FTC Reports Reveals the Fraud Battleground

-

The FTC refunded $232 million to fraud victims in 2019

-

Check Fraud leads the pack

-

Can you guess which state is the fraud leader per capita?

The Federal Trade Commission released a report indicating that their actions led to more than $232 million in refunds to consumers across the country in 2019.

During 2019, more than 1.9 million consumers cashed FTC checks received as a result of law enforcement cases. When consumers don’t cash their refund checks, the FTC uses that money to send additional mailings to ensure the maximum amount of money is returned to consumers. Any remaining refund money is sent to the U.S. Treasury.

Data and Measurements

The FTC offers outstanding resources for a wide array of interactive reports at their Tableau Public landing page, Data and Visualizations page, and Datasets page.

Additionally, fraud in all of its varied forms continues to climb, as pointed out by Alogent:

The Federal Trade Commission (FTC) reported this month that check fraud reports have risen 65% since 2015, and the typical loss is about $2,000 – much higher than losses from other fraud types. In the same report, the FTC revealed that their fraud network received more than 27,000 reports of check scams, with losses of more than $28 million.

Alogent also pointed out that the check trend carried over to the latest 2019 ABA Deposit Account Fraud Survey Report:

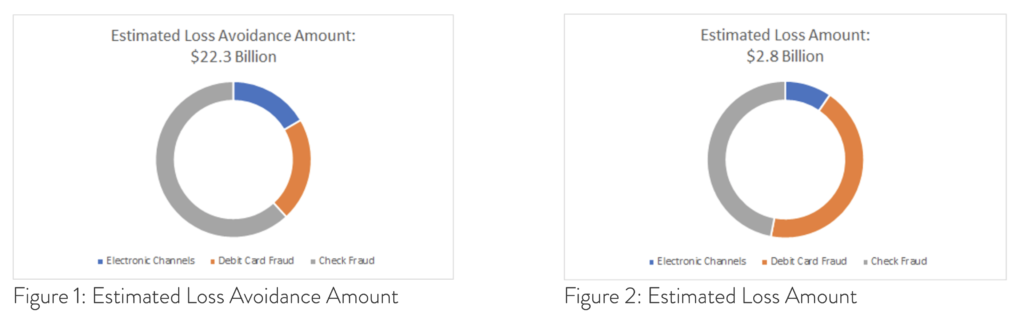

Based on the information that the participants in the survey reported, fraud against deposit accounts amounted to $25.1 billion in 2018, up from $19.1 billion in 2016. This amount includes $2.8 billion in losses to the industry and $22.3 billion in fraud prevention, i.e., fraudulent transactions that were stopped by the financial institution’s prevention measures. The breakdown of the losses, by channel, are bulleted and depicted in Figure 1 and Figure 2 below.

• Check fraud accounted for 47% or $1.3 billion of industry deposit account fraud losses

• Debit card losses amounted to 44% or $1.2 billion

• The remaining 9% or $265 million of losses were attributable to electronic bank transactions, including billpay, P2P transfers, wire, and ACH transactions

Leading check fraud categories, according to the report, were counterfeit checks, forged signatures, and return deposited items (RDIs). Remote deposit capture (RDC) accounted for 30% of the check fraud losses (consumer and business RDC combined).

The Fraud Leader

Are you surprised that Nevada, home of Sin City, is registered the highest per capita incidence of reported fraud of any state in 2019? It's a small state, but data compiled by the Federal Trade Commission from consumer complaints put the median dollar loss from fraud in Nevada at $395, second only to Hawaii by $4.

The Las Vegas Journal Review reported that identity theft was the top category, with nearly 4 in 10 identity theft cases involving credit card fraud. Impostor scams came in second after identity theft -- about one-quarter of all complaints. These scams include people posing as needy relatives of the elderly, small-business owners who receive supplies they never ordered, or job-seeking military vets lured into buying work equipment in employment scams. Very often a very legitimate-looking check will be sent to the "mark" for deposit, and, after a request to return an "overage" or buy gift cards using a portion of the proceeds, the check bounces and the victim is left liable.

It is critical for banks to keep up-to-date with the fraud trends, data, and resources available to them in order to incorporate new strategies and technologies to better protect themselves and their customers. We are determined to keep our readers informed through our articles in the Modernizing Omnichannel Check Fraud Detection Blog and provide invaluable resources like the Fraud Perpetrator Profile Summary to better educate the market.