2018 Conference Highlight: Payment Reconciliation Realities

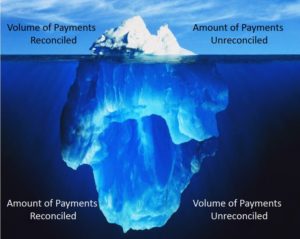

We’ve borrowed the great visual metaphor that Koch used in his presentation: Very often, the amount of reconciled and unreconciled payments that current systems recognize are merely the tip of the iceberg – – an alarming realization, to say the least.

Koch, the President of two healthcare technology companies focused on automating the back-office of healthcare organizations as the industry transitions from a fee-for-service to a fee-for-value model, pointed out the following “reconciliation realities” that the healthcare industry faces:

- The payers don’t always send the same check number in the check that is reported by the financial institution

- The availability of the ACH data is many times separated from the full bank deposit

- The check arrival date could be prior or later than a full week from when the funds are available in the bank

- For example: Using the date of Thursday May 31, 2018, as CCD+ Effective Entry Date and assuming the health plan’s business days are Monday thru Friday, the 835 and associated funds could be available as early as Monday the 28th or as late as Tuesday June 5th

- This is only for 835 to ACH reconciliation

Koch also advised the following steps to help get started with maximum effectiveness:

- Evaluate your banking options

- Increase 835 and ACH volumes

- Convert all paper

- Do not use virtual cards

- When possible, validate funds in the bank prior to posting

- Go beyond Certification to “Double Reconciliation”

- Batch all payments for easier matching to bank deposits

- Review all exceptions daily

- Use an automated tool

To avoid being the Titanic (you all saw THAT coming, right?), it pays to be able to maximize available tools to recognize all that lay beneath the surface! Access Payment Reconciliation leverages EFT Reassociation to ERA matching technologies to link remittance advices to payments via a reference identifier (TRN). This allows the provider to generate and easily manage a list of outstanding payments.