New Infographics Provide Advice for Identifying Money Mules and Check Fraud

- The American Bankers Assoc. & U.S. Postal Inspection Service have produced useful infographics

- The infographics address individual and business account safety

- Several methods are recommended to recognize money mules

In an effort to further educate society on the dangers of criminals stealing checks in the mail to commit check fraud, the The American Bankers Association Foundation and the U.S. Postal Inspection Service have teamed up to provide three new infographics to help identify money mule scams and check fraud to protect consumers from scams.

As noted in the article, the three infographics targets specifics audiences:

- The first infographic teaches consumers how to detect and avoid falling victim to a money mule scam

- The second infographic provides advice for bank staff on how to spot money mules (only available to banks)

- The third infographic teaches small business owners how to protect themselves from check fraud

Focus on Consumers

Typically, we see these type of instruments focus on banks. It's refreshing to see both the ABA and USPS focus on helping individuals and businesses -- as they are ultimately the victims.

Many money mule scams are committed by using someone else's bank account to transfer and launder illegally obtained money. Often the account owners are unwitting or unknowing that what is occurring is illegal, as many Americans continue to struggle with financial education.

The consumer infographic provides 9 tips to avoid a money mule scam, and what to do if an individual spots one.

Focus on Businesses

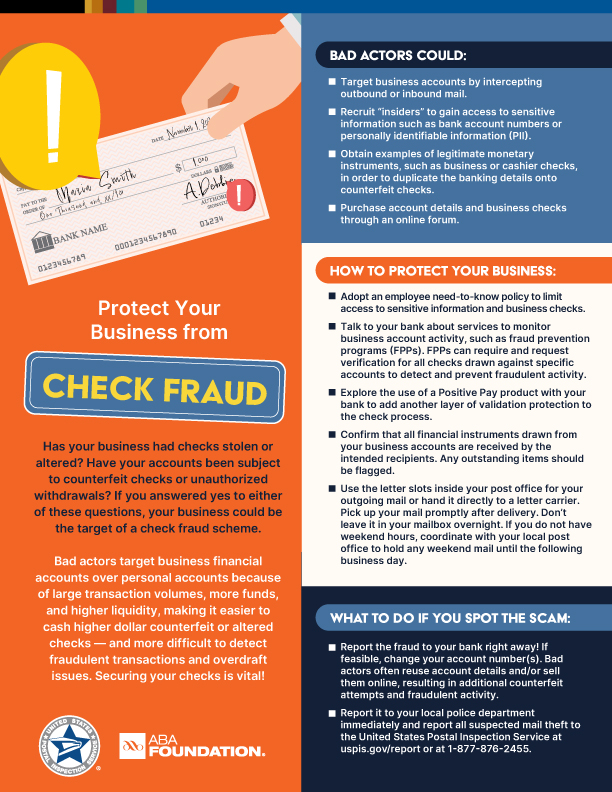

The infographic for business focuses on check fraud, and how they are major targets for fraudsters. It lists the ways criminals can steal businesses checks via the mail or gain access to their accounts.

Additionally, the infographic goes on to provides tips on how to protect businesses from check fraud -- ranging from behaviors like dropping off checks at the post office, to leveraging technologies from banks like payee positive pay.

Lastly, the infographic provides advice on what to do when a business becomes a victim, noting that time is crucial and the business needs to contact their financial institution immediately and the local authorities.

How Banks Can Identify Money Mules

There are several methods by which financial institutions can identify money mule activities. these include:

- Utilizing behavioral analytics to monitor accounts for anomalous activity. An influx of checks to an account -- particularly high dollar -- is a key indicator for money mule activity.

- Image forensic AI to analyze the images of checks. While fraudsters have honed their craft creating counterfeits and altering/washing checks, there are still key indicators on a check that image forensic AI will flag, enabling banks to review the check before funds are released.

- Leveraging consortium data enables banks to verify the legitimacy of the payment from previous transactions and account information available.

- Monitoring the dark web to proactively scan illegal marketplaces for the presence of an account and their checks.

Stopping check fraud will take efforts from all parties including individuals/business, government agencies, and financial institutions. Collaborations like the ABA and USPS help move the industry forward to catch up to the fraudsters.