NICE Actimize Highlights Growing Threat of Money Mules in Account Fraud

- Overall banking fraud is climbing

- Account takeover fraud is now surpassed by authorized payments scams

- While check deposits are down, check fraud is up 33%

NICE Actimize has gathered and published some in-depth research that clearly shows a precipitous rise in banking fraud, which is understandably a growing concern for Financial Institutions (FIs) and consumers alike. Fraudsters are becoming increasingly sophisticated, shifting their tactics from traditional account takeover and unauthorized fraud to more complex authorized payments fraud, or scams.

Here are just some of the threats -- constantly growing -- facing FIs today, including an unexpected twist when it comes to checks:

- Attempted fraud transactions increased by 92% from 2021 to 2022

- Attempted fraud amounts increased by 146% over the same period

- Authorized payments fraud (scams) overtook account takeover fraud

- Fraudsters are using money mules to transfer funds away from FIs

- There has been, however, a decrease in the total overall attempted P2P fraud dollar volume by 18%.

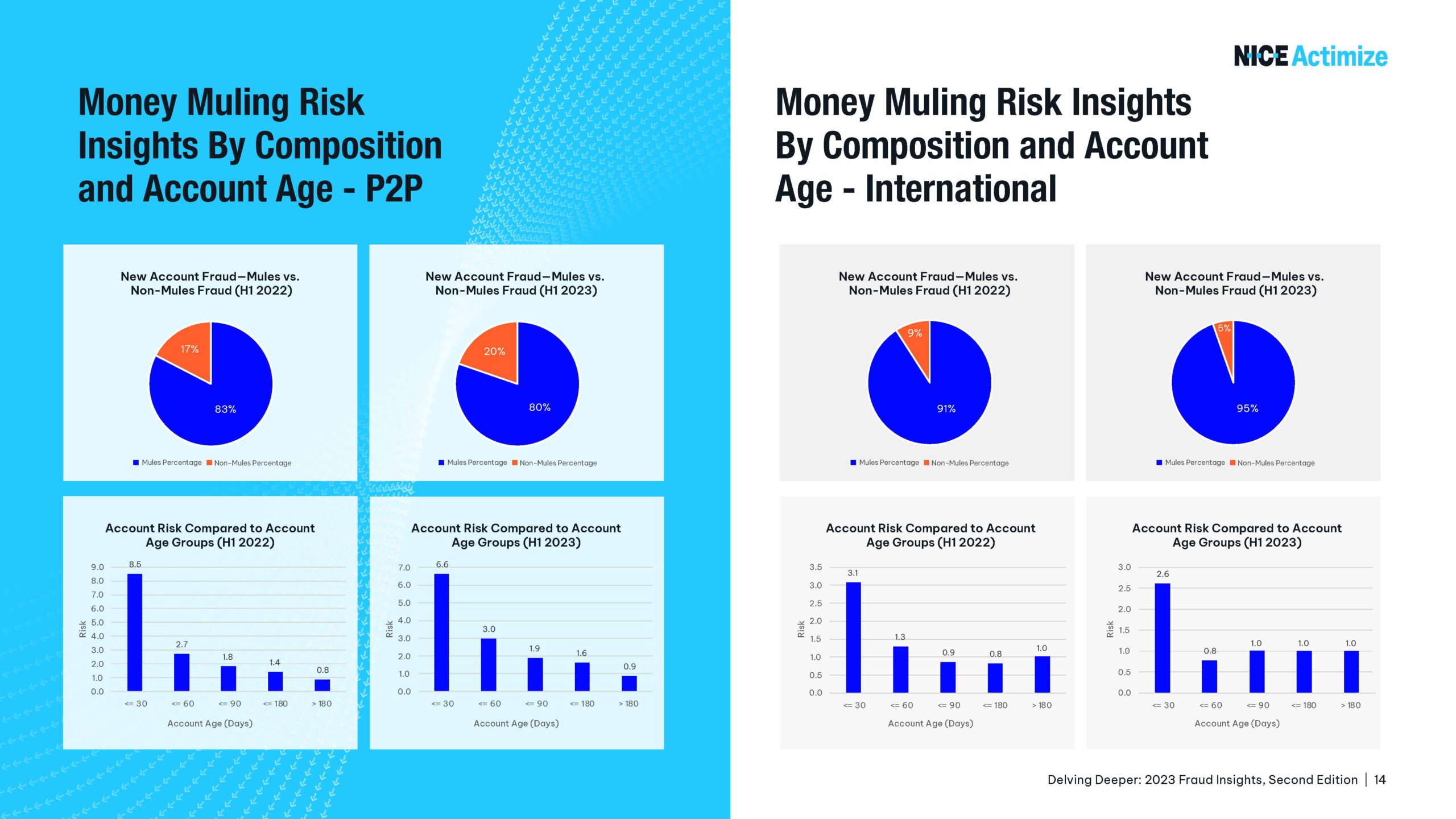

Mules Play a Larger Role in New Account Fraud

Money mules are essential to a fraudster's operation. They can serve as the individual who deposits or extracts funds, including stolen/fake checks, and also allow a fraudster to use their existing checking account or open a brand new account for deposits.

According to data from the NICE Actimize report entitled Delving Deeper: 2023 Fraud Insights:

- 59% of new account fraud is mule related, and the majority of these accounts demonstrate mule characteristics within 30 days, indicating that fraud is being conducted almost instantly.

- Money is typically moved in a mule network within two hours before its completely gone, exiting the account within 12 hours.

With financial institutions increasing their verification for new accounts, money mules with legitimate or stolen credentials become a key cog for fraudsters.

Fewer Checks; More Fraud

As expected, the adoption of more modern payment methods has impacted check deposits, which are, by value, down 2% year-over-year. However, while total deposits are down, the percentage of fraud dollars on those deposits is up a staggering 33%. This aligns with research from Advanced Fraud Solutions, which reported a staggering 1 million cases of deposit related fraud in first half of 2023.

Fraudsters continue to focus on check in-clearing controls and their weaknesses, particularly in the U.S. This is due, in part, to legacy fraud risk management solutions for check inclearing and the extended timeframes that can occur ahead of the receipt of check returns.

For financial institutions, it has become increasingly difficult to deal with the complexities of check fraud, as on-us and deposit fraud present different challenges. However, both need to be approached with a multi-layered technology strategy, leveraging a variety of technologies to detect fraudulent checks. A combination of transactional analysis, image forensic AI, and leveraging consortium data provides the foundation for a strong defense against both on-us and deposit fraud.