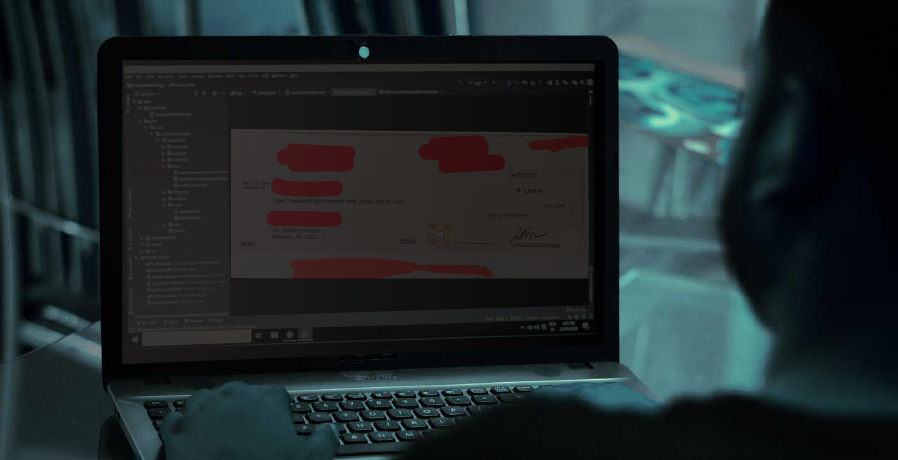

Banks Shifting From Competition to Collaborations to Fight Check Fraud?

- NICE Actimize shares tips for fighting check fraud

- Technology plays key role in check fraud detection

- Banks are shifting from competitors to collaborators while tackling challenges

Brian Keefe, Senior Pre-Sales Consultant at NICE Actimize, shares some advice for combating check fraud in the financial industry. Via "Q&A" format, Keefe highlights the ongoing threat posed by fraudsters to the traditional paper check system, despite a significant decline in check usage over the years.

Keefe identifies six major types of check fraud currently prevalent:

- Forgery

- Counterfeiting

- Altering

- Washing

- Kiting

- Remote-deposit capture fraud

The Need for Technology

Mr. Keefe stresses the need for real-time detection technology to prevent financial losses and "reputational damage" caused by fraudulent checks, and stresses that investment in such tech is crucial and cost-effective compared to the potential losses incurred from ongoing check fraud.

Moreover, Keefe suggests that financial institutions should implement automatic monitoring steps to analyze signatures and detect unusual behaviors during check deposits. He also calls for increased collaboration within the banking industry to combat check fraud collectively. Additionally, he recommends educating consumers and businesses on staying vigilant, setting up account alerts, and transitioning to digital payment methods to reduce the risk of falling victim to check fraud.

It's extremely important for financial institutions to adapt to the evolving landscape of financial crimes -- and the best way to do so is by embracing technological solutions such as incorporating transactional analytics, image forensic AI, and consortium data, enhancing monitoring processes, and fostering a culture of awareness and education among consumers and businesses.

From Competition to Collaborators?

The banking industry has seen a shift in the way banks are interacting with each other. While banks are competing for customers and their deposits, AML and Fraud departments are looking to move to a more collaborative approach.

Mr. Keefe notes:

"Competition aside, the banking industry needs to have more conversations among themselves on how to better combat check fraud."

This is a sentiment that was heard frequently by James Bi, Marketing Manager and Fraud Detection Specialist at OrboGraph, and Peter Shortino, Implementation Engineer and Check Fraud SME at OrboGraph, while attending the American Bankers Association's AML and Fraud School this past month. Throughout the two-week course, the AML and Fraud professionals shared their experiences and strategies to tackling the check fraud.

It was a great experience, especially hearing all the AML and Fraud professionals being candid about the challenges they are facing. It's not easy to speak up, but there were so many students bringing up scenarios and providing feedback to help each other. - Peter Shortino

Mr. Bi echoes the sentiment:

Collaboration is key to curbing check fraud. The discussions from the ABA AML and Fraud School were similar to what is occurring at industry events and focus groups like our Check Fraud Roundtable. It is clear that industry professionals are shifting from seeing each other as competition to industry colleagues.

As financial institutions continue to navigate check fraud, they need to understand that they are not alone -- and, by engaging with other professionals, the industry can achieve the goals of reducing losses for both FIs and customers.