Check Washing is Still Prevalent…How Can Banks Catch It?

- Checks can be "washed"

- Many businesses buy checks with anti-fraud features

- Deploying forensic AI technology thwarts "check washers"

Since checks are most often delivered by mail -- via what are generally non-secure receptacles that can be emptied by any sticky-fingered thief willing to open a public mailboxes or stolen directly from home mailboxes --- they are extremely vulnerable to what is known as "check washing." This scam involves a person illegally obtaining a check and then utilizing chemicals to remove ink and change certain fields (typically the payee and amount).

The YouTube channel Ask Sileo features a very detailed primer on how check washing is performed and why businesses use high security checks to help prevent fraud.

In the video, John Sileo compares the effects of "check washing" on a regular check and one that has security features included in the paper, printing ink, and even the pen used to fill it in. It quickly becomes clear that an unprotected check can fairly easily be made into a template for a fraudulent payment made out in any amount to any person or entity.

High Security Checks as a Preventative Measure

High security checks are specially made to deter fraudsters. While they are a bit more expensive, they offer a host of protections against fraudsters who may pilfer checks from mailboxes or other nonsecure storage.

For example, industry leader Deluxe Checks touts the following features on their website:

Additionally, Mr. Sileo recommends businesses use security pens that utilize formulated gel ink that cannot be dissolved by the common chemicals used in check washing (we recommend you not get any of this particular ink on your clothing!).

But, while high security checks and pens have their benefits, is it enough? The simple answer is no, specifically now that the fraudsters are utilizing mRDC as their deposit channel.

Overcoming The Technology Gap

The weakness of high security checks is that it unless the check is deposited at a bank location where a teller is able to examine the physical check, the chances that the fraud is spotted is much lower.

Fortunately, there are tools readily available for banks to overcome the technology gap. A great first step is deployment of a positive pay system that leverages AI technology to read the payee field accurately on the check to match with a payee issue file provided by the business. This will ensure that the funds are deposited to the intended payee.

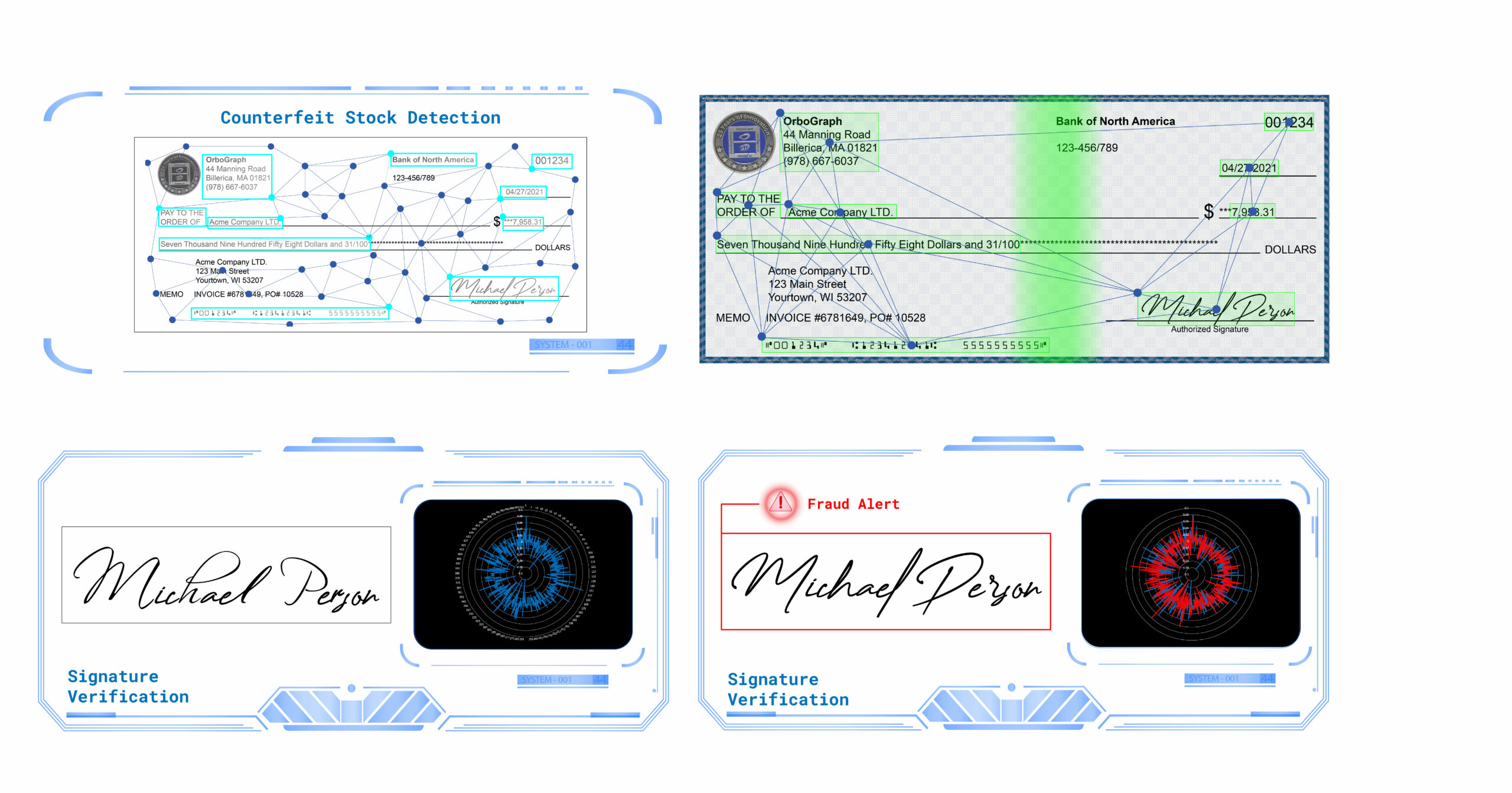

Next, Check Stock Validation (CSV) leveraging AI Technology is an effective tool to identify missing or altered security features, as well as inconsistencies in the check like, for instance, different fonts. With CSV, a profile of previously cleared good checks is created, including positioning of security features such as foil hologram. If one of these features are washed and added back, CSV can detect the issue and alert the bank before the check can be cleared.

Finally, engaging forensic AI technology for automated signature verification (ASV). When a fraudster washes the check, the signature will most likely also be washed away during the process, forcing to fraudster to trace, recreate, or sign a phony signature on the check after it is dried. Forensic AI ASV, as utilized by OrboGraph, activates 512 feature vectors on every signature to analyze attributes via “forensic screening.” You can get more details in the Forensic Document Examination interview.

As long as checks continue to be delivered via mail, there will always be the inherent threat of criminals stealing them for nefarious purposes. Banks can better protect themselves and their customers by deploying innovative technologies to ensure that the check payments are legitimate.

I was the victim of check washing. The thief didn’t get any money because I didn’t have the money they were trying to withdraw. Now my bank is holding my payroll deposits for 7 days. It is really hurting since I am a one-income family.

Under federal banking rules from federal reserve. Funds from a

Check deposit especially payroll must be made available the next business day. That’s a federal regulation. If you get direct deposit funds should be available the day deposit is received.

I was hoping to find ways to spot a possibly washed check as a cashier in a store.