Jack Henry & Associates: Check Fraud Tops Fraud Trends to Watch for in 2025

- Fraud is evolving quickly

- There are five major fraud trends to watch this year

- Advanced fraud detection tools are crucial

As financial technology continues to advance, fraudsters are finding new and sophisticated ways to exploit vulnerabilities and target financial institutions and their customers. A new Jack Henry Fintalk post takes a look at several key fraud trends emerging in 2025 that community banks and credit unions must be prepared to address.

Fraud is evolving at an unprecedented pace, and community banks and credit unions are increasingly finding themselves in the crosshairs of bad actors. While some fraud schemes are executed by sophisticated and well-organized criminal operations, many are carried out by individuals (or small groups) using readily available tools and tactics.

Fraud Trends to Watch in 2025

The article highlights five major fraud trends to watch out for in 2025:

- Check Fraud

- Account Takeover (ATO) Fraud

- Synthetic Identity Fraud

- Payment Fraud

- Elder Abuse Fraud

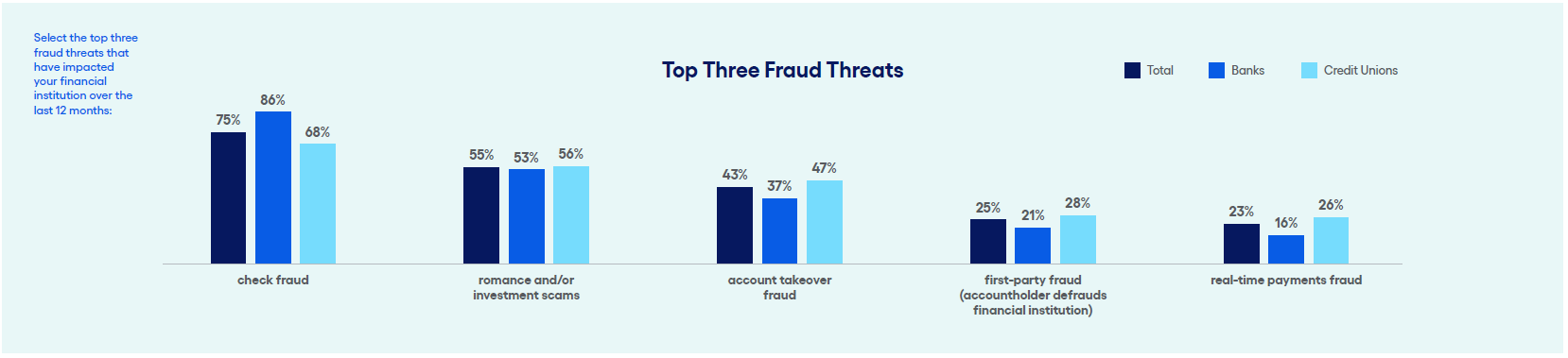

It is no surprise that check fraud is listed first, as in their 2024 Strategy Benchmark report, Jack Henry & Associates report that 75% of FIs indicated check fraud as a major concern.

However, Jack Henry & Associates note that fraudsters are evolving rapidly by utilized generative AI to bypass traditional check fraud systems:

In addition to traditional means of check fraud (mailbox fishing/stolen arrow keys, check alteration, forged signatures, check washing, etc.), we are seeing fraudsters take advantage of AI-generated forgeries to bypass traditional verification systems. AI tools enable fraudsters to create highly convincing counterfeit checks, while remote deposit capture has inadvertently provided new avenues for exploitation.

Fighting Back

To combat these emerging fraud threats, Jack Henry Fintalk recommends taking a multi-layered approach -- leveraging a multitude of technologies, employee training, and industry collaboration:

As FIs look to tackle the check fraud challenge in 2025, FIs not only need to focus on deploying advanced check fraud detection tools-- including image forensic AI to analyze the images of checks -- but also remain agile with ongoing strategy refinements and consistent stakeholder education and training. By having the right technologies in place along with a strategic multi-layered approach, financial institutions can effectively protect themselves and their customers from fraudsters.