61% of Merchants Plan to Increase Spending on Fraud Tools and Technology

- Fraud attacks of many types are on the rise

- Merchants are reporting huge fraud impacts

- A shift from operational costs to improving customer experience and mitigating payment fraud is evident

While our blog's main focus is the checks payment channel, it's worth taking a look at other payment channels and their fraud trends -- particularly from end-users (merchants).

The 2024 Global Fraud & Payments Report, conducted by Verifi and Visa Acceptance Solutions, provides key insights into the challenges faced by eCommerce merchants in effectively updating and refining their strategic approaches to payments and fraud management.

Findings included in the report:

- There has been a rise in various fraud attacks, with first-party misuse, account takeover, and loyalty fraud becoming more prevalent.

- Fraud management priorities are shifting towards improving customer experience and reducing fraud and chargebacks, with a focus on enhancing AI/ML-driven fraud management tools.

- A multi-faceted approach is recommended to combat fraud effectively, employing tactics like reviewing non-fraud chargebacks, checking customer histories, and monitoring transaction data.

- Collaboration with third-party payment enablers is essential to ensure seamless and secure payment processing and enhance the overall payment management approach.

Overall Fraud Rates Rising

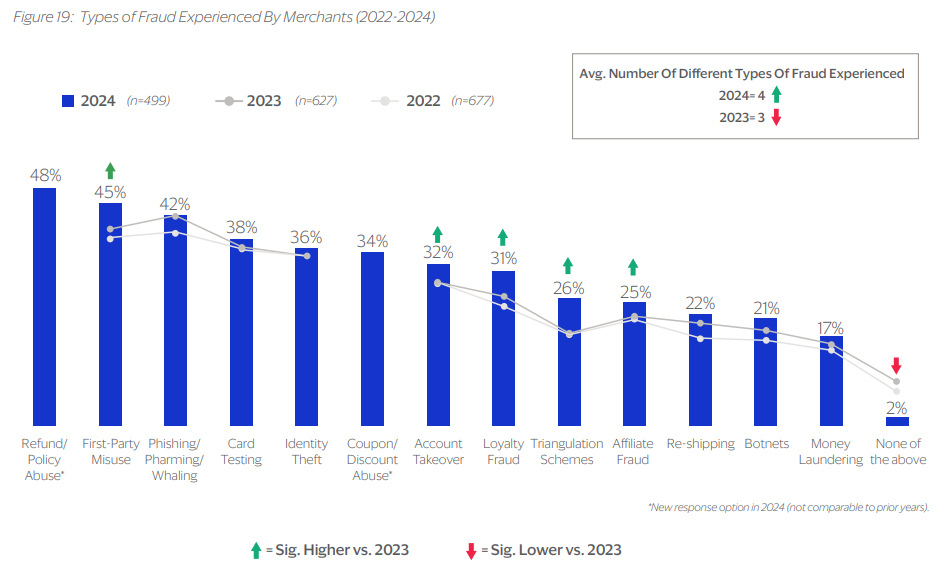

The report notes that fraud rates overall are rising, with merchants experiencing four different types of fraud in 2023 -- up from three from 2022.

Merchants are facing more fraud attacks than they have in prior years. The number of different types of fraud experienced by the average merchant this year rose from three to four (see Figure 20). In particular, merchants cite increased rates of first-party misuse, account takeover, loyalty fraud, triangulation schemes, and affiliate fraud than those reported in 2022 and 2023.

With the rise of fraud, merchants are also struggling with resources and operational challenges to handle the increase.

