Modernizing Omnichannel Check Fraud Detection

Tech Against Scams is a new anti-fraud consortium Escalating fraud leads to needed coordination among social media, dating apps, financial institutions, and crypto firms About a third of Big Tech and FinTech firms have experienced fraud in recent months PYMNTS.COM reports on Tech Against Scams is a newly announced anti-fraud consortium that includes crypto companies…

Read MoreA growing number of FIs deploy machine learning and AI to fight back against fraud Steep declines in fraud are noted However, less success is noted in preventing charitable-donation and fake debt-collection scams According to PYMNTS Intelligence’s “Leveraging AI and ML to Thwart Scammers,” a report created in collaboration with Hawk, a growing number of financial institutions (FIs) are…

Read MoreHighlights Include Check Fraud Trends, SARs Analysis, OrboAnywhere Sherlock 5.3, and Deposit Fraud Burlington, MA, May 23, 2024 – OrboGraph, a premier supplier of check processing automation and fraud detection software and services, reports successful Check Fraud Roundtable and Innovation Conferences on May 14-16, 2024, at the Hilton Tampa Downtown. These two distinct meetings brought…

Read MoreFraudsters have graduated beyond mere check washing An LLC “business” can be inexpensively opened and used for fraud Transactional analytics and image forensic AI systems are crucial to meet this challenge We all are aware of check washing/alterations and how effective this method is for stealing funds. However, the success rate is not guaranteed, particularly…

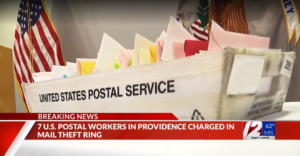

Read MoreMail theft is a growing threat Thieves are usually looking for checks to copy “Inside jobs” by postal service employees raise the stakes We have in past posts related some pretty alarming tales of postal theft and efforts to stop it. Now there’s news of an elaborate and ongoing “inside job” series of postal thefts in…

Read MoreAn Illinois Mayor is accused of forging checks with the village Clerk’s stamp The Mayor is also accused of wrongful termination of employees who refused political work The FBI has been brought in to investigate Unfortunately, politics and corruption seem to go hand-in-hand. The US is ranked number 24 out of 180 nations in terms…

Read MoreSARs accounted for nearly 20% of SARs filings in 2023 There is nothing to indicate they will not continue their increase into 2024 Checks remain fraud targets Thomson Rueters reports that the number of suspicious activity reports (SARs) – the documents that financial institutions must file with the federal government’s Financial Crimes Enforcement Network (FinCEN)…

Read MoreWhen examining a check to determine whether it’s real or not, it’s also worth looking for other general irregularities and mistakes. Look for spelling errors or typos in the printed information on the check, such as a misspelled business name or address. You can also check to make sure that the address of the check’s…

Read MoreCheck Fraud is nothing new – it’s been around for decades Methods to ID fraudsters were a bit different as the 80’s began Modern check fraud needs to met with modern tools An interesting artifact from way back in the ’80s depicts a fraudster’s-eye view of the techniques in play a little over 40(!) years…

Read MoreDrop accounts are becoming a fraud “staple tool” These accounts are easy to open Fraudsters are advised to be patient and “age” the account for maximum effectiveness Many in the banking industry as are aware of one tool that is crucial to a fraudster: drop account. For those who are not as familiar, this is…

Read More