FinCEN Warns of Increasing Use of Crypto for Money Laundering… But, How Bad Is It?

- FinCEN issues warning on cryptocurrency being used by Mexican Drug Cartels

- 2%-5% of the worlds GDP -- or $2.22 to $5.53T -- is laundered

- Cryptocurrency makes up only .47%, or one-half of one percent, of money laundered

On June 20, 2024, the US Financial Crimes Enforcement Network (FinCEN) issued an updated advisory to US financial firms that Mexican drug cartels are increasing their utilization of cryptocurrency to purchase chemicals for drug manufacture.

According to FinCEN, criminal organizations in Mexico are “increasingly purchasing fentanyl precursor chemicals and manufacturing equipment” from suppliers based in China, with payments often conducted via digital assets. These transactions frequently result in funds being transferred to the Chinese suppliers’ wallets hosted by crypto firms, sometimes through secondary money transmitters.

FinCEN urges that financial institutions beef up detection of crypto transactions within their AML programs. While this is a strong use case for how cryptocurrency's assists criminals in illegal activities, is the government -- and, in turn, the media -- overstating the problem?

Money Laundering Sources

According to the United Nations Office on Drugs and Crime, "The estimated amount of money laundered globally in one year is 2 - 5% of global GDP," which translates to a range of $2.22 trillion to $5.54 trillion according to a report from cryptoslate.com. Here is where the major misconception occurs.

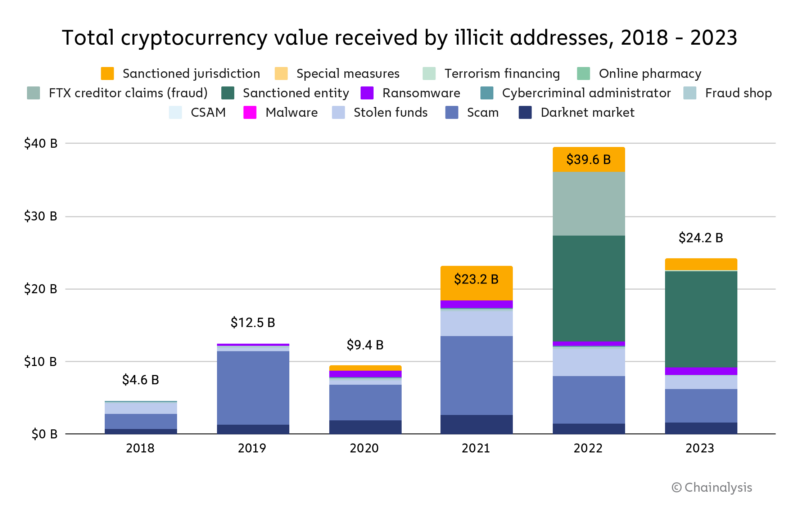

Although the government and media would have you believe that cryptocurrency makes up a majority of the laundered money, the data does NOT back this up. As you can see from data collected by Chainanalysis, cryptocurrency made up just 0.47% or $23.8B in 2022. Furthermore, in 2023, money laundered through cryptocurrency dropped from $39.6B to $24.2B.

Source: Cryptoslate.com

Majority of Laundered Money Still Perpetrated Through Financial Institutions

As noted in the article, "This proportion emphasizes that while crypto facilitates some laundering activities, traditional financial systems continue to dominate the landscape. Thus, these statistics challenge the narrative that cryptocurrency is a primary tool for money laundering."

Financial institutions remain the primary method for money laundering. This can be done in a multitude of ways, including check fraud. While many believe that check fraud is mainly an individual or small group of criminals trying to make quick cash, this is simply not the case anymore. We've seen a sharp increase in organized crime perpetrating check fraud, to the tune of millions of dollars stolen. These funds are not just spent on lavish lifestyles, but utilized to fund criminal organizations -- such as the purchase of materials for drugs or other illegal activities. Once the funds are made available, they are easily and instantly moved from one bank account to another through P2P channels like Zelle.

While we do agree with FinCEN's recommendation to update their processes for AML detection, there are still other payment channels similar to checks that are much more widely exploited for these purposes.