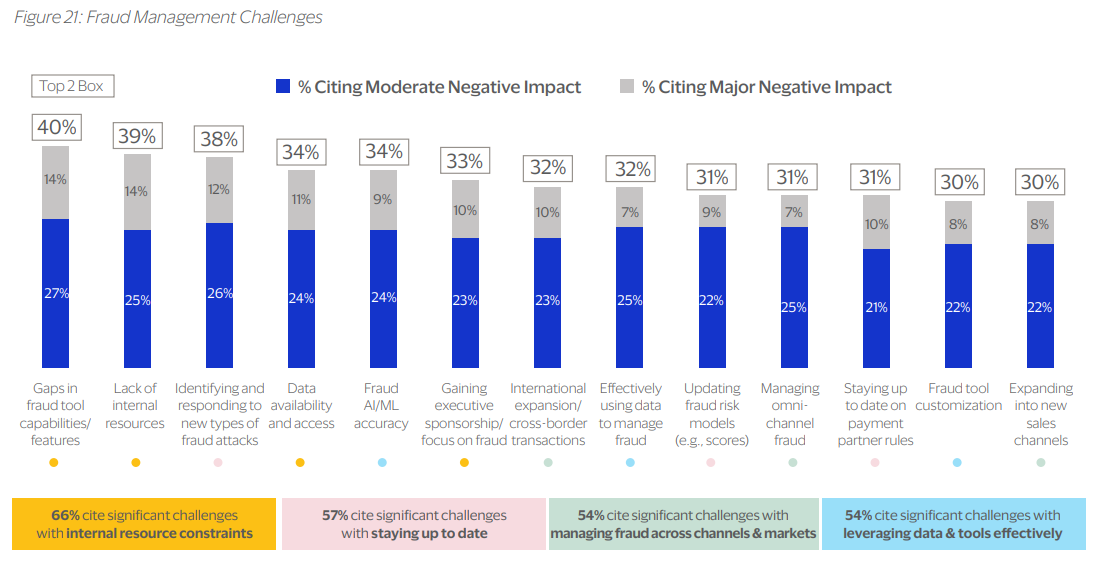

Gaps and shortfalls in internal resources represent merchants’ biggest overall challenge in fraud management. Globally, 30-40% of merchants identify gaps in fraud tool capabilities, lack of internal fraud management resources, and limited data access/availability as having significantly negative impacts on their abilities to manage fraud...

...Staying up to date (on new attacks, risk models, and rule changes), managing fraud across different sales channels and geographic markets, and leveraging data and tools to effectively prevent and mitigate fraud are other high-level challenges inhibiting many merchants in their fraud prevention efforts.

Overall, merchants are reporting massive impacts from fraud:

- Fraud Rate by Revenue: 3.1%

- Fraud Rate by Order: 3.3%

- Order Rejection Rate" 5.8%

- Chargeback/Dispute Win Rate: 17.4%

Tackling the Fraud Challenge

As noted by the report, the increase in fraud has shifted focus from operational costs to improving customer experience and mitigating payment fraud -- they have both seen a 45% rise in investment. And it is no surprise that AI/ML is the leading technology.

Merchants show more consensus when it comes to which aspects of fraud management they will focus on improving over the next year, with the majority citing AI/ML-driven fraud management tools, fraud orchestration, and refund management as top priorities. Business process outsourcing, managing omnichannel sales, and reducing or eliminating manual review are less likely to be points of emphasis, with less than a third of merchants identifying these as priority areas for improvement next year.

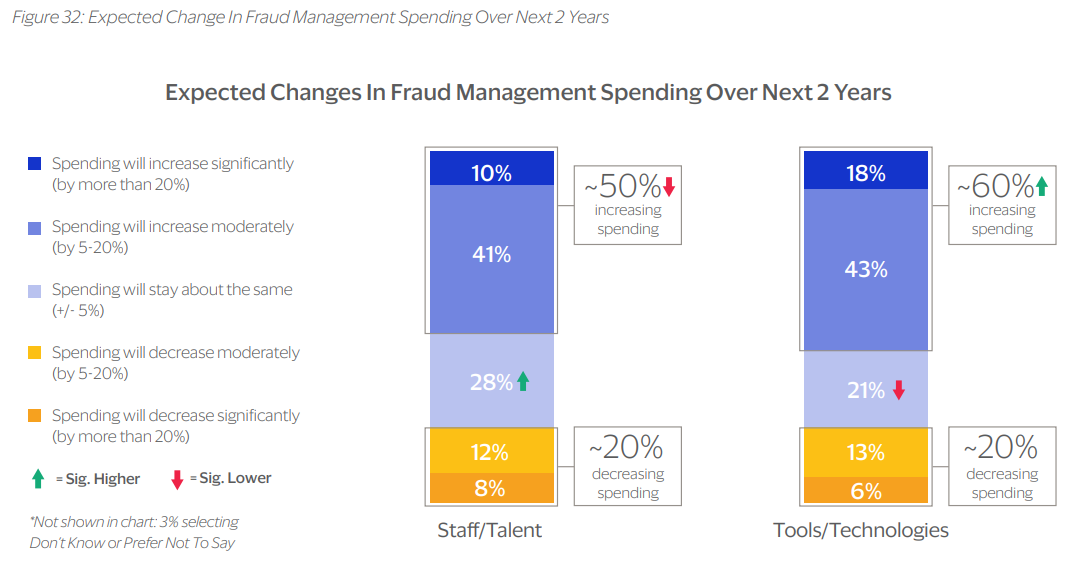

In fact, 61% of merchants plan to increase spending on fraud tools and technologies over the next two years.

Merchants are following in the footsteps of their financial institutions, investing more in tech that can mitigate fraud. These technologies include AI and machine learning, which analyze a wide range payments including credit card, wire, and even checks. While a portion of merchants are moving away from accepting checks from consumers, many continue to accept their customers' payment of choice.

Unlike merchants, banks do not have the option of limiting what type of payments are accepted. And, even as checks have seen a decline in volume, they are still a major payment tool and utilized heavily for B2B. This means that banks need to continue to invest in technologies such as image forensic AI to detect fraudulent checks.

Merchants are realizing that in order to fight back against fraudsters, they need to invest in technologies that can mitigate fraud -- a lesson that financial institutions have already learned.