Cryptocurrency: A Comprehensive Primer

A few months back we wondered whether Santa would take cryptocurrency - this was in reference to a rather bleak Huffington Post article called "The Bitcoin Hoax".

Pessimists aside, ever since Bitcoin appeared, the ever-growing ecosystem of cryptocurrency has continued to expand and spawn new varieties -- some that sound like sci-fi movie titles and terms (Ethereum is pretty "out there," you have to admit).

Of course, blockchain is the backbone of cryptocurrency and the Crypto Coin Society offers a fantastic overview of the cryptocurrency universe including how blockchain technology solidified and legitimized the currency.

What makes Bitcoin so intriguing and perhaps where it primarily derives its value is the technology behind it— Blockchain technology. It is defined as a list of records called blocks that are cryptographically linked to each other. This technological concept is nothing new and was first described in 1991 by Stuart Haber and W. Scott Stornetta. When it was implemented in Bitcoin it was improved with Proof-of-Work as a decentralized way of writing new blocks.

Blockchain technology serves as the “trust layer” that made it possible for Bitcoin users to transact securely without the various risks associated with peer-to-peer transactions. Through this technology, all transactions are guaranteed to be immutable, irreversible and final. Most important of all transactions are not dependent on any centralized organization or entity and thus becoming immune to any centralized related risk that might arise from this.

Blockchain 3.0: Distributed Ledger Technology

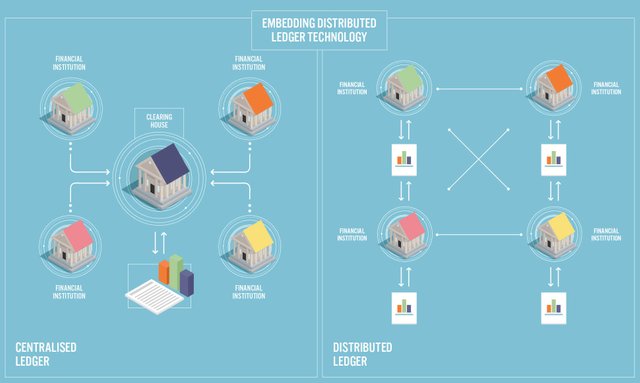

While many people are familiar with blockchain and cryptocurrencies, not all the technologies are using "blocks." Another approach is referred to as Distributed Ledger Technology (DLT). Another major methodology being utilized today is what is known as Directed Acyclic Graph (DAG).

A DAG does not use blocks, and transactions are added directly on the distributed ledger. Instead of using blocks it uses a group of nodes that can exist simultaneously. These nodes are connected like branches of trees which enables it to have more than one parent node. This means that the system can start processing other transactions without having to wait for the previous transaction to finish.

Source: Crypto Coin Society

One of the advantages that DLT possesses over traditional blockchain is the speed of processing. According to Cryto Coin Society, DLT is able to process up to 10K Transaction per second (TPS) versus 7 & 15 TPS for bitcoin and ethereum.

The Current State of Cryptocurrency and Blockchain for Banking

Understandably, the banking industry is being cautious with blockchain adoption. While there are many tangible benefits to the technologies, there are also government regulations to navigate, along with the need for mass adoption in order for the technologies to make a meaningful impact.

JPMorgan & Chase has adopted the technologies with its JPM Coin, and Facebook has entered the arena with its Libra Coin. Additionally, Ripple and its XRP has shown great promise with its ability to reduce costs and processing time for cross-border payments.

It's hard for "newbies" to get their minds around the idea that cryptocurrencies have no physical form or representation whatsoever. Even if you feel comfortable discussing the intricacies of cryptocurrencies and can hear the term "Non-fungible Tokens" without giggling, spending some time with the Crypto Coin Society's comprehensive how-to guides will surely introduce you to something new and useful. Additionally, check out accenture's "How Banks are Building a Real-Time Global Payment Network" research paper.