Industry Insights: OrboGraph’s James Bi Breaks Down mRDC Check Fraud on Wespay Podcast

- James Bi of OrboGraph was a recent guest on the Wespay Payments Perspective Podcast

- The primary topic was how mobile deposit is leveraged by fraudsters

- Investment in tech is vital, as fraudsters are constantly evolving their techniques

It is not a stretch to say that fraudsters LOVE technology -- particularly when it comes to banking. Since the pandemic, the majority of financial institutions offer mobile remote deposit capture through their banking apps. This deposit channel s the most convenient method of depositing a check -- and, unfortunately, the most convenient method for fraudsters to commit deposit fraud as well.

In the latest episode of the Wespay Payments Perspective Podcast, OrboGraph's own James Bi, Marketing Manager and Check Fraud Detection Specialist, joins host Jeff Duffy to discuss mRDC and how fraudsters are leveraging this deposit channel to commit check fraud.

The Hows and Whys of mRDC Check Fraud

During the podcast, Mr. Duffy and Mr. Bi discuss 5 major topics:

- Types of fraud FIs are seeing in their remote deposit capture systems

- Why financial institutions would not take advantage of their ability to delay funds availability for greater lengths of time (Reg CC)

- How financial institutions can implement changes like longer holds and deposit limits

- Artificial intelligence for mRDC check fraud detection

- How FIs can become more adept at evolving along with fraudsters to detect and prevent their schemes

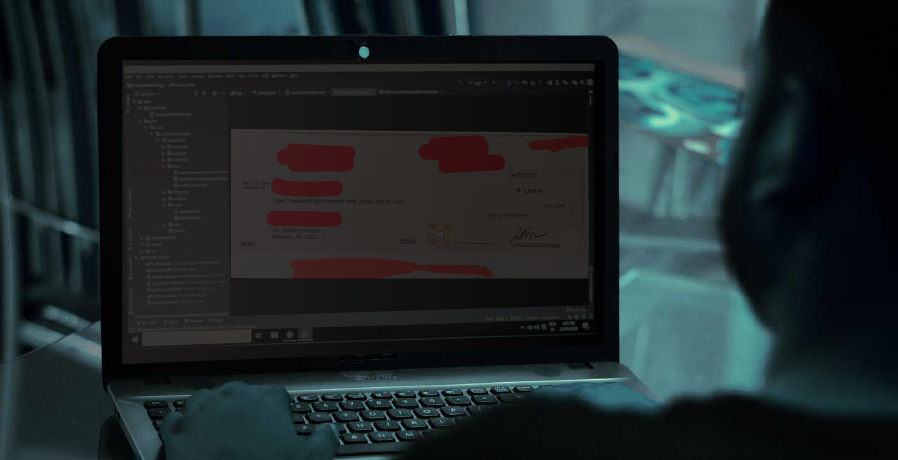

Mr. Bi discusses how alterations (washed checks) were predominant early on, but fraudsters evolved and adopting "check cooking" -- using technology to digital recreate checks -- as the primary method for check fraud.

He goes on to discuss why, even though Reg CC only addresses alterations, FIs are not taking advantage of putting longer holds on check deposits via mRDC. Mr. Bi focuses on a recent discussion with an industry expert, pointing to the fact that FIs want to achieve "channel parity" because different policies for different channels disrupt customer experience.

As the podcast turns to technologies for mRDC check fraud detection, Mr. Bi notes the following as ways to strengthen mRDC check fraud detection:

- Behavioral analytics leveraging AI

- Account analysis and reporting capabilities

- Consortium data

- Image forensic AI

The podcast concludes with Mr. Bi sharing advice from the discussion with an mRDC expert: For consistant check fraud detection success, Invest in your technologies, where fraudsters are one or more generations ahead of FIs.