Learning the Fraud Lingo, Round Two: “Stimmy”

We've discussed previously the fact that fraudsters, like most insular groups, have their own lingo. Eric Huber, TD Bank Cybercrime Research & Analysis Leader and curator of Fraudsterglossary.com, discusses the dreaded Stimmy, or Stim -- a term used by fraudsters for any sort of check issued by the US Treasury regardless of the program.

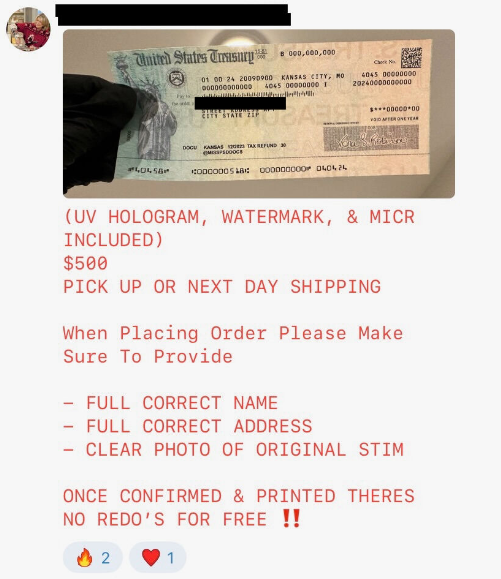

There is a robust market not only for selling stims, but also creating counterfeits. This is a post from a vendor on Telegram who specializes in this work and has a good reputation among the baddies.

For $500 dollars, she will create a counterfeit that includes the hologram and watermark security features. This is handy if the fraudster is going to be sending someone into a bank branch to deposit the check.

He notes that prices for the actual stolen US Treasury checks vary, but it’s usually a percentage of the value of the check -- bigger check, bigger purchase price. The lowest he's seen seen over the past several months on Telegram has been 6%, but Mr. Huber as also seen it as high as 15%.

US Treasury Checks are "Good as Gold"? Not if Technology Has Anything to Say!

As noted in the LinkedIn Post, "The baddies love these checks for many reasons including the next-day availability of funds due to Reg CC, they know the money is always going to be in the account, and how good they’ve gotten at counterfeiting them."

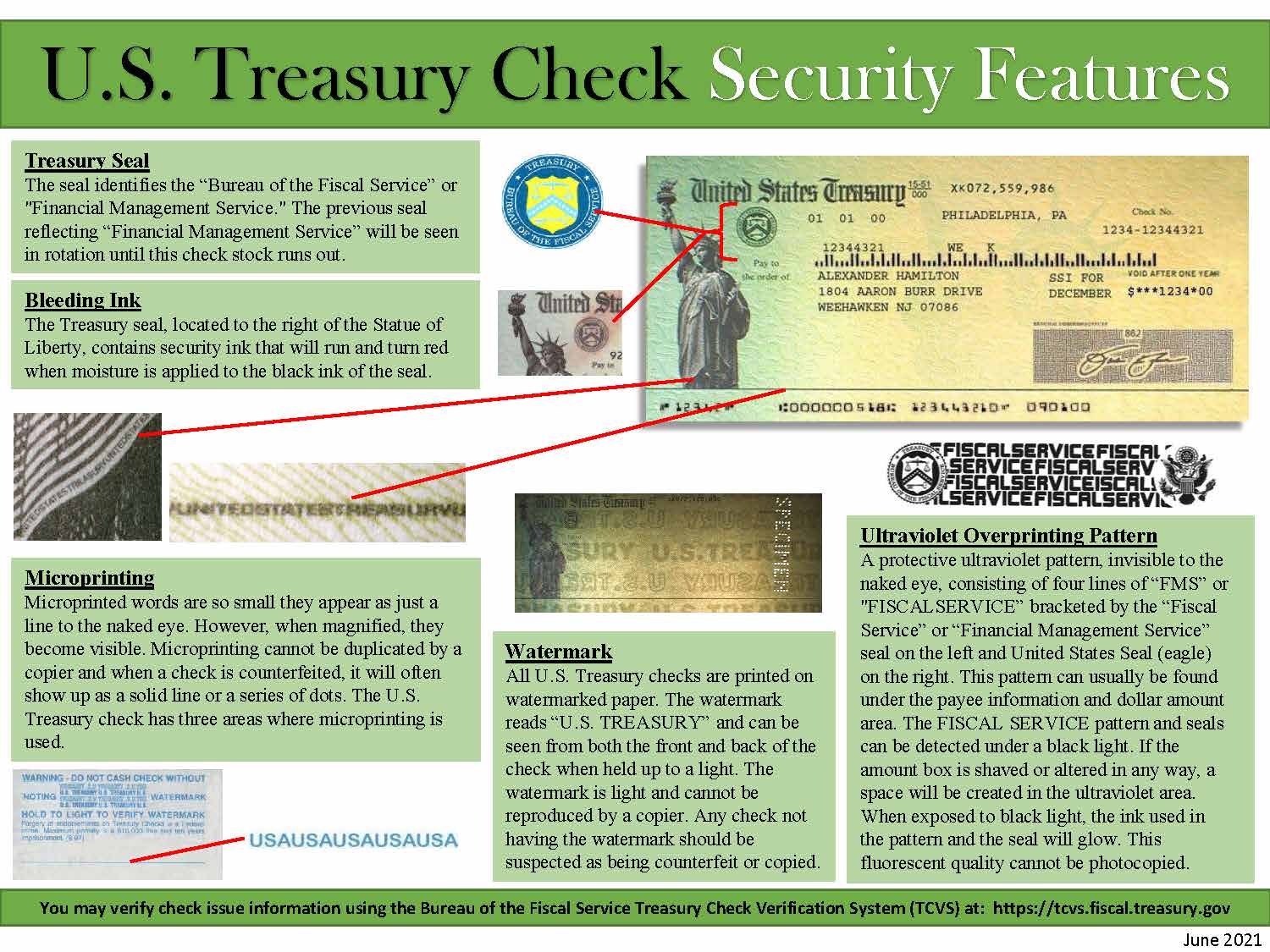

However, similar to US currency notes, US Treasury Checks have many security features that counterfeiters cannot duplicate. The US Treasury provides a handy PDF of features that bank tellers and staff should consult when handed a US Treasury Check:

We in the industry understand, however, that not all US Treasury Checks are deposited at the teller where a human can visually inspect the check. Many of these checks are deposited via mRDC and ATM. And, with next day funds availability, makes it incredibly difficult to inspect the checks before the fraudsters can get their hands on the entire amount.

This is why banks need to turn to technology for early analysis of these deposits. In order to deploy robust fraud detection against counterfeit US Treasury Checks, banks must utilize a combination of Image Forensic AI that analyzes the images of the check, and check verification like Advance Fraud Solutions TrueChecks which validates the payment from thousands of transactions through their consortium and direct link to the U.S. Department of the Treasury database. This is a major benefit for OrboGraph and AFS customers, as our two organizations have joined forces to combat deposit fraud.

You can learn more by scheduling a demonstration here.