Check Fraud Scenario Highlights Issues with “Breach of Warranty”

- Check fraud continues to be a threat

- The Wespay 2024 Payments Symposium offered valuable insight

- "Breach of Warranty" determinations present a problem

This past week OrboGraph’s own James Bi, Marketing Manager and Check Fraud Detection Specialist, was in attendance at the Wespay 2024 Payments Symposium. In addition to his presentation: Check Fraud in 2024: Are We Catching Up to the Fraudsters?, the conference held three distinct sessions on check fraud -- the banking industry continues to struggle with this specific challenge.

At the conference, Steven S. Cree, Vice President of ECCHO / The Clearing House, hosted an informative and interactive session entitled: Do You Have a Clue? Let’s Walk-Through Check Scenarios, where attendees were presented real-life check fraud scenarios and discussed the warranties and liabilities for each bank.

"This session was truly eye opening for all the attendees." said James Bi. "Different attendees had different perspectives, referencing regulations from UCC and Reg CC that they believed applied. Mr. Cree did an excellent job in explaining the answers so that attendees were able to take this information and apply it to scenarios at their FIs."

Examining a Real-Life Check Fraud Scenario

With all this in mind, we see our friends at EPCOR providing a similar exercise on their Knowledge Community Blog.

Marcy Cauthon, AAP, APRP, NCP provides the following storyline:

Here is the scenario our members saw time and time again in 2023:

XYZ Copiers issues check #6125 in the amount of $850 to B & B Printers for recycled printer cartridges. B & B Accounting Department receives the check and deposits through their Remote Deposit Capture system with their financial institution.

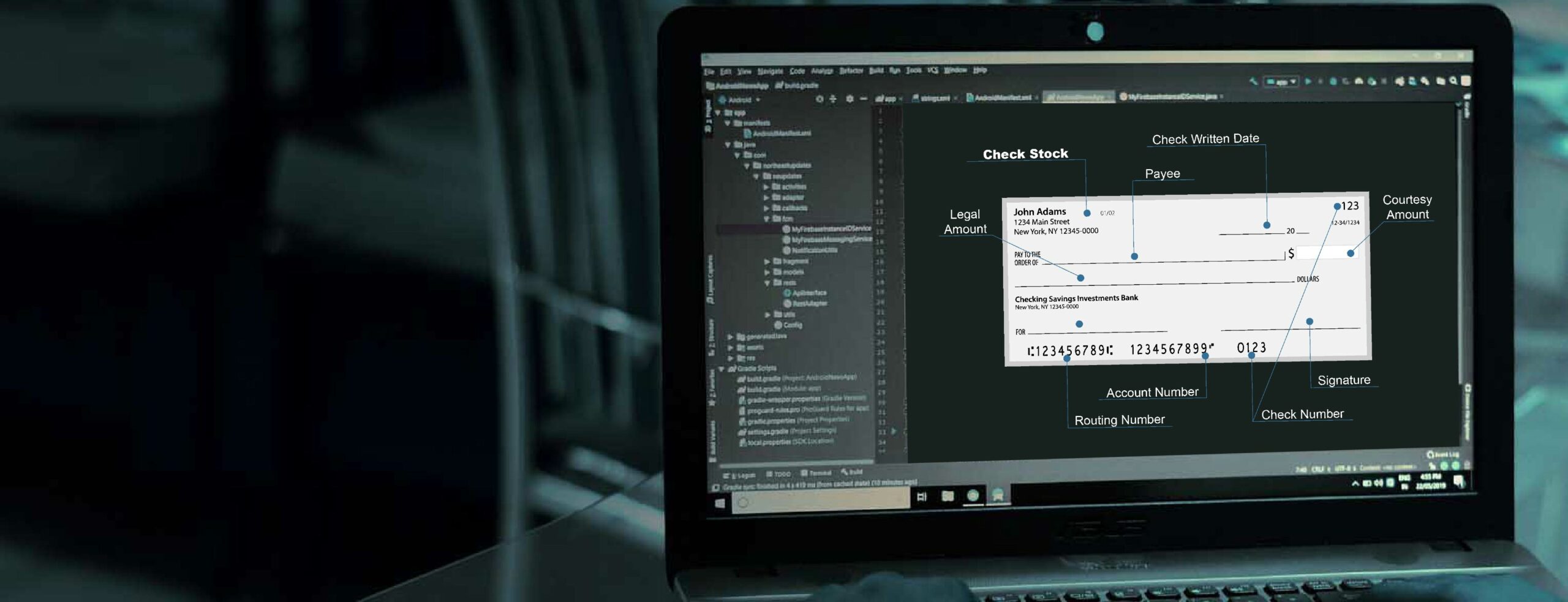

An employee working in the accounting department takes the original paper check home with them instead of securing it until the destroy date set by B & B Printers. This employee has some business check stock at home and a great laser printer. They have purchased software that can overlay all the information from check #6125 perfectly onto the business check stock, including the drawer’s signature. This software enables them to reproduce check #6125 for $850 but they change the Payee name to their name.

When the second check hits XYZ Copier’s account, they call their financial institution immediately and explain that check #6125 cleared a second time but to a different payee. Their financial institution sends a Breach of Warranty back to the depositary bank for the altered check. A week later the financial institution receives a denial letter from the depositary bank stating the item is counterfeit not altered, therefore; they did not breach any of their warranties.

So, which do you believe is correct?

This exercise helps fraud professionals assess a real-life check fraud scenario and use their knowledge to determine if the BoFD had breached its warranty, and which FI is liable for the loss.

If you are looking for more training, we recommend that you register for EPCOR's upcoming webinar entitled Don't Fall for Frightening Fraudulent Checks on Wednesday, October 23, offering further support to financial institutions in protecting their clients and accounts.

I agree that based on the facts presented above, the check is counterfeit. However, I believe, to determine whether the check is altered or counterfeit, the burden of proof is on the bank of first deposit. If requested, they must produce the original check for examination. (Presumption of Alteration.) Seeing how the check was remotely deposited and stolen, the bank of first deposit would not be able to produce the original check for inspection. This would make the bank of first deposit liable for the loss. Opposing viewpoints welcomed.