Modernizing Omnichannel Check Fraud Detection

Revisiting a film glamorizing check fraud An adolescent leaves a bank with $1 million in cash Fortunately, is virtually impossible for this scenario to occur today When thinking of a film glamorizing check fraud, most instantly think of the hit film Catch Me If You Can, directed by Steven Spielberg and featuring A-listers Leonardo DiCaprio…

Read MoreBMG is a former scammer and current YouTuber He was able to learn fraud methods while incarcerated He now passes along fraud techniques to help potential victims protect themselves A factor that we commonly bring up when discussing fraudsters is their willingness to teach each other the tips and tricks needed to commit check fraud.…

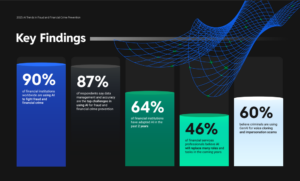

Read MoreA new report states that 60% of fraudsters are using GenAI in scams Fighting fire with fire, an overwhelming majority of FIs use AI AI has presented measurable benefits We’ve all heard the buzz around AI and its potential for fighting fraud — including check fraud. Well, FIs have put it into action. According to…

Read MoreFighting fraud requires a delicate balance Despite digital payments, checks remain a valid form of payment Rules engines play a key role in detecting and preventing fraud In a recent ATM Marketplace podcast, Bradley Cooper spoke with Scott Fieber, Chief Strategy Officer at Cook Solutions Group, and Austin Smith, Director of Product Development at Cook…

Read MoreNew AI infrastructure optimized for speed and latency with improved check fraud detection Burlington, MA, May 8, 2025 – OrboGraph, a leading provider of check fraud detection and image recognition solutions, is excited to announce the general availability of their new OrboAnywhere Turbo 6.0 release. The release is focused on speed, efficiency, and modernization of…

Read MoreFour men have been accused of check fraud crimes “A massive, multi-million dollar scheme” They face 30 years in prison if convicted In a shocking case of financial fraud, four men have been accused of stealing checks from the mail and cashing in over $50 million by altering the names and dollar amounts. This massive…

Read MoreThe FBI’s latest report reveals a substantial increase in internet crime Though digital scams are popular, checks are still targeted Fraudsters are “equal opportunity” thieves, though elderly are heavily targetted The FBI’s Internet Crime Complaint Center (IC3) has released its latest annual report, detailing a significant increase in internet-enabled crimes in 2024. The report distills…

Read MoreCheck fraud is discussed on The Payments Podium Some of the “specialized skills” need for check fraud are identified Many financial institutions struggle with rules and regulations that determine liability As has been made clear in this space many times previously, even in today’s increasingly digital world checks remain a surprisingly relevant – and vulnerable…

Read MoreIn spite of its effectiveness, Positive Pay is not yet adopted universally Adoption of Positive Pay is expected to increase over the next two years Positive Pay is an essential tool for check fraud detection, but cannot detect the majority of check fraud alone Positive Pay is an essential tool for check fraud detection. In…

Read MoreIn case you missed it, over the past month, we have published incredible content on our OrboNation Blog and Modernizing Omnichannel Check Fraud Detection. Review the latest OrboNation Newsletter online or via PDF download.

Read More