Check Fraud Accounts for 30% of Fraud Losses, According to Fed Survey

- Checks and debit cards are leading fraud tools

- Checks, payee forgery & check washing led the pack in fraud

- Leveraging multi-technologies to address check fraud is key

Earlier this month, the Federal Reserve published its findings from the Annual Federal Reserve Financial Services (FRFS) Financial Institution Risk Officer Survey (2024).

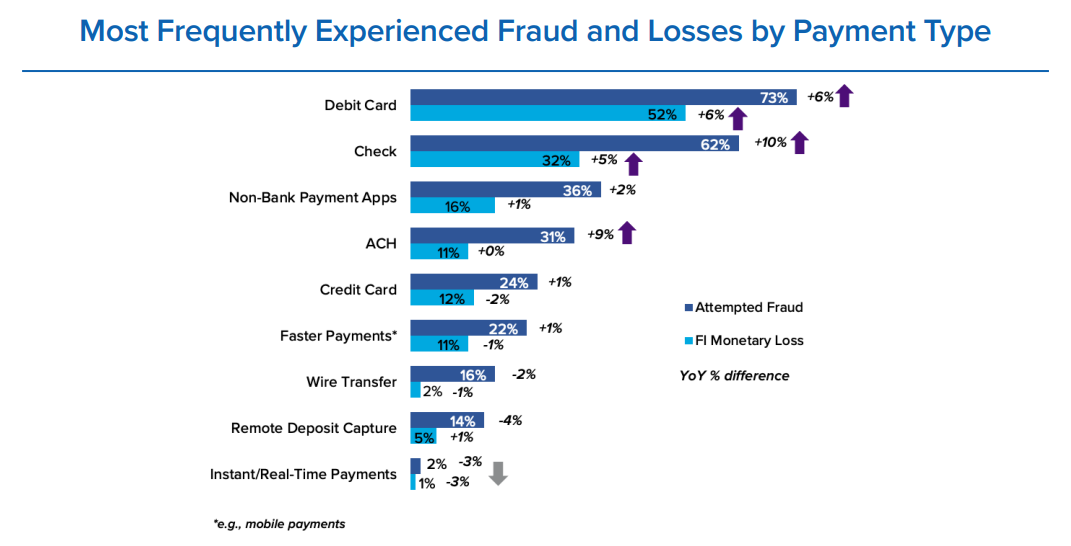

The most prominent payments for fraud: checks and debit cards.

According to the findings:

- Checks were responsible for 30% of fraud losses

- Debit cards were responsible for 39% of fraud losses

- Check fraud grew 10% between 2023 to 2024

- Debit card fraud grew 6%

Deeper Dive into Check Fraud Statistics

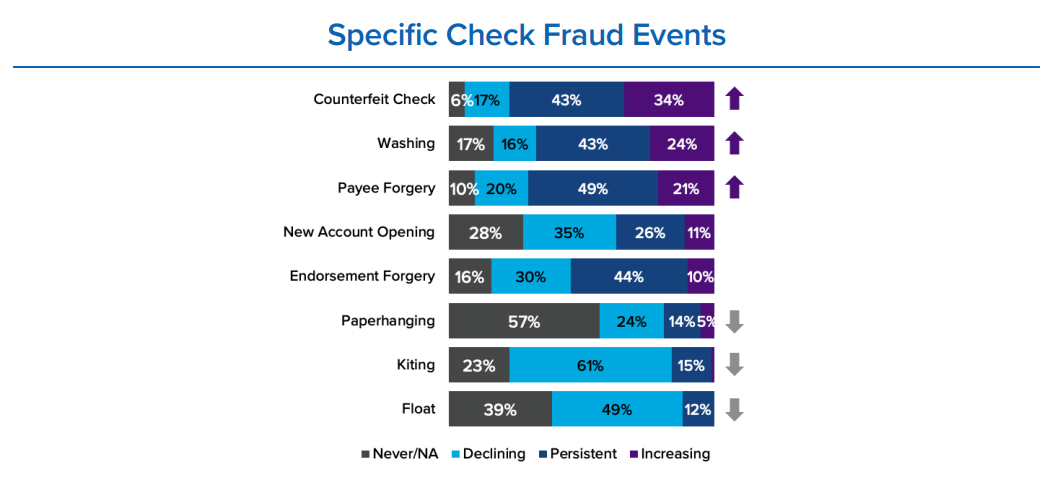

According to the Federal Reserve, "counterfeit checks, payee forgery and check washing were among the primary drivers of fraud events for financial institutions in 2024." This is consistent with observations from OrboGraph.

As noted by Peter Shortino, Fraud Implementation Engineer:

When speaking to direct FI clients of OrboGraph, we are seeing that counterfeits and alterations (altered or forged payees and washed checks) are the two methods used by fraudsters. It is incredibly easy for fraudsters to create counterfeits with the help of photo editing software. Furthermore, for the less sophisticated fraudsters, the use of acetone to wash payee names is a lost-cost, low-effort way to steal funds quickly.

The survey provides details on the different types of check fraud experienced:

- Counterfeit check (94%)

- Payee forgery (90%)

- Endorsement forgery (84%)

- Check washing (83%)

Addressing the Growing Check Fraud Trend

With check fraud growing by 10% and accounting for 30% of fraud losses, FIs are in the non-enviable position of having to find ways to curb this trend. However, as we've noted previously, FIs are not alone.

FIs have a plethora of fintechs ready to step up -- from solutions available via the core processors to third-party fraud vendors. The key is leveraging multiple technologies to address certain check fraud challenges. This includes close examination of check images to detect counterfeits, forgeries, and alterations. Solutions like OrboGraph's Anywhere Fraud analyze check images and compares them to previously cleared items, enabling banks to detect any discrepancies.

Teaming this technology with others like transactional analysis, consortium data, and dark web monitoring gives FIs the ability to fully protect themselves and their clients from check fraud losses.