JP Morgan Chase (JPMC) made a powerhouse move in the healthcare payments space by acquiring InstaMed. This $500M investment “shows that the nation’s largest bank views the fast-changing world of payments as a battleground worthy of aggressive wagers.” According to the report, US Healthcare expenses are expected to reach $6 trillion in 2027, so this kind of investment could have an amazing ROI once the JPMC gets rolling.

InstaMed has street cred when it comes to data. Take, for example, their ninth annual Trends in Healthcare Payments report. Any revenue cycle servicer interested in payment automation and electronification will want to pay attention to this report. In many ways, it actually syncs up very well to the CAQH Index.

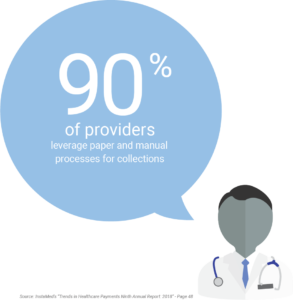

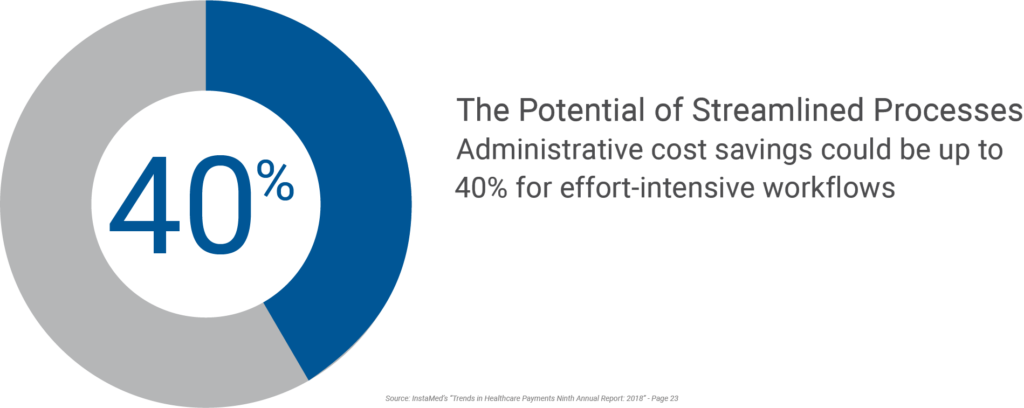

Surprisingly, manual paper processes on all fronts are still a concern overall in the industry. This report provides valuable insight into the state of payments and illustrates the business opportunities for revenue cycle management companies:

- Ninety-one percent of providers still receive paper checks from one or more payers, yet 82% of providers prefer EFTs from payers

- Ninety percent of providers leverage paper and manual processes for collections

- Fifty-three percent of payers still deliver checks to providers (We thought this one would be higher)

- Eighty-eight percent of payers prioritize consumer preference for making all of their healthcare payments in one place.

- Administrative cost savings could be as high as 40% for effort-intensive workflows

- Electronic adoption would yield $11.1 billion in annual savings and $9.5 billion of that would accrue to providers

The report covers paper and inefficiencies from multiple perspectives but paints an overall picture that killing paper across the revenue cycle has obvious benefits.

InstaMed discovered providers are adopting electronic and automated payment options to decrease the burden of collections across the organization. Paper and manual processes burn valuable staff time and suck down operational resources, while electronic options don’t require manual interventional.

Claims Reimbursements and Paper

For every claim submitted to a payer, a provider performs seven transactions to complete the process. All of these transactions can be heavily paper-based and depend on manual processes to complete, despite the fact that payers are mandated to maintain electronic channels.

The report emphasizes the fact that the claims reimbursement process is “in need of a complete overhaul to eliminate all paper and manual transactions.” CAQH CORE’s three phases have helped move the industry toward end-to-end electronification of claims processes, but providers are still attached to paper.

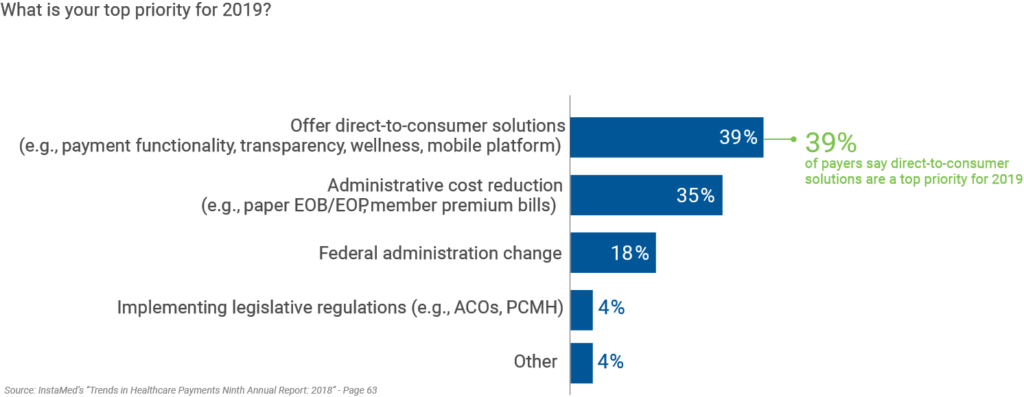

Payers are ready to turn things around. Thirty-five percent of payers indicated their top priority for 2019 is reducing administrative costs (e.g. EOB/EOP and member premium bills). This priority came in second only to offering direct-to-consumer solutions such as payment functionality and transparency.

In the Meantime, Hybrid Electronification

Hybrid electronification is a smart approach to making paper and PDF-originated remittances incredibly efficient and cost effective. Paper is scanned and merged with PDF EOBs/EOPs. These remits are then run through AI technology for data extraction, which is then converted to EDI 835 output files.

With the cost to manually post a single claim from an EOB approaching $3.00 (Per CAQH Index 2018), hybrid electronification is a strategically superior approach to unexpected revenue cycle variability and reduces costs to as low as $0.50 per claim on the remit.

Eroding Competitive Advantage

Any revenue cycle servicer who isn’t addressing these issues faces an increased risk of being left behind by their competition. We expect to see hybrid electronification emerge as a strategic advantage and competitive differentiator for those who are able to provide a straight-through process that incorporates paper and PDF-originated remits and payments.

For another perspective on this topic, download the white paper, “Healthcare's "New" Strategic Assets - Explanations of Benefit Forms (EOBs/EOPs) and Correspondence Letters”.