Jack Henry & Associates Reinforces “Multi-Layered Technology” Approach to Check Fraud Detection

- Fraud continues to rise, and tools need to keep up

- Better fraud detection requires a layered approach

- Multi-layered tech allows informed decisions on each item

We've stated many times that there is no single solution that can detect the majority of check fraud.

Well, in a recent Jack Henry Fintalk, Bette-Lou Rush notes that "the name of the fraud prevention games is layers."

To fight back against fraud effectively, you need to adopt a robust, multi-layered defense strategy ‒ one that provides layers of protection for your financial institution, staff, and accountholders, and also includes layers of transaction monitoring and solutions that provide you with meaningful and impactful alerts (and won't waste your time with a multitude of false positive events).

Ms. Rush provides insights from discussions with Jack Henry clients regarding one of the top three fraud concerns for FIs: check fraud.

When I speak with clients, I ask, “What kind of fraud are you experiencing the most?” Often the reply is "check fraud." Yet within the check fraud channel alone, this could encompass several things: transit checks drawn on another financial institution being negotiated at your teller line, ATM, or mobile deposit; or checks drawn on your own financial institution that have been washed, duplicated, or written against a closed or dormant account or the account of someone who is deceased. These are just some of the examples within the “check fraud” category.

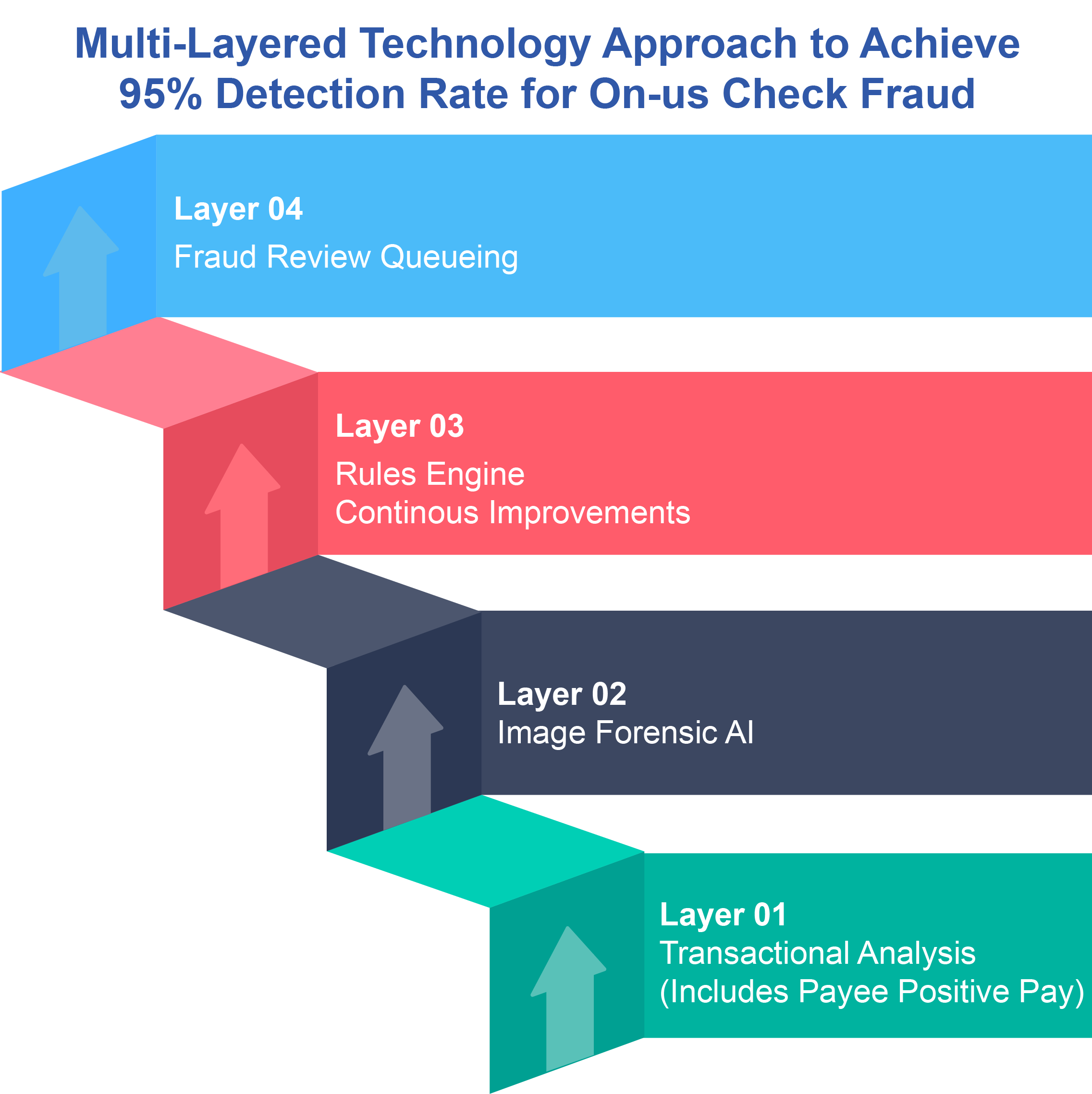

A Multi-Layered Approach: The Tools and Framework

How does a financial institution deploy a multi-layered technology approach for detecting check fraud? First, you need the right tools. The article explores several key prevention tools, including:

- Know-your-customer practices

- Fraud monitoring software

- User authentication, and

- Positive Pay

In addition to these tools, it's critical to deploy AI to analyze the images of checks and increase check fraud detection for on-us items. This is why Jack Henry announced at their 2024 Jack Henry Connect conference their partnership with OrboGraph to leverage our Anywhere Fraud with OrbNet Forensic AI technology.

All of these tools need to work harmoniously and integrate into a single case management or fraud review platform so fraud analysts at the FI can review each transaction and make an informed decision as to whether to reject or clear the item.

Here is a sample framework for FIs:

- Layer 1: Onboarding and proper thresholds -- Utilizing tools to ensure KYC

- Layer 2: Transactional/Behavioral Analytics -- Continuous monitoring and analysis of the transactions and behaviors of the account

- Layer 3: Image Forensics AI -- Analyzing the images of the checks for counterfeits, forgeries, and alterations

- Layer 4: Rules Engine and continuous improvements -- Analyzing the data to adapt to trends and new behaviors of fraudsters

- Layer 5: Fraud Review Queueing -- Amalgamating all the data into a central platform wherein fraud analysts can review the items, note indicators for why the item was flagged, and accept or reject the item

By utilizing a multi-layered technology approach for check fraud, FIs are able to ensure there are no gaps in their defenses.