NY Times Highlights the Check Fraud Epidemic

- Despite the decline in check usage, check fraud has become a significant problem for banks and customers, particularly since the pandemic

- Criminals have leveraged tech and social media to commit fraud on a grander scale, and the theft of checks has become more sophisticated

- Often the anti-fraud efforts of financial institutions can negatively impact fraud victims

As has been made abundantly clear via this blog, check fraud is on the rise and merits serious attention by financial institutions. The New York Times recently reported on the enduring popularity of checks and the resultant "scam economy" being created and nurtured:

What was once a routine way to pay your bills — handwriting paper checks at the kitchen table, dropping envelopes into a blue metal box on the street — has become a high-risk endeavor: It provides the raw materials for low-level fraud artists and sophisticated crime rings, costing financial institutions billions. It has put banks on high alert, though their efforts to catch the fraud also routinely entangles innocent customers, causing institutions to suddenly freeze or shut down customer accounts in the process. Many of the bad guys manage to disappear without any consequences.

“Fraudsters go where the money is easiest,” said Chad Hetherington, a vice president at NICE Actimize, a financial crimes company specializing in fraud prevention.

Decline and Rise

The article notes that in 2022 "the typical American consumer wrote about 1.5 checks per month, accounting for about 3.8 percent of the total number of payments made in a month, according to a 2022 survey by the Federal Reserve Bank of Atlanta. In 2015, the typical consumer wrote 3.1 checks per month, accounting for about 6 percent of the total number of payments made."

So, even as check usage has indeed rapidly declined in recent decades, the Times reports, check fraud has risen sharply, given a boost by the pandemic. At the same time, fraudsters are becoming more sophisticated and organized in their endeavors.

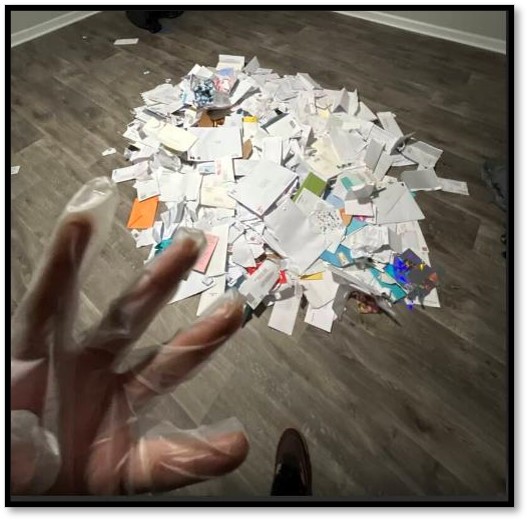

The cons may start with stealing pieces of paper, but they leverage technology and social media to commit fraud on a grander scale, banking insiders and fraud experts said. In the past, criminals needed a special internet browser that would grant entry into the dark web marketplace of stolen checks, maybe even someone to vouch for them — now all they need is an account from Telegram, a messaging app.

As we've reported here, the uptick in mail theft has moved the Financial Crimes Enforcement Network, which is the part of the Treasury Department known as FinCEN and charged with safeguarding the financial system, to take action this year.

Banks and credit unions are expected to file nearly 540,000 suspicious activity reports tied to check fraud this year, a record, according to a Thomson Reuters analysis of data from FinCEN. That’s about 7 percent higher than 2022, but more than double the levels in 2021, when fewer than a quarter-million such reports were filed.

The Times consulted our friend David Maimon in their reporting as well.

David Maimon, a criminal justice professor and director of a cybersecurity research group at Georgia State University, acts like a secret agent, watching the deals that take place on dark corners online, where criminals brazenly advertise their stolen checks using code words. The number of stolen checks circulating escalated during the pandemic, he said, when scam artists figured out how easily they could pull off such crimes.

In September, Professor Maimon’s group found nearly 9,148 stolen checks circulating in 80 select Telegram markets, up from 4,527 in February.

“This is just the beginning in a really long road that we will be experiencing,” Professor Maimon added. “Not enough is being done.”

Victims Frustrated with Reimbursement -- Early Detection is the Answer

The article notes that banks will typically refund the victims, but the wait can be extremely frustrating.

Banks will eventually return stolen funds to the vast majority of consumers, who have 30 to 60 days from the date of their last statement to report check fraud. But the wait can be frustrating. It varies by institution, but some banks won’t credit customers until after the claim is adjudicated, and some wait another 30 days after that. Banks aren’t required to complete their analysis within any set period of time.

In order to mitigate risks and, in turn, extreme frustration for their customers, banks need to deploy technology that detects fraudulent checks early to protect their customer funds. This includes behavioral analytics to monitor consumer accounts and transactions; image forensic AI to analyze images of deposited checks for counterfeits, forgeries, and alterations, and; dark web monitoring to ensure customer information and checks are not being sold on the dark web or encrypted messaging apps like Telegram.