CrowdStrike Outage: Financial Institutions Experience an Estimated $1.15B Loss

- A recent CrowdStrike outage impacted an array of businesses and individuals

- Airline travelers found themselves significantly inconvenienced

- Financial institutions were not immune from impact

A few weeks ago, the world was disrupted by the CrowdStrike outage -- with air travel, healthcare, and even the financial industry feeling the impact. Almost everyone knows someone who was somehow inconvenienced by the event, as a logic error in a CrowdStrike update -- not a hacking incident -- caused the "blue screen of death" to appear on many Windows systems, disrupting operations for widespread personal and business sectors.

NBC11 news reported that many large financial institutions reported no disruptions:

Eventually, however, the story unfolded over the several weeks and we did indeed see many banks of all sizes across many different countries reporting issues.

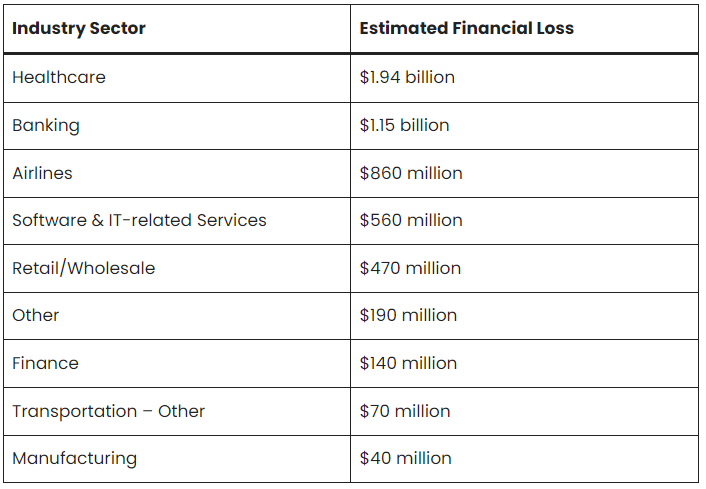

The disruption has lead to major financial impacts as well. According to a report from CyberSecurity News, the banking industry has seen an estimated loss of $1.15B.

Understanding Underlying Implications

While CrowdStrike is remedying the situation -- according to their website, "~99% of Windows sensors are online as of July 29 at 5pm PT," -- the incident brings to light underlying implications that need to be addressed for financial institutions. We noted in a previous post the abrupt collapse of Synapse, where banks’ customers were unable to access their accounts. While CrowdStrike is a much larger company with a stronger reputation and deeper resources, financial institutions are nevertheless left scrambling to ensure minimal disruptions for their customers and taking major losses.

These instances leads to bigger underlying problem. As noted in an AP News article:

“It is an ‘all our eggs are in one basket’ situation,” Craig Shue, professor and computer science department head at Worcester Polytechnic Institute, said in emailed commentary. “This lets us make sure our ‘basket’ is high quality: the software provider tries to identify threats and respond to them quickly. But at the same time, if anything goes wrong and the basket fails, we have a lot of broken eggs.”

From a foundational standpoint, financial institutions need to evaluate all technology partners and solutions -- fintech or other systems -- to ensure that their technology not only performs as presented, but the company behind it can be trusted. Disruptions to widespread systems have major impacts -- from operations to customer experience.

We've noted earlier that "financial institutions (FIs) should balance innovation by thoroughly evaluating current and potential partners based on longevity, profitability, and reliability to mitigate disruption risks and ensure long-term success." This is why financial institutions have trusted companies like OrboGraph as a partner for nearly 29 years.