Many Americans Believe Checks are More Secure Than Digital Payments…Are They Wrong?

- The rise of new payment methods has not eliminated check usage

- Checks present a security risk to both consumers and financial institutions

- Are check payments more secure than digital payments?

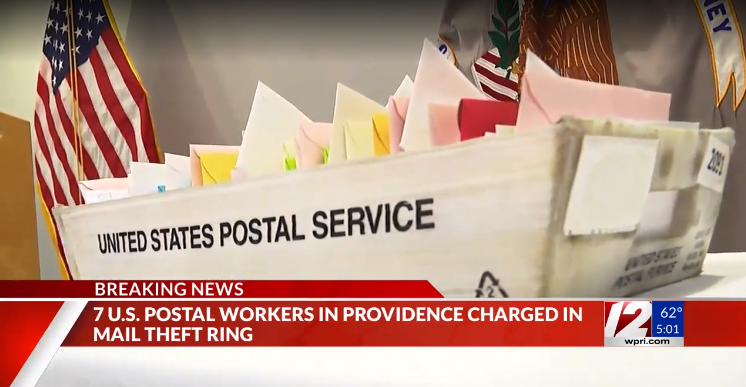

Over the past several months, it's been suggested by industry experts and technology vendors that the "checks are dead" sentiment has lead to the surge in check fraud -- and fraudsters took full advantage of.the lack of investment by financial institutions to secure checks as an active payment channel.

Well, PaymentsJournal observes that, despite the rise and popularity of digital payments, paper checks are still widely used -- which will continue to make check fraud a major threat to individuals, businesses, and financial institutions. In fact, over half of Americans wrote a check last year, and many organizations rely on them for payments.

Though fraud is a constant focus for businesses, many fraud teams have shifted their attention to emerging payment methods. As Jennifer Pitt, Senior Fraud and Security Analyst at Javelin Strategy & Research, found in her latest report, The Pervasiveness of Check Fraud: Banks are Paying the Price, check fraud is an increasingly rampant threat that financial institutions must address.

Checks are More Secure: A Misconception?

Older adults tend to use checks more frequently, as they are comfortable with the payment method. This is because many Americans believe checks are more secure than digital payment methods. However, many individuals and businesses are not fully aware that criminals have developed simple and effective ways to commit check fraud, such as check washing and check "cooking."

“Many Americans are also still under the mistaken impression that checks are more secure than peer-to-peer platforms, ACH transfers, and digital payments,” Ms. Pitt said. “The Javelin report found that most Americans believe those methods are either as secure as or less secure than checks.”

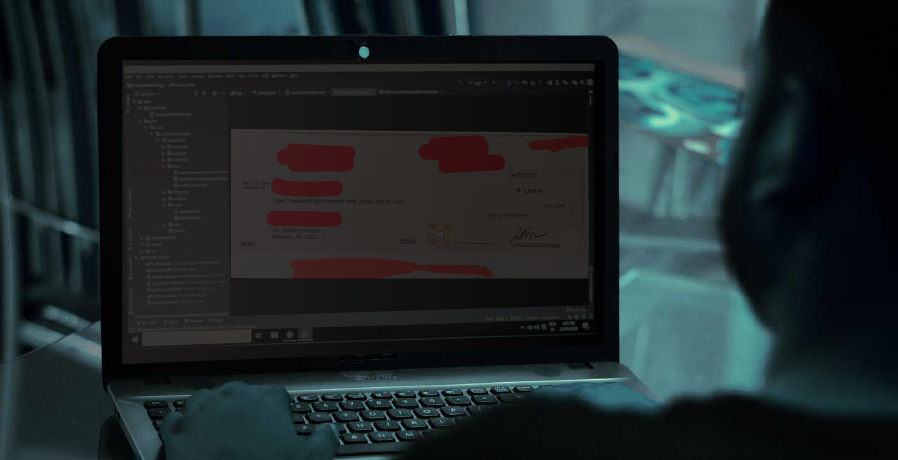

However, many individuals and businesses are not fully aware that criminals have developed effective ways to commit check fraud, such as check washing and check "cooking."

“Over the past few years, there have been more headlines about mail theft,” Pitt said. “Organized street gangs and criminal syndicates have moved away from drugs and other activities because those crimes are often prosecuted harder and there are stiffer penalties. Fraud, and particularly check fraud, carries minimal penalties at the moment.”

Credit cards stand as the only payment method that most Americans feel are safer than checks -- likely because credit cards have been around long enough that older adults see them as "tried-and-true." However, the article notes, some utility companies still require payment by check, and federal and local governments will still often put stimulus or treasury checks in the mail.

But why do many American's believe that checks are more secure?

Here are a few reasons:

- Checks leave a paper trail

- Checks do not extract funds immediately like digital options

- Checks payments can be stopped

Education and Technology

While there are misconceptions that checks are more secure, it boils down to the fact that the general public and many businesses are simply unaware or have been unaffected by check fraud. -- when they become a victim, then they realize the problem. Education from the bank needs to be ramped up -- financial institutions need to publish resources and send out communications to their customer's informing them of the very real check fraud threat.

Financial institutions also need to step up their investment in check fraud detection technology. While more and more financial institutions have strong fraud detection measures, only 22% use check fraud detection solutions, according to the Javelin survey. This disconnect leaves them vulnerable, as check fraud is on the rise.

This includes utilizing behavioral/transactional analytics, image forensic AI, a rules engine, consortium data, and dark web monitoring. Financial institutions should not assume or rely on their customers protecting themselves. Rather, they need to be proactive in educating their customer base, while also deploying the latest technologies to protect them from being victimized.