Most Common Financial Crimes in America: Where Does Check Fraud Rank?

- Top financial crimes in America are ranked

- "Fraud geography" is also noted

- The most common variety: check fraud

In a recent article from Visual Capitalist, author Julia Wendling takes on the task of ranking the top financial crimes in America. And, as you may have guessed, check fraud is ranked number 1 of most common financial crimes with over 521,000 monthly reported in 2024.

One of the key drivers of this surge in financial crime is the growing use of AI and modern technologies by bad actors to perpetrate fraud and money laundering schemes. While check washing is a common method for check fraud, many organized crime rings are adopting technology to streamline the process. With a single stolen check, a fraudster can create counterfeits through photo editing software and print dozens, if not hundreds, of counterfeit checks -- also known as check cooking.

And, there are no signs of slowing down. According to Kroll's 2025 Financial Crime Report, 71% of respondents expect financial crime risks to grow even greater throughout 2025.

Which States Experience the Most Financial Crimes?

In addition to ranking the most common financial crimes in America, Visual Capitalist and Inigo Insurance dive deeper to rank which states are most effected. Delaware tops the list with 2,352 per 10,000 people, and provides context:

So why is Delaware’s suspicious activity count so much higher than other states? With more than 2 million business entities—outnumbering its residents—Delaware is a hot spot for financial crime. In fact, about two-thirds of Fortune 500 companies are incorporated in Delaware due to its flexible, business-friendly laws.

However, the rest of the top five may shock you:

- Delaware: 2,352 per 10,000 people

- South Dakota: 1,967 per 10,000 people

- Utah: 1,101 per 10,000 people

- Ohio: 542 per 10,000 people

- North Carolina: 464 per 10,000 people

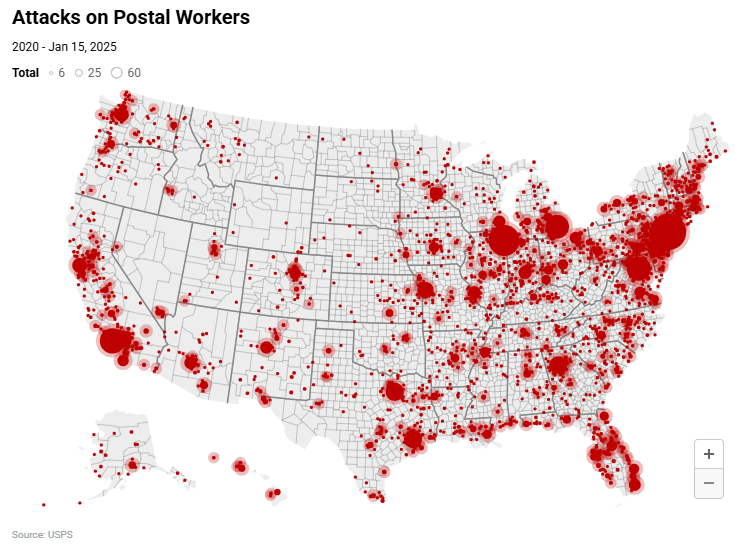

With check fraud being the most common variety, one would assume that a map of stolen checks would align with the "states most affected" map, right?

Wrong.

Stolen checks appear to be most common in larger urban areas across America, as they are better focus zones for organized crimes rings vs rural areas. They are more fruitful for criminal enterprises and provides the most logical reasoning for fewer stolen checks in the less populated states.

As noted by Visual Capitalist and Inigo Insurance, financial crimes -- including check fraud -- are expected to continue growing in 2025. However, we've seen financial institutions across the US fight back with technology -- including image forensic AI. From small community banks to large financial institutions, the industry recognizes that tools are readily available. They are actively deploying these tools to protect themselves and their customers.