Check Fraud Detection: Understanding the Different Types of Positive Pay

- Even as digital payments grow, check fraud remains a major threat to financial institutions

- Positive Pay is a key technological solution

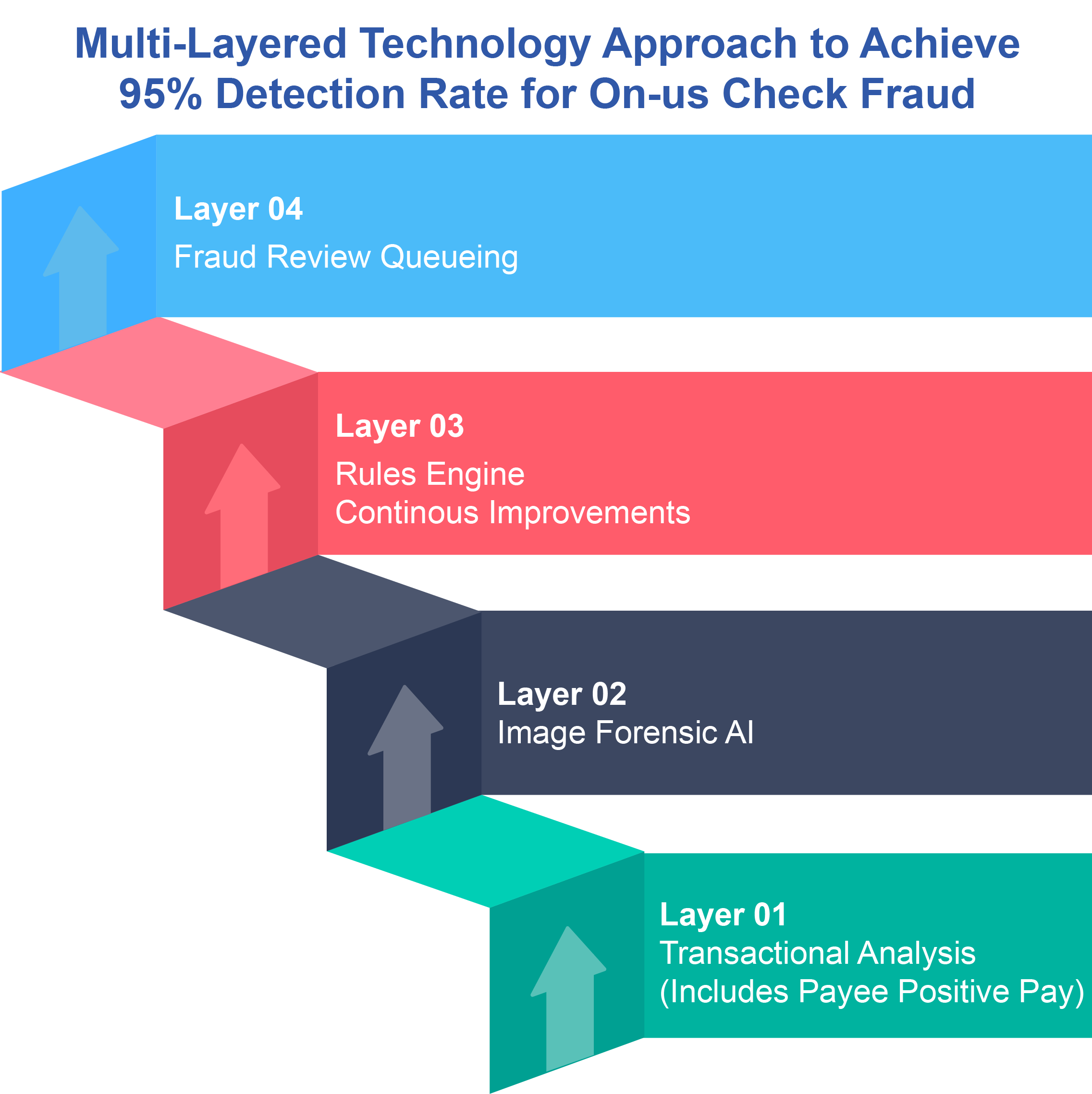

- A comprehensive, layered approach is recommended

In a recent article, BAI looks ahead to check fraud defense in 2025, outlining several strategies financial institutions can use to combat the growing threat of check fraud. Check fraud remains a major threat to financial institutions, even as digital payments become more prevalent. According to the Association for Financial Professionals (AFP), 65% of organizations faced check-related fraud attacks in 2023, and overall payments fraud is up 15% year-over-year.

Additionally, criminals are also increasingly stealing checks from USPS mailboxes and postal workers, with cases of serious crimes against postal property doubling between 2019 and 2023.

To combat this growing threat, financial institutions need to leverage a range of fraud prevention tools and tactics. One key technology is Positive Pay.

Understanding the Types of Positive Pay Solutions Available

Most fraud professionals understand the concept of positive pay solutions, where data extracted from a check or transaction is compared to an "issuer" or "issuance" file from the corporate client. However, there are many different types of positive pay:

- Check Positive Pay: Enables banks to compare certain fields of the check to the issuer file, including serial number, amounts, and date.

- Payee Positive Pay: Enables banks to compare the payee to the issuer file, along with the other standard fields. This is particularly effective for altered checks.

- Reverse Positive Pay: A standard report is created with data extracted from the check and sent to the corporate client for transaction verification.

- ACH Positive Pay: Monitoring ACH debit activity and sends alerts for unauthorized or potentially fraudulent transactions based on a set of rules or parameters.

While a powerful tool for check fraud prevention, there are clear flaws -- for instance, the need for the corporate client to send a issuer file AND the verification of transactions from the corporate client. Many corporate clients are busy, and will delay or forget to send the issuer file, or clear alerts without fully verifying the transactions.

And, we would be remiss not to note that positive pay solutions do not detect check fraud for personal checks.

Multi-Layered Technology Strategy for Check Fraud

The BAI article goes on to note that financial institutions must adopt a comprehensive, layered approach - combining fraud detection tools, staff and customer education, and proactive adaptation to emerging schemes - to effectively safeguard against the evolving threat of check fraud. On top of deploying positive pay solutions, banks need to consider other technologies including:

- Behavioral/Transactional Analysis

- Image Forensic AI

- Consortium Data

- Dark Web Monitoring

By deploying a comprehensive, layered approach, financial institutions can safeguard account holders and the broader financial ecosystem.