Federal Reserve Publishes Check Fraud Mitigation Toolkit

- the United States Federal Reserve has created and published two valuable new resources

- The Fed are proponents of a multi-layered tech approach

- Educating the industry is vital

Recently announceed via LinkedIn, the United States Federal Reserve has created and published two new resources — the Check Fraud Mitigation Toolkit and Scams Mitigation Toolkit. Both are welcome tools, intended to "support education and increase awareness about scams and check fraud, enable the payments industry to better identify and fight them, and foster industry collaboration on fraud and scams mitigation."

As Mike Timoney, Vice President of Payments Improvement at the Federal Reserve, states in the post: "Scams and check fraud are two areas where education can make a real difference for the payments industry, businesses and consumers."

Check Fraud Mitigation Toolkit

The Check Fraud Mitigation Toolkit is indeed a valuable resource, offering an overview of check fraud methods, types, and schemes, as well as guidance on preventing and detecting fraudulent checks. It explains, for example, that check fraud can involve authorized party fraud, where the account holder willingly sends or writes a check for the purpose of committing fraud, or unauthorized party fraud, where criminals use stolen checks or account information.

The toolkit also includes recommendations on how industry stakeholders can combat check fraud, starting with understanding potential check vulnerabilities and fraud scenarios. Possibly the most important of all: arming financial institutions' employees, customers and external partners with proactive education and knowledge about check fraud to help prevent, detect and mitigate it.

Also included:

- Toolkit Module 1: Check Fraud Basics — An overview of check fraud methods, types, and schemes (how the fraud is facilitated), all of which are important for prevention, detection, associate training, customer education, and awareness.

- Toolkit Module 2: Check Fraud Schemes — Check fraud could be the result of authorized party fraud, where the account holder willingly sends or writes a check for the purpose of committing fraud — or unauthorized party fraud, where criminals use stolen checks or account information for their own financial gain.

- Toolkit Module 3: Preventing and Detecting Check Fraud — Explore this module to learn about how people, processes, and technology can work together to mitigate check fraud, while becoming more familiar with common practices for preventing and detecting fraudulent checks.

Each module contains a wealth of knowledge on the topic of check fraud, including several infographics and downloadable PDFs. These range from exploring the basic types of check fraud to different methods of detection. There are also two quick quizzes to test your ability to correctly identify types of check fraud.

The FED: Proponents of Multi-layered Technology Approach to Check Fraud Detection

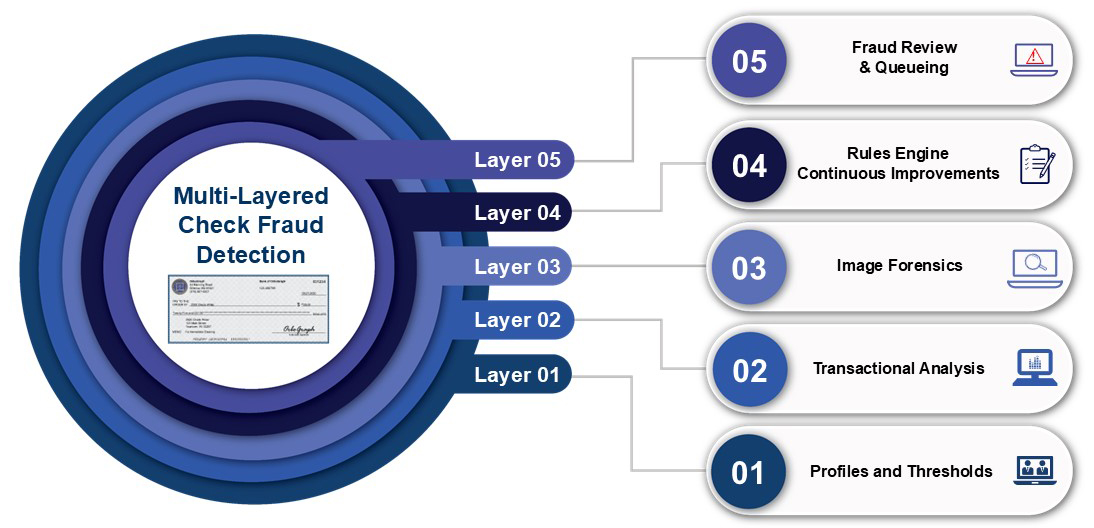

Within the Combating Check Fraud with Effective Prevention and Detection Strategies Module, the FED provides several downloadable PDFs to help prevent and detect check fraud. Throughout, the FED's message is consistent with the multi-layered technology approach that OrboGraph has been advocating for years.

Additionally, the FED emphasizes that image forensic technology is a crucial component for both Deposit Fraud and On-Us fraud detection:

Deposit Fraud: "Detecting fraudulent deposits is more effective with a combination of real-time analytics and manual intervention," with common practices including "Check Image Analysis."

Inclearing (On-Us) Fraud: "Artificial intelligence (AI) and machine learning (ML) systems have the capability to evaluate millions of data points and flag anomalies in check serial numbers, payees, and/or payment amounts. This technology also can analyze images and assess the likelihood of a possible forgery, alteration, or counterfeit check."

Below, we illustrate a recommended multi-layered technology approach to deposit and on-us fraud.:

Deposit Fraud

On-Us Fraud

Click the images above to enlarge.

OrboGraph supports educating the industry, hosting several virtual and in-person Check Fraud Roundtables each year -- including the upcoming Check Fraud Roundtable on September 16-17, 2025, in Mclean, VA. If you're interested in attending, register by completing the form below (free to attend for financial institutions).