Are Financial Institutions Ready to Shift from Automation to Cognitive Enterprise?

- Banking is shifting rapidly toward AI-powered cognitive enterprises and automation

- SEffective intelligent automation requires human oversight, governance, and coordinated orchestration

- OrboGraph applies specialized AI to improve payments, fraud detection, and anomalies

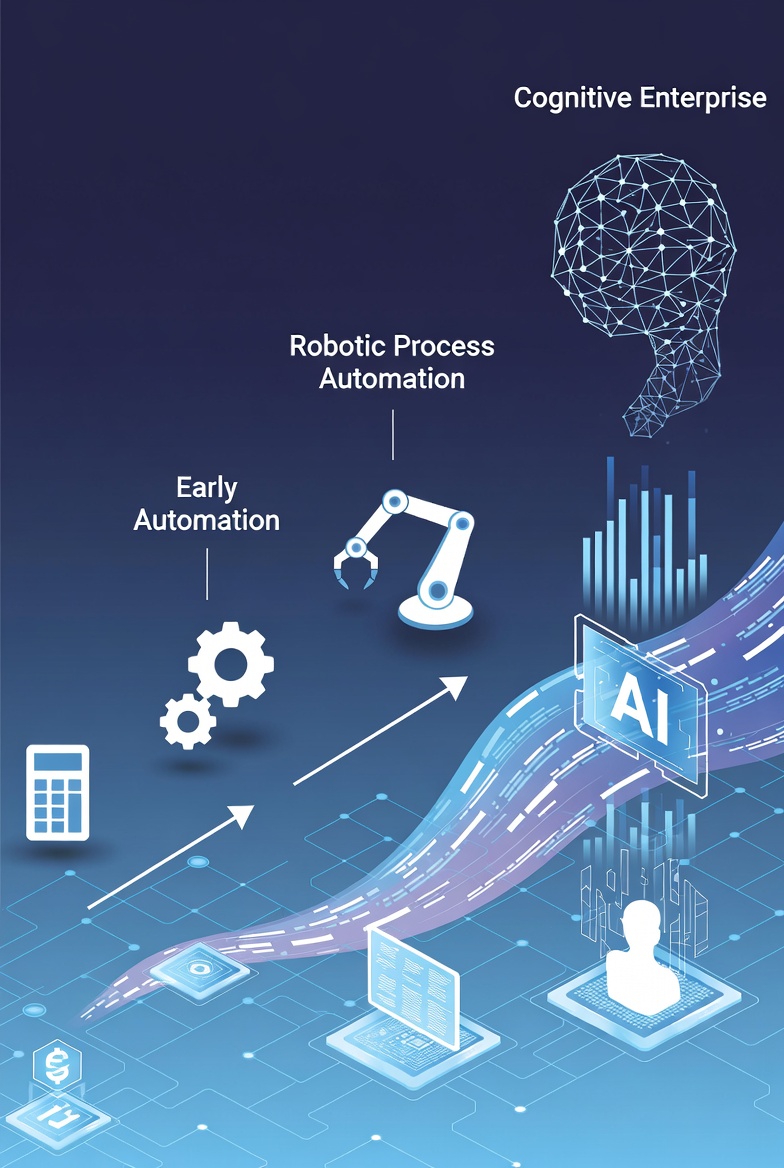

A recent article published on Forbes.com takes a look at the evolution of technology from simple banking automation to a cognitive enterprise model where AI learns, reasons and collaborates with people across the organization. The focus is no longer just on speeding up manual tasks but on building an intelligent ecosystem where data, workflows and human judgment operate in concert.

Author Sanjoy Sarkar, SVP, Senior Director - Application Development & Support at First Citizens Bank, notes that evolution from early rule-based RPA, which handled repetitive work, to workflow and low-code platforms that extended automation across back-office and customer-facing processes. Today’s “cognitive enterprise” goes further, using anomaly detection, natural-language understanding and decision engines to anticipate needs and recommend next best actions, augmenting how humans think rather than simply replicating what they do.

The Human Factor

Technology alone is not enough, the post notes; culture and structure determine whether automation scales. Successful programs are designed around people, with human-in-the-loop feedback so employees can validate and refine AI outputs, building trust and turning automation into a shared capability rather than a one-off project. Unifying decision-making is equally critical, as many banks still run automation in silos, fragmenting intelligence and limiting the ability to respond quickly and consistently to customer needs.

Governance, data quality and ethics form the backbone of this new era. A strong Center of Excellence sets standards, enforces reuse, and balances innovation with compliance, while high-quality, well-governed data allows automation to learn, surface patterns and generate actionable insight. At the same time, explainability and accountability are essential so regulators, customers and employees can understand how AI-driven decisions are made, preserving long-term trust.

Lastly, Sarkar points out that the biggest change comes from leadership. Technology can speed things up, but people make change happen. Successful leaders in the next decade won’t see automation just as a way to cut costs—they’ll see it as a way to shape culture. They’ll invest in training, bring business and IT teams together, and encourage experimentation. Lasting change happens when teams feel empowered to innovate—not because they’re told to, but because they believe in the mission.

Where Automation Meets Intelligence

As we look forward to the near future, what does this mean for the payments? Well, it means that all payments are not only automated, but integrated in a way that provides the financial institution a clear view of what is occurring at the individual level and holistically across all accounts.

This "new view" of payments is something that OrboGraph has been building towards for many years. While automation of check payments is a major factor, the end goal is for financial institutions to integrate check payments with all the other payment channels. As our OrbNet AI and OrbNet Forensic AI analyzes check payments -- for both reading/extraction of data and analysis of for fraudulent items -- the goal is for financial institutions will integrate the results to leverage throughout the banking ecosystem.

As this shift toward the cognitive enterprise accelerates, financial institutions will need partners that align both technologically and strategically with their vision. At OrboGraph, our motto is “intelligent payment automation,” reflecting our commitment to helping banks transform payments data into actionable intelligence that drives fraud detection, operational excellence, and next-level customer experiences.