Money Mules: A Growing Global Threat

- Scammers are using "mules" to pass bad checks

- Some "mules" are unaware that they are aiding a scam

- There are risk factors to look for when detecting mule-aided scams

Sarah Cassidy, a senior consultant at FICO specializing in fraud, takes a look via the FICO Blog at money mule fraud, a major and growing problem worldwide.

She notes that a recent global crackdown uncovered over 10,000 money mules, with losses of around 10 million EUR. However, it's very likely that this only scratches the surface - the UK alone estimates £10 billion in illegal money is laundered through money mules each year.

For the USA, the most recent data comes via a press release from Biocatch in 2022, noting "money mules constitute up to 0.3% of accounts at U.S. financial institutions, or an estimated $3 billion in fraudulent transfers."

Recruitment: Why do People Cooperate with Criminals?

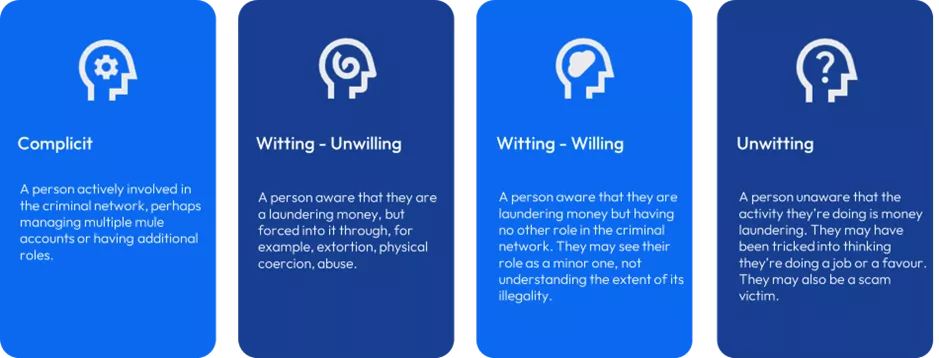

People get lured into becoming money mules for a few key reasons:

- Some see it as an opportunity to make passive income with little effort. These people may already have financial difficulties or existing poor credit (a "nothing to lose" approach).

- Criminals also target vulnerable groups like students and those with good credit, tricking them through scams.

VICE investigates the rise of money mule recruiting via different social media apps:

How to Detect Money Mules

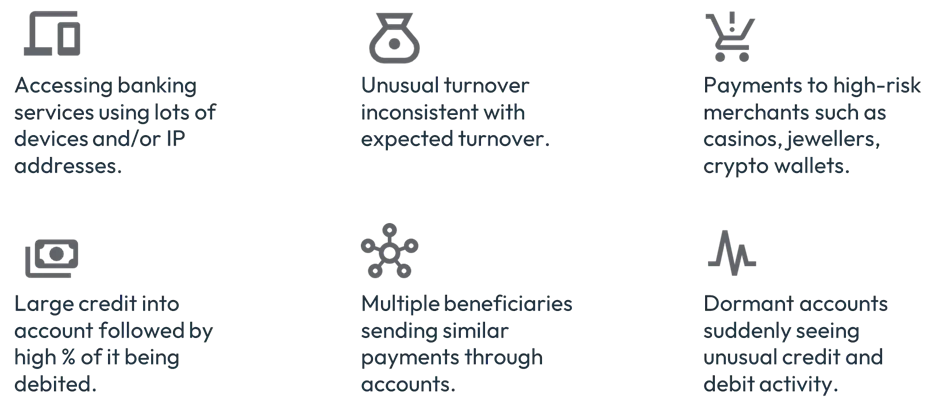

Detecting money mules is challenging, as they often try to behave as "normally" as possible to avoid being uncovered. Key risk indicators to look for include:

- Sudden high-value payments

- High transaction volumes

- Changes in device or location

To combat this threat, organizations need to take a proactive, multi-faceted approach. This includes:

- Profiling at the beneficiary level to track suspicious payees and networks

- Using personalized customer communications to disrupt mule activity without harming legitimate customers

- Leveraging advanced analytics and visualization tools to uncover complex mule networks

Detection of money mules is crucial in the fight against check fraud, as they are a main method for depositing altered and counterfeit checks. Banks need to deploy behavioral/transactional analytics to detect anomalous behaviors. If an account rarely sees check deposits, but suddenly deposits multiple high dollar checks, this could be an indicator of illegal activity that should be investigated.

Furthermore, image forensic AI can be utilized to compare the image of the check with previous clear deposited items, while extracting data to be sent to consortiums like AFS and EWS to validate the transactions.

As long as quick money can be made, there will be individuals willing to take part -- knowingly or not -- in the schemes. It's important for FIs to have the right technologies in place while also warning their customers of the dangers of illegal deposits.