is quite misleading. Fraudsters know that any legitimate check can turn into a significant amount of stolen funds.

Check washing is just one method of fraud that is addressed in the article. However even if the check writer uses gel-ink that is difficult to wash, it does not mean its the fraudster is unable to alter the check. When depositing a check, most mRDC is unable to detect any flaws on the colored image of the check. A fraudster can simply use "White-Out" and alter the payee and amounts and deposit into a drop account. The image of the check is converted into a bitonal image, which is typically what is seen by the bank.

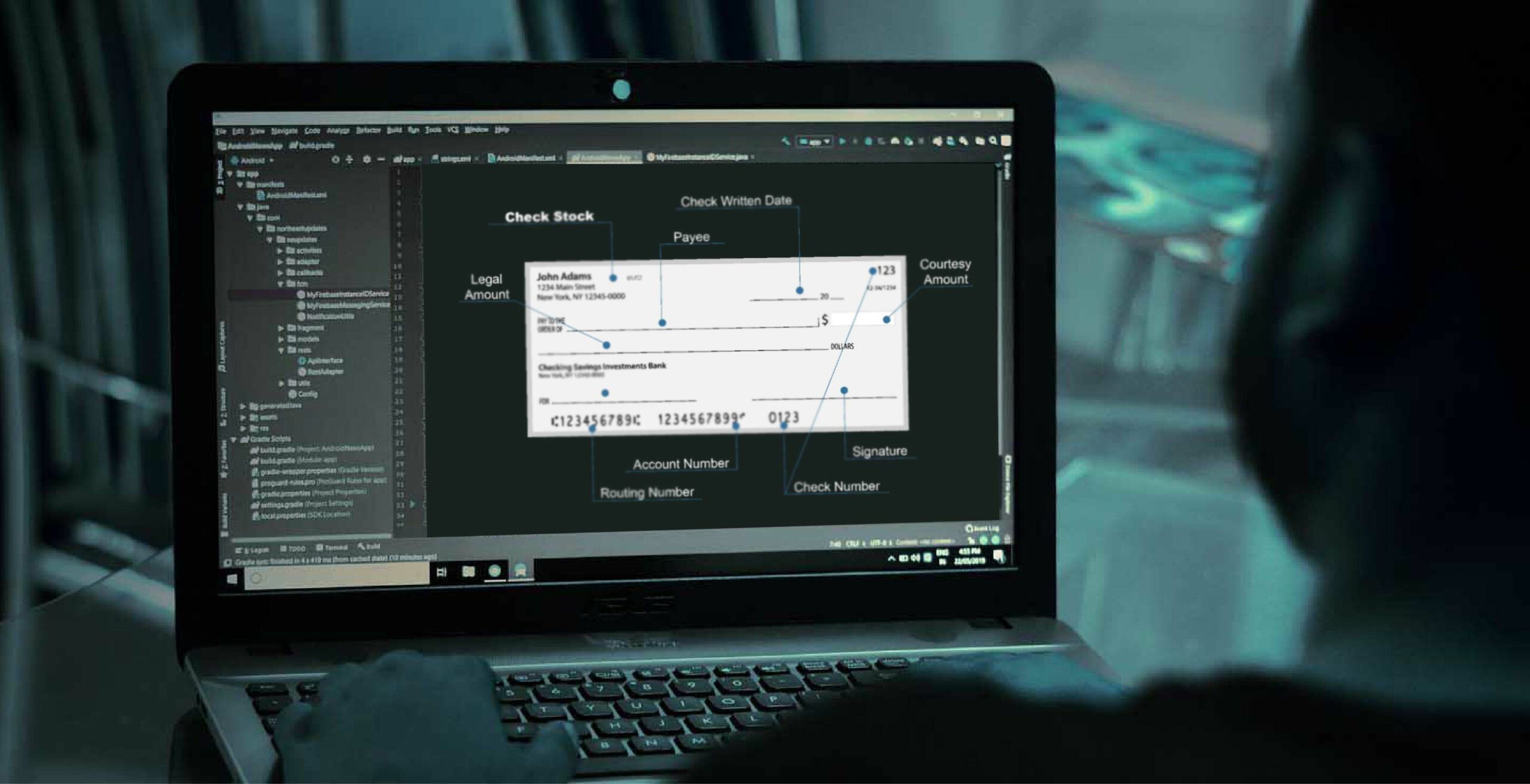

Additionally, the fraudster does not need to wash the check in a physical sense when it can simply be created from scratch. As we noted earlier in the week, easy to access software, a home printer, and some specialty paper makes it easy to counterfeit any check and deposit it via mRDC or ATM. Additional counterfeits can be created to "double dip" on the account.

Lastly, checks contain a significant amount of information which can be used to perpetrate identity theft -- a legal name, address, and many times a legitimate phone number. The fraudster only needs a few more bits of information to find a birth date (which unfortunately, many people disclose on their social media).

Detecting Check Fraud Requires Technology

In a perfect world, all checks are reviewed by a bank employee. Unfortunately, that is simply impossible. While community banks and small financial institutions are able to review a higher percentage of checks and their images -- a few mRDC and ATM vendors host colored images for review -- this isn't the case for the majority of financial institutions.

That's why financial institutions need to deploy technologies to automate the process -- identifying checks that show indicators of being a counterfeit, forgery, or an alteration. Many banks are taking a multi-layered technology approach, blending transactional analysis, image forensic AI, consortium data, and dark web monitoring to build a strong defense against check fraud.

While we do commend Kiplinger on there efforts to safeguard individuals -- and we cannot stress enough the importance of educating society -- it will take more than simple vigilance to combat a significant, pervasive issue like check fraud